EBC Markets Briefing | Chinese investors awake to bullish stock market

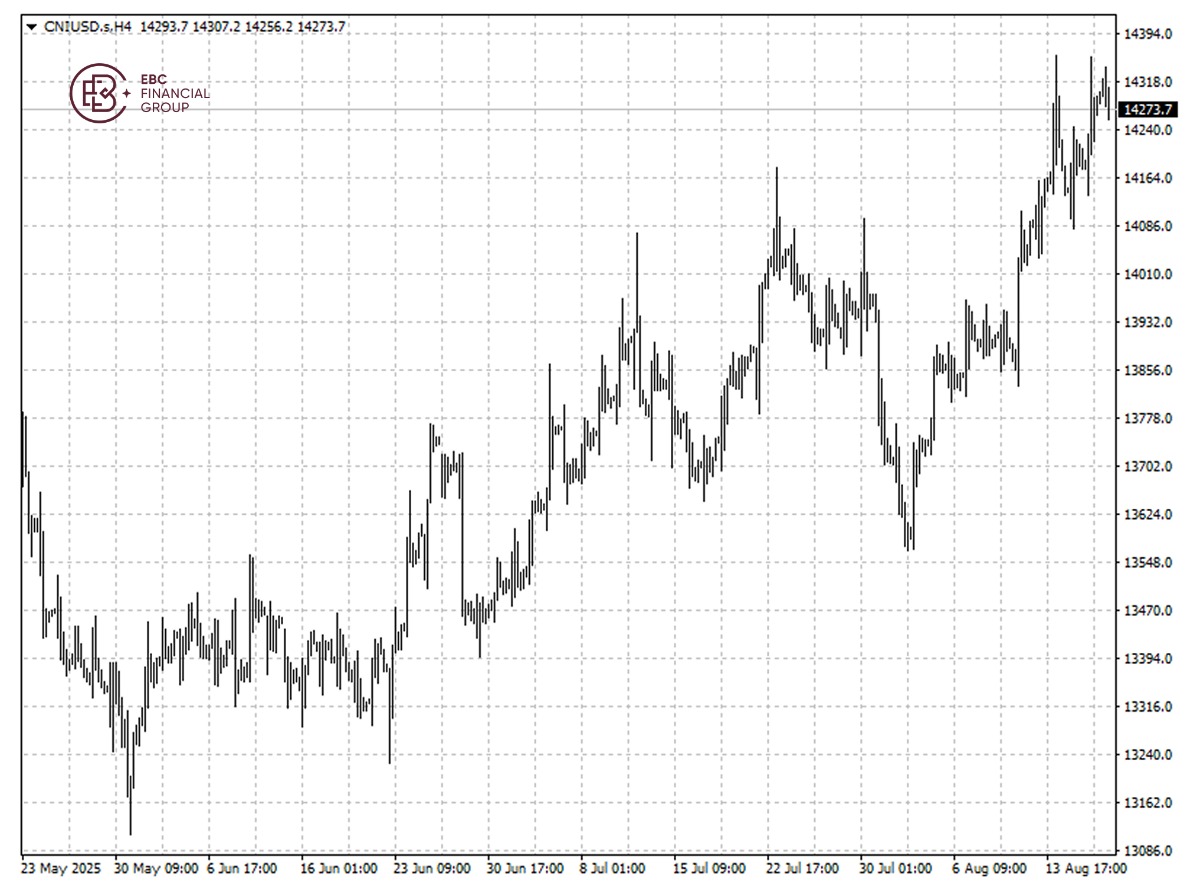

China A50 index saw a third straight daily gain on Tuesday before a key meeting of central bankers and as traders evaluated promising diplomatic signals toward ending hostilities between Russia and Ukraine.

The rally reflects a rising sense of optimism among retail investors, flush with near record-high savings and increasingly rotating out of bonds, as Beijing instils confidence in equity market.

Fund managers in China are now hoping that the current rally has enough behind it — ranging from hopes about AI to government moves to bolster growth — to stand the test of time.

Turnover on mainland exchanges was more than 2.7 trillion yuan on Monday, the second highest turnover, according to Bloomberg-compiled data. There has also been a surge in loans for stock purchases.

China's factory output growth slumped to an eight-month low in July, while retail sales slowed sharply, raising pressure on policymakers to roll out more stimulus to revive domestic demand.

The latest Reuters poll projected China's GDP growth to slow to 4.5% in Q3 and 4.0% in Q4. New home prices extended their slump in July, but declines eased slightly in major cities.

The A50 has formed a double top pattern, so a pullback is more likely than not. We see it touch the low at 14,220 before trending higher further.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.