Global Markets Surge on Rate Cut Anticipation

Global Markets Surge on Rate Cut AnticipationAsian markets have edged up following a surge in U.S. equity markets, which attained record highs as investors anticipate an early rate cut by the Federal Reserve next year. The U.S. dollar remains subdued, contributing to the continued rise in gold prices. Geopolitical tensions escalate in the Middle East, marked by attacks on vessels in the Red Sea, further supporting the safe-haven appeal of gold. Meanwhile, oil prices jumped by more than 2.5% due to a fresh attack on oil shipping in the Red Sea, sustaining concerns over short-term disruptions in oil supply. The Bank of Japan's Core Consumer Price Index (CPI) falling short at 2.7% has hindered the strength of the Japanese Yen.

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (83.5%) VS -25 bps (16.5%)

Market Movements

DOLLAR_INDX, H4

DOLLAR_INDX, H4

The US Dollar index experienced a decline yesterday as markets resumed activity following the Christmas holiday. Recent U.S. economic data indicating a potential easing of inflation has reinforced speculation about a Federal Reserve rate cut next year, exerting downward pressure on the strength of the dollar.

The dollar index has yet to find support and continues to edge lower, suggesting a bearish bias for the dollar. The RSI is on the brink of breaking into the oversold zone while the MACD continues to flow below the zero line, suggesting the bearish momentum remains strong.

Resistance level: 102.60, 103.50

Support level: 101.30, 100.80

XAU/USD, H4

Gold prices have maintained a sideways trend while testing their near-resistance level at $2069.35. The softening strength of the dollar presents a potential catalyst for gold to edge higher, especially with signs of easing inflation in the U.S. Additionally, escalating tensions in the Middle East are heightening concerns, providing further impetus for the safe-haven appeal of gold and potentially pushing its prices higher.

Gold prices are testing to break above its near resistance level; a break above such a level will serve as a solid bullish signal for gold prices. The RSI has been hovering near the overbought zone while the MACD has been flowing above the zero line, suggesting the gold price is trading with strong bullish momentum.

Resistance level: 2069.35, 2088.10

Support level: 2028.50, 2010.00

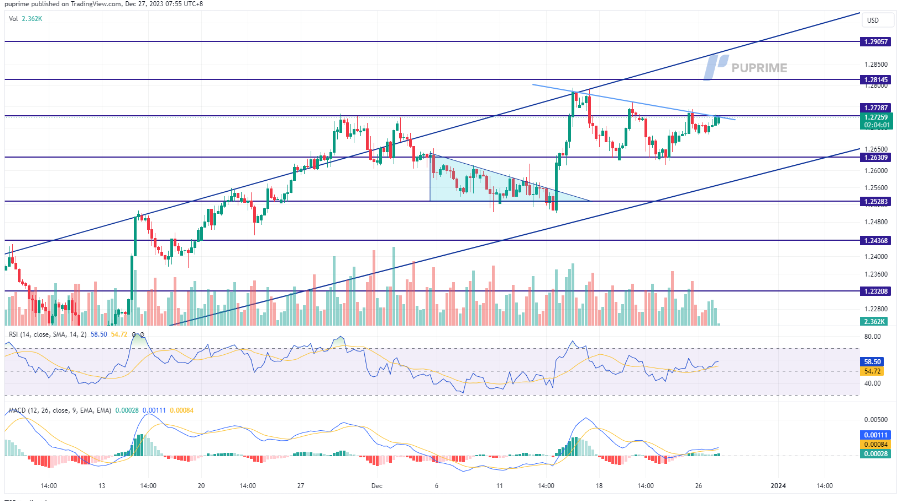

GBP/USD,H4

The U.S. dollar remains weakened, nearing its lowest level since late July, contributing to the upward movement of the GBP/USD pair. The divergence in central bank policies plays a crucial role, with the U.S. Federal Reserve contemplating a potential rate cut next year. In contrast, the United Kingdom's inflation rate remains well above the targeted 2%, and the Bank of England (BoE) currently has no intentions of cutting rates, thereby bolstering the strength of the Sterling.

The GBP/USD is testing to break above its downtrend resistance level, a break above may serve as a trend reversal signal for the pair. The RSI gains while the MACD rebounds above the zero line, suggesting bullish momentum is forming.

Resistance level: 1.2729, 1.2815

Support level: 1.2630, 1.2528

EUR/USD,H4

The EUR/USD pair has attained its highest level since mid-August, benefitting from the softening U.S. dollar. The European Central Bank's (ECB) vice president conveyed a relatively hawkish stance, stating that it would be premature to start easing monetary policy. This position contrasts with the Federal Reserve, where discussions among some officials about a potential shift in current monetary policy have begun. The perceived hawkishness of the ECB is contributing to the Euro's strength against the weakening dollar.

The EUR/USD remains trading with its uptrend trajectory and is testing its resistance level at 1.1041. The RSI remains flowing at an elevated level, while the MACD hovering above the zero line suggests the bullish momentum remains strong.

Resistance level: 1.1040, 1.1140

Support level: 1.0954, 1.0866

USD/JPY,H4

The Japanese Yen has demonstrated restrained trading against the U.S. dollar, staying below its long-term downtrend resistance level. The Bank of Japan's (BoJ) Core Consumer Price Index (CPI) fell short at 2.7%, lower than its previous reading of 3%, preventing the Japanese Yen from strengthening against its counterparts. The BoJ has indicated that any policy shift will be considered only if the wage-price cycle intensifies.

USD/JPY continues to trade sideways, awaiting for a catalyst to pick a direction for the pair. The RSI tends to move upward while the MACD is approaching the zero line from below, suggesting the bullish momentum is forming.

Resistance level: 143.78, 145.30

Support level: 141.60 138.88

AUD/USD, H4

The Australian dollar continues to showcase strength against the subdued U.S. dollar, currently trading at its highest level in five months. The Reserve Bank of Australia (RBA) could adopt a hawkish stance in the coming year, potentially opening the door for future rate hikes if inflation in Australia persists. This more assertive posture from the Australian central bank has contributed to the ongoing strength of the Australian dollar.

The AUD/USD pair continues to trade in its uptrend trajectory. The RSI hovering close to the overbought zone while the MACD flowing at an elevated level suggests the bullish momentum remains strong.

Resistance level: 0.6876, 0.6946

Support level: 0.6744, 0.6677

CL OIL, H4

Oil prices experienced a notable surge, breaking above their short-term resistance level and currently trading above the $75 mark, driven by unforeseen factors. A fresh attack by Houthi rebels on a vessel has led to a disruption in oil supplies, contributing to the upward pressure on prices. Furthermore, the increased risk of a broader conflict in the Middle East heightens concerns, potentially propelling oil prices even higher.

Oil prices break above their short-term resistance level, suggesting a bullish bias for the oil prices. The RSI jumps while the MACD continues to flow above the zero line, suggesting that bullish momentum is forming.

Resistance level: 77.25, 81.00

Support level: 73.80, 68.50