A strong jobs report supports the demand for risk

A strong jobs report supports the demand for risk

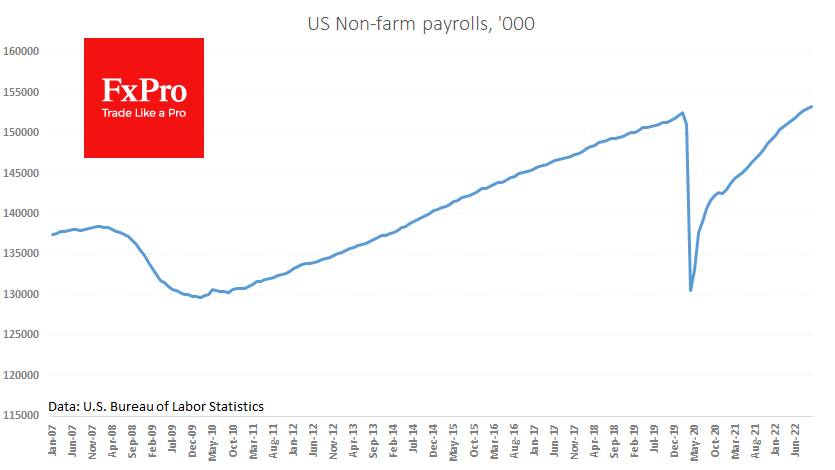

According to the latest BLS report, the US economy created 261K new jobs in October. These figures exceeded the expected 200K. Furthermore, last month's estimate was significantly improved from 288K to 315K. The labour market thus continues to create jobs at a rate above the trend rate of 200K per month.

Average hourly earnings rose 0.4% m/m, while the year-on-year increase slowed from 5.0% to 4.7%. This deceleration is within expectations. It turns out that above-normal employment and inflation growth do not lead to above-normal wage growth. They rose much more strongly late last year and early this year when market conditions (from stock prices to interest rates) were friendlier.

Somewhat discouraging is the rise in unemployment from 3.5% to 3.7%, with a falling share of the economically active population. Different methods estimate wages and unemployment rates; sometimes, they produce confusing results.

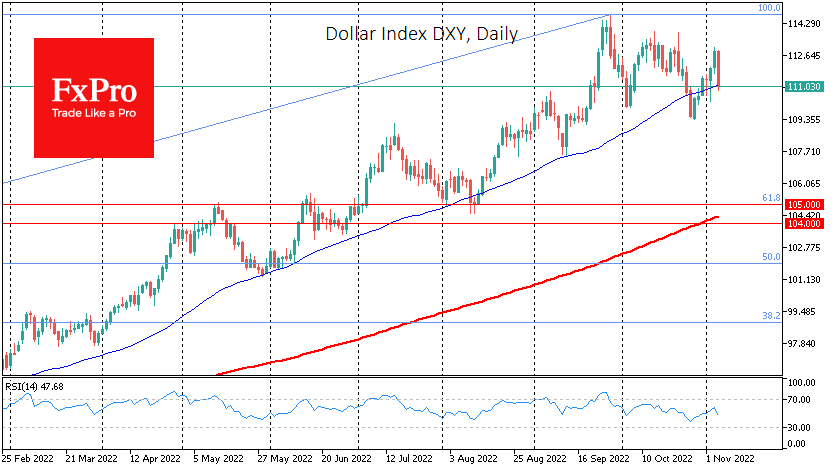

While the release of vital jobs data in the first minutes showed a fundamental underpinning to the Fed's confidence earlier in the week, the Dollar Index lost around 1% half an hour after the release. Even more remarkable is the reaction of silver and gold, up 5% and 2%, respectively, since the start of the day. The market is hungry for buying, but the current jobs report is unlikely to provide the momentum participants are waiting for.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)