Altcoins have taken the initiative

Altcoins have taken the initiative

Market Picture

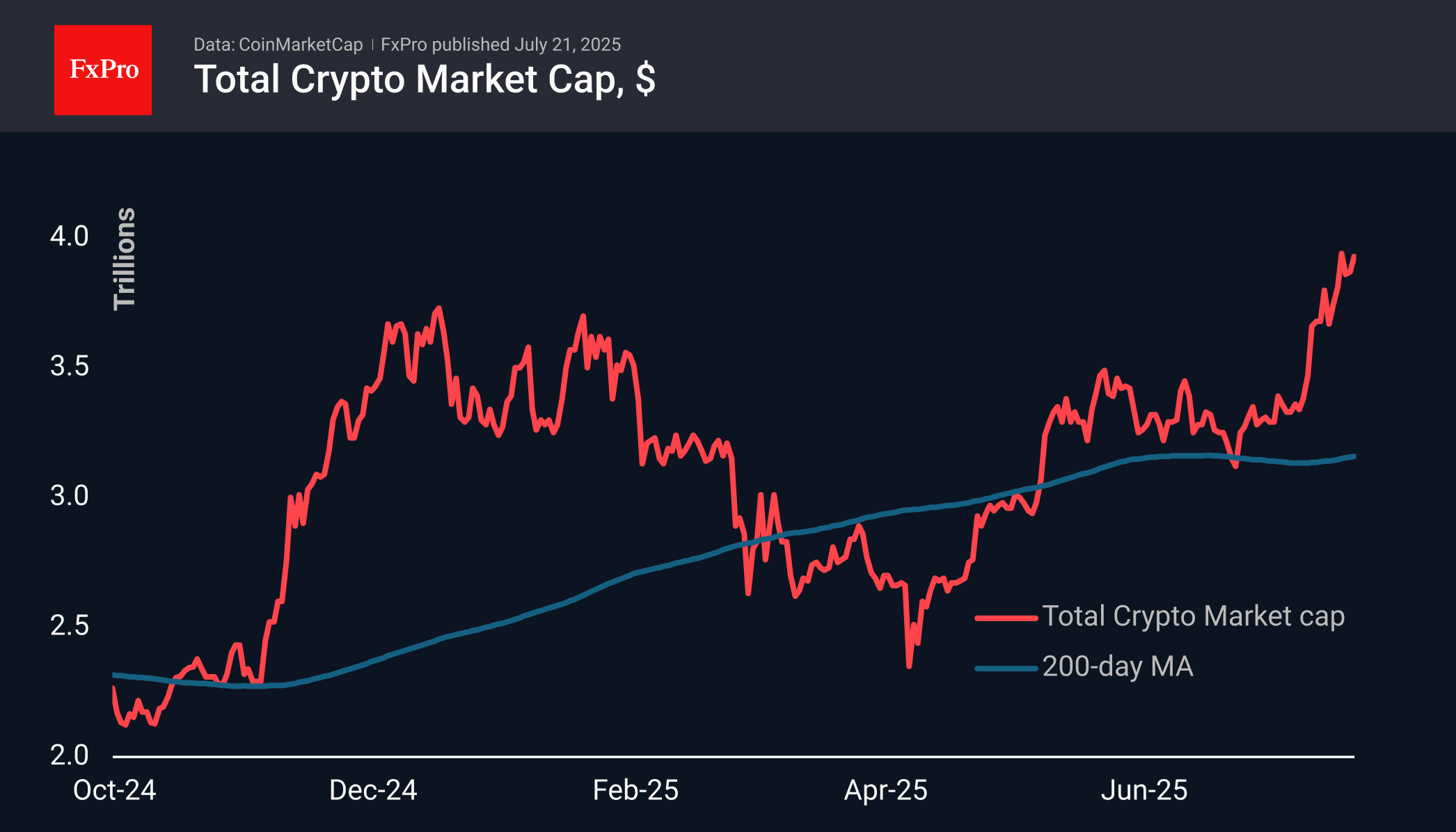

The cryptocurrency market capitalisation is once again approaching 4 trillion, currently standing at $3.96 trillion. The market returned to growth after Friday's jump and rapid correction. Unlike in previous months, the main driver is the rise in altcoin prices, rather than the first cryptocurrency. This is an important indicator of buyer confidence. However, demand is currently focused on proven names such as Dogecoin (+33% in 7 days), Litecoin and Ethereum (both +25%) and XRP (+20%).

Bitcoin has not been able to maintain its growth over the past week, consolidating around $118K after updating its historical highs. At such moments, enthusiasts carefully reduce their positions in BTC, increasing them in altcoins. Bitcoin has been gaining its share for almost three years, bringing it to almost two-thirds of the market. This is only slightly below the 70% range, which served as a kind of ceiling in 2019–2021.

XRP set a new all-time high above $3.66, the previous one having held for more than seven years. Since Trump's victory in the US presidential election last November, XRP has risen by almost 600%. The frenzy was followed by a pullback to $3.35 over the weekend, close to previous peaks. Still, the price is recording its sixth consecutive daily gain, trading above $3.5, indicating a solid breakout to a new price level.

News Background

Weekly inflows into spot Bitcoin ETFs in the US have declined slightly but remain near 8-week highs; positive dynamics have been observed in 12 of the last 14 weeks. According to SoSoValue, net inflows into spot BTC ETFs over the past week amounted to $2.39 billion, totalling $54.75 billion since the approval of Bitcoin ETFs in January 2024.

Weekly inflows into spot Ethereum ETFs in the US jumped to $2.18 billion, setting record highs for the second week in a row. Total net inflows since the ETF's launch in July 2024 have grown to $7.49 billion.

The inflow of capital into Ethereum could have intensified against the background of BlackRock's application to the SEC to add a staking feature to its ETH ETF. Several other providers have submitted applications with similar options. According to Bloomberg, the deadline for reviewing early applications is the end of October.

Mining company BitMine Immersion Technologies has become the largest public holder of Ethereum with a balance of 300,657 ETH worth over $1 billion. The accumulation of Ethereum began at the end of June. BitMine stated its goal is to acquire and stake 5% of the total ETH supply.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)