Cryptocurrency market nervousness grows

Cryptocurrency market nervousness grows

Market Picture

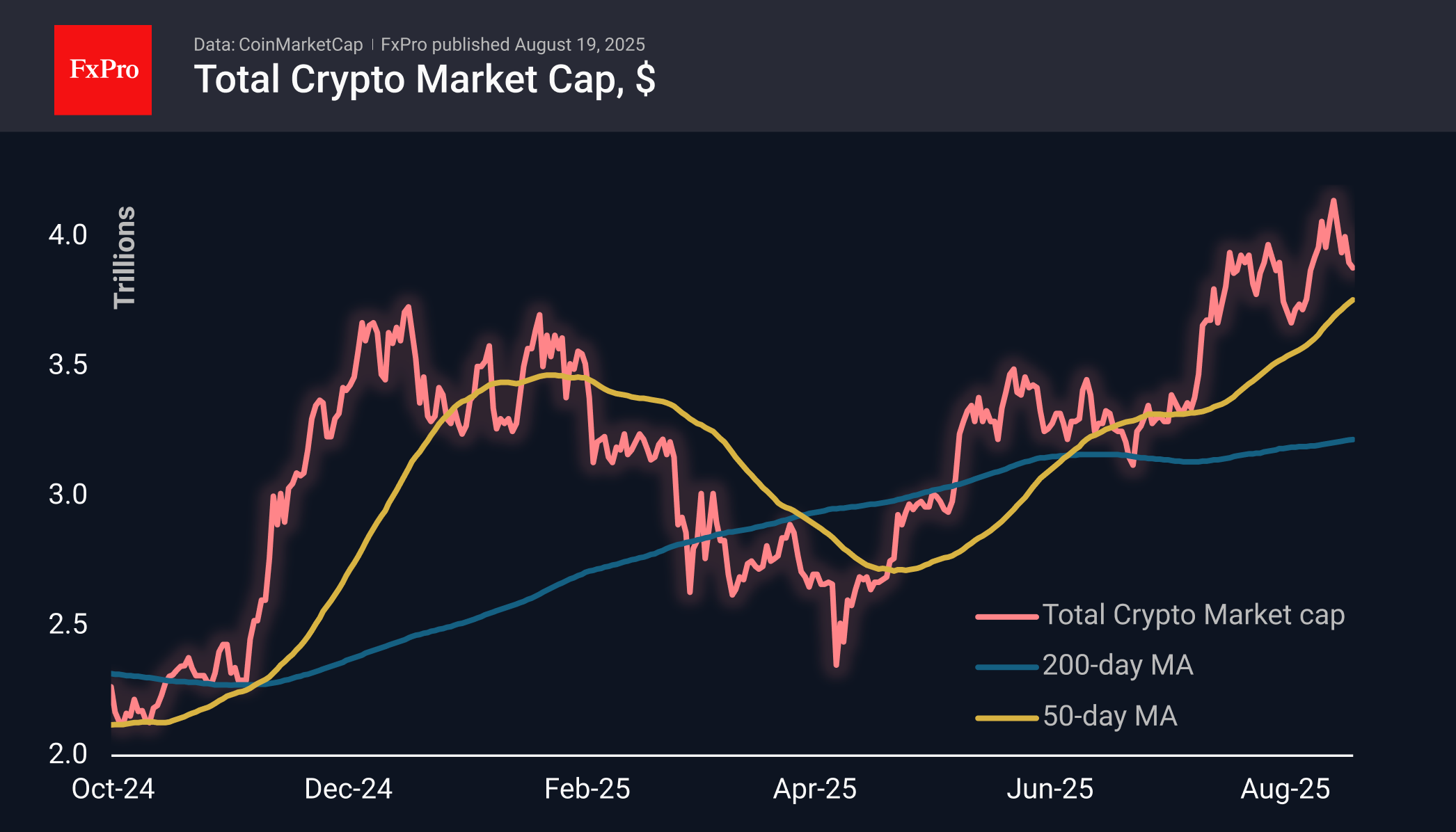

The cryptocurrency market capitalisation fell by another 0.4% to $3.87 trillion. The market is plunging below the former resistance level, raising speculators' fears of a possible major correction towards $3.6 trillion.

Bitcoin fell to $114.7k, rolling back to levels seen two weeks ago and below the medium-term trend line, which is a 50-day moving average. This dynamic reinforces fears of a deeper correction, which could affect the entire crypto market, potentially triggering a deeper correction to $100K, near the 200-day MA.

Ethereum rolled back to $4,200, losing more than 12% from its peak. The second-largest coin by capitalisation seems to be seriously aiming to test the strength of the former resistance area near $4,100, which has been holding back price growth since March 2024. The ability to stay above this level will indicate a change in the market regime for this cryptocurrency. The abundant capital inflows also point to this.

News Background

According to CoinShares, global investment in crypto funds rose more than sixfold last week to $3.748 billion, the highest inflow in the last four weeks. Investments in Bitcoin increased by $552 million, Ethereum jumped by $2.868 million, Solana grew by $177 million, XRP by $126 million, and Sui by $11 million.

According to Glassnode, the number of addresses with a balance of more than 10,000 BTC fell to an annual low, and the number of wallets with 1,000–10,000 BTC also decreased. This indicates that large holders are taking profits after reaching record highs.

According to Canary Capital, Bitcoin is 50% likely to reach $140,000–$150,000 by the end of 2025, but a bear market will come next year.

Solana became the first network to reach 107,540 transactions per second (TPS) during a stress test. The actual throughput of the blockchain is lower, at around 3,700 TPS, which is 59 times higher than that of the main Ethereum network.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)