ECB promises to be more active than Fed in 2023

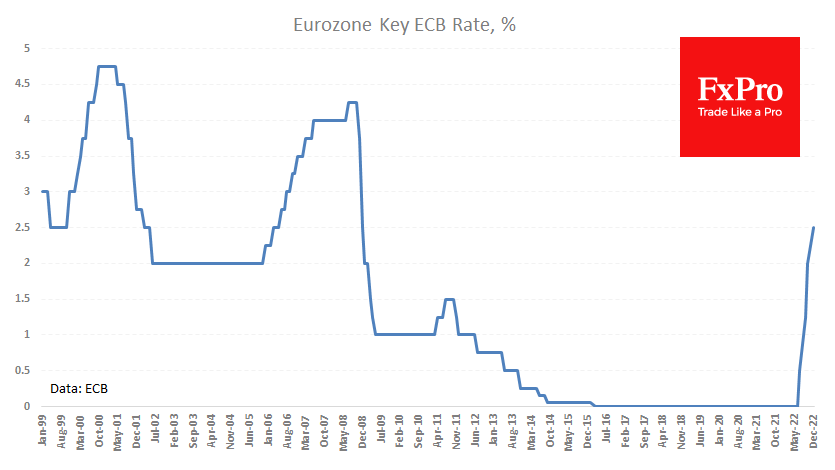

The ECB raised key rates by 50 points, bringing the key rate to 2.5% - the highest in 14 years, but promising not to stop there. In addition to the rate decision, the ECB will start selling assets off the balance sheet from March 2023, starting at 15bn per month, promising to revise the parameters regularly.

The commentary on the decision states upside risks for inflation and downside risks for the economy, expecting the economy to grow by 3.1% this year and 0.8% next year. This is noticeably better than the Fed's forecasts which expect GDP growth of 0.5% each in 2022 and 2023. A sharp cooling of GDP growth has not stopped the Fed and is unlikely to stop the ECB.

The US business cycle is often 2-3 quarters ahead of the European one, which is why the Fed was the first to rush with rates. But now the ECB is starting to sound more hawkish than the Fed. During the press conference, Lagarde predicted more 50-point rate hikes, while the Fed is expected to raise rates by +25 percentage points next.

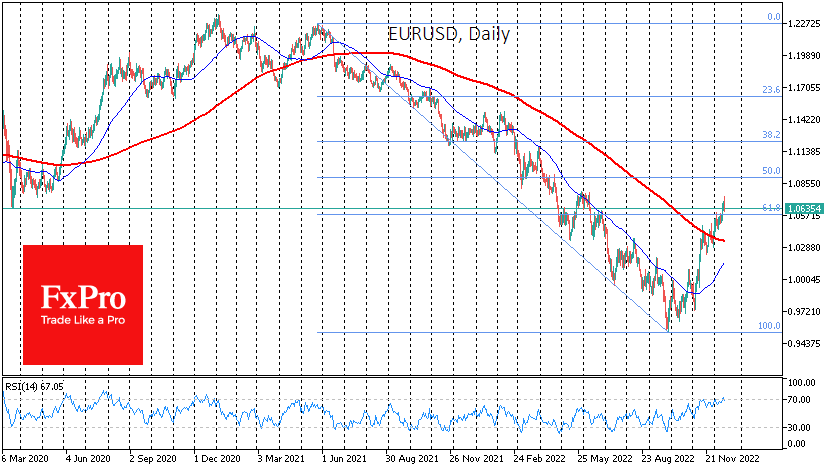

EURUSD added significant news for the third day in a row, strengthening by 1% after the US inflation release, regaining initial losses and rewriting semi-annual highs after the Fed, and strengthening by almost 0.5% after the ECB rate decision.

The EURUSD has been trading steadily above its 200-day average since the beginning of December, signalling a break in the downtrend. The pair has also crossed above the 61.8% mark of the declining amplitude from May 2021 to September 2022, and now it looks like it is about to start a long rally rather than a correction. The results of the most recent Fed and ECB meetings this year have underpinned this trend reversal by showing that the ECB is now catching up to the Fed. However, there is an essential technical test ahead at 1.0750-1.0800, where the 2020 lows are concentrated, a significant April-June consolidation area and local fatigue from an already past rally will accumulate.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)