The Nasdaq100 surge is positive, but doubts remain

The Nasdaq100 surge is positive, but doubts remain

On Thursday, we saw one of the most significant intraday moves of the Nasdaq100, which added 7.5%. The move is very similar to what we have seen in November 2020, December 2018, and March 2009: a strong pullback from the local lows, which starts the subsequent rise. A prolonged move-up often follows that pullback, but there are still a couple of worrisome issues.

Yesterday's surge took the Nasdaq100 back to its October-November highs, threatening to break higher. Moreover, the price was above its 50-day average in a sharp move, which acts as a significant short-term bullish signal.

Suppose the news that feeds the market risk appetite dries up slowly. In that case, the next potential target for the index full of technology companies might be the area of 12800, where the 200-day average and the local peaks of September and June are concentrated.

Now for the obstacles. The principal market reversals that we have seen in 2020, 2018 and 2009 did not happen after reports that inflation was 0.2 percentage points below expectations or a "not so dramatic loss of seats" of the current batch after mid-term elections. It was actual or expected changes in policy - monetary or fiscal.

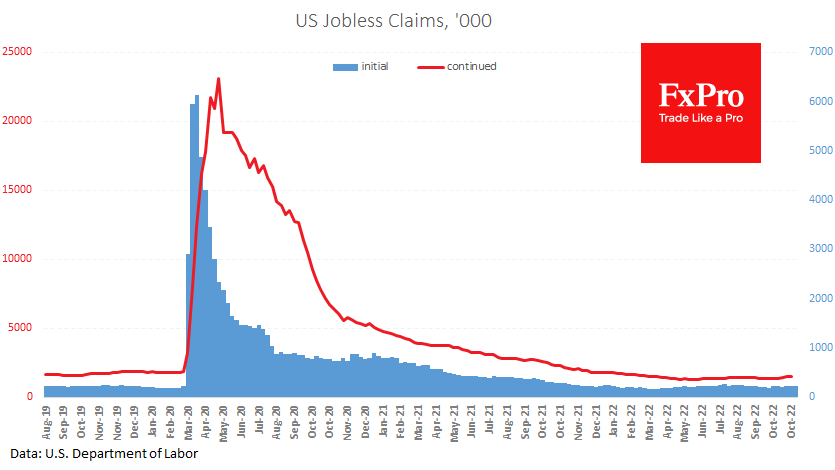

Furthermore, in the context of the economy, we point out that the slowdown in inflation results from tightening the screws to cool demand, leading to a fall in prices for services, not just goods. Separately, we turn our attention to the increasingly evident signs of a reversal in the labour market, where jobless claims rose last week to 1,493,000 - the highest since March and forming lows in June. The primary claims lows were in March before the Fed started its rate hike cycle.

Yesterday the markets were reassessing the ceiling height at which the rate will end up, discounting around 25 points but assuming a maximum near 5% and keeping it at that level for at least a year. This is a relatively tight monetary environment in which it will be challenging for all the fast-growing companies that fill the Nasdaq index to refinance or raise new loans.

As a result, although we expect further upward momentum in the coming days or weeks, there are still doubts regarding a fundamental break of the downtrend, which increases our attention towards the 200-day average. This test will determine the fate of the market for us.

By the FxPro Analyst team

-11122024742.png)

-11122024742.png)