EBC Markets Briefing | Yen slips amid hopes for continued rally

The yen retreated from its three-week high on Tuesday after carry trades began aggressively unwinding earlier this month. Strategists said the unravelling could be far from over.

Throughout most of 2024, the yen has seen sharp volatility, with the currency weakening to levels not seen since 1986 and prompting the BOJ to intervene in July to support the currency.

The BOJ's experience dovetails with findings in a new research presented at this year's Jackson Hole conference, showing that central bank communication has maximum impact when words are matched with action.

With a measure of calm now restored, Governor Ueda returned again to hawkish jawboning, telling parliament on Friday the BOJ will keep hiking rates to levels seen as neutral.

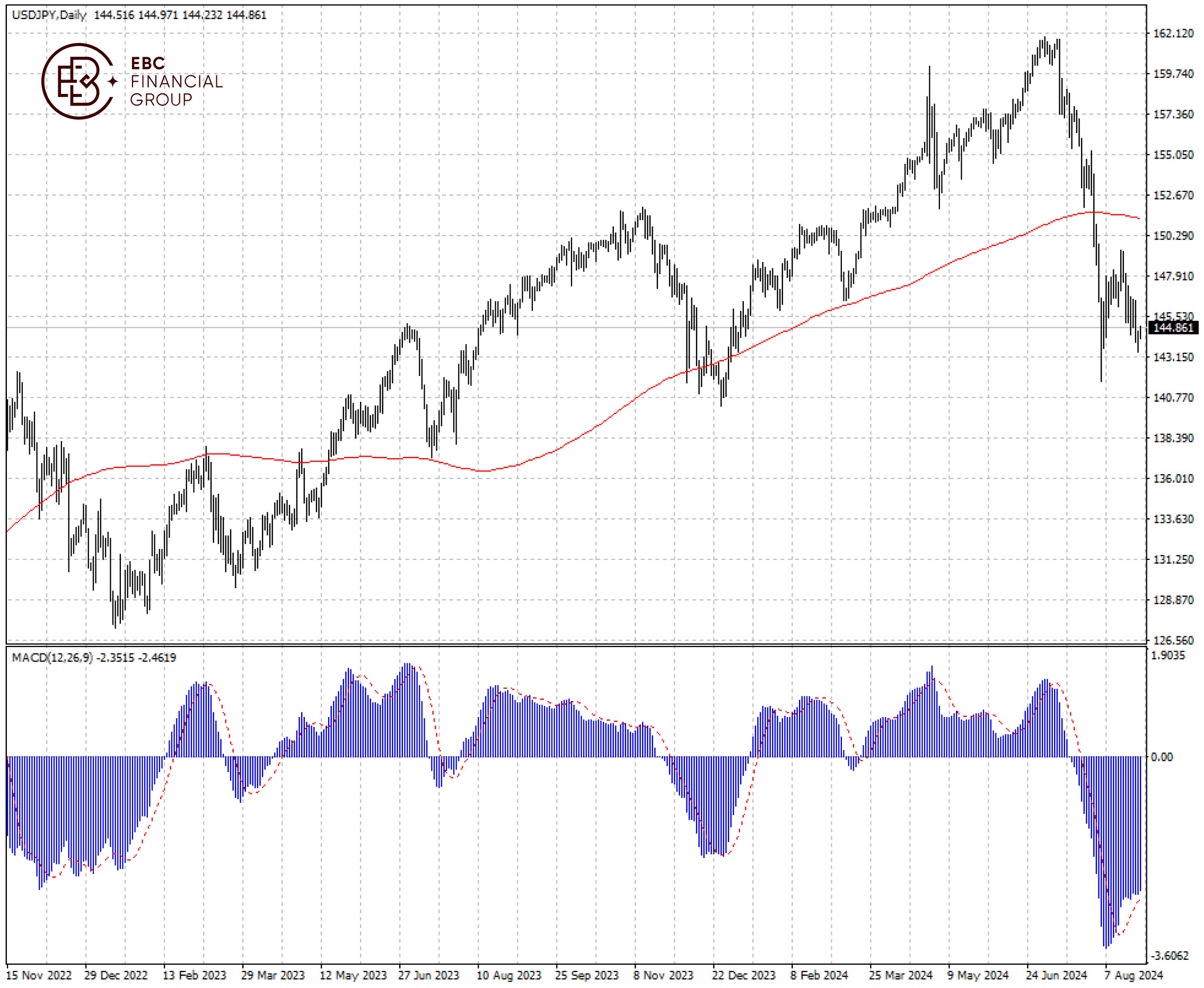

BNY strategist said that the greenback weakness was expected to persist against a number of major currencies through to the end of the year and expected the yen to go on the 130 handle by then.

A similar view is from the SMBC economist who expects the yen will trade around 145 to the dollar this year before rising to about 138 or even 130 per by the end of 2025 with “some high volatility”.

Bullish MACD divergence points to further gains ahead for the yen with initial support around 146.7 per dollar. The uptrend on a longer horizon is underpinned by 200 SMA.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Brand Influence or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.