Gold surges to record high amid weak US labor data

Recent US employment figures revealed a softer-than-expected labor market, with job creation falling short of forecasts and the unemployment rate edging higher. This disappointing data fueled investor demand for safe-haven assets, propelling gold prices to a new all-time high at the psychologically significant 3,600 level.

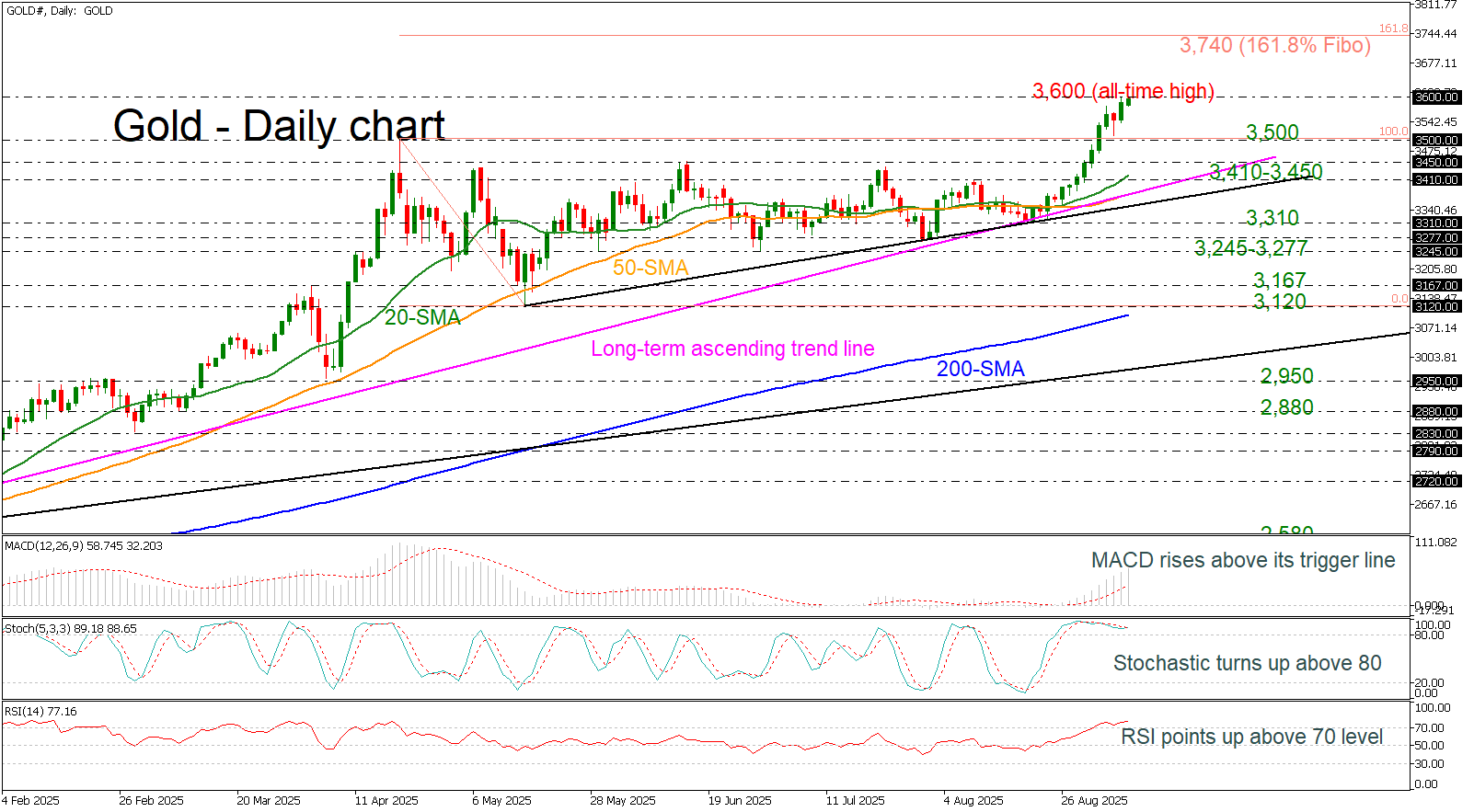

From a technical standpoint, momentum indicators continue to support the bullish outlook. The MACD oscillator is gaining positive traction above both its signal and zero lines, while the RSI remains elevated above 70, indicating strong upward momentum. Additionally, the stochastic oscillator has formed a bullish crossover within the overbought zone, reinforcing the prevailing upward bias.

Currently, gold is consolidating near its record peak, with the potential to extend gains further. The next key resistance is projected at 3,740, corresponding to the 161.8% Fibonacci extension of the corrective move from 3,500 to 3,120.

On the downside, immediate support lies at 3,500, followed by the 3,410–3,450 region, which encompasses both the short- and long-term ascending trend lines.

In brief, with technical indicators signaling continued bullish momentum, the metal appears poised for further gains.

.jpg)