Market greed has shifted to smaller names

Market greed has shifted to smaller names

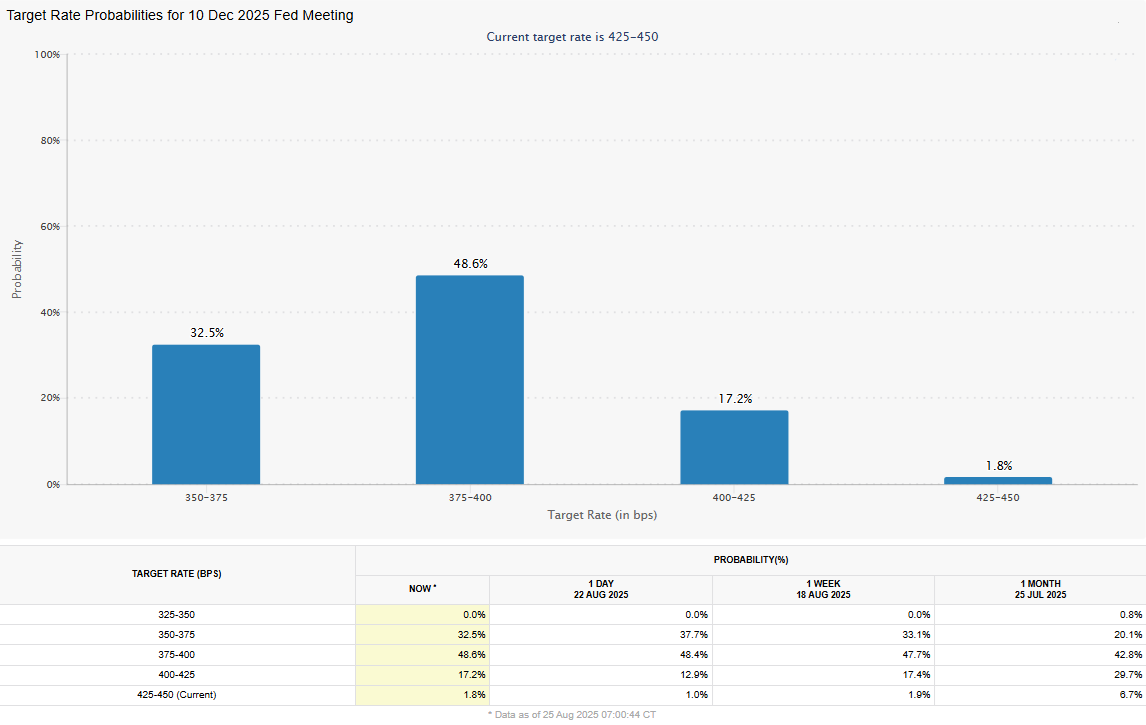

On Friday, speaking in Jackson Hole, Fed Chairman Powell confirmed his readiness to lower the key rate in September. Prior to these statements, expectations that the key rate would remain unchanged were gaining momentum, bringing the chances of this outcome to 25%. On Monday, however, this probability fell to 12.7%.

In fact, Powell removed the uncertainty on Friday, and it is pretty logical to expect the probability of a cut to approach 100% as September 17th approaches. This is a settled issue, and the market will now be influenced by expectations of how rate expectations will change over the next one to two quarters.

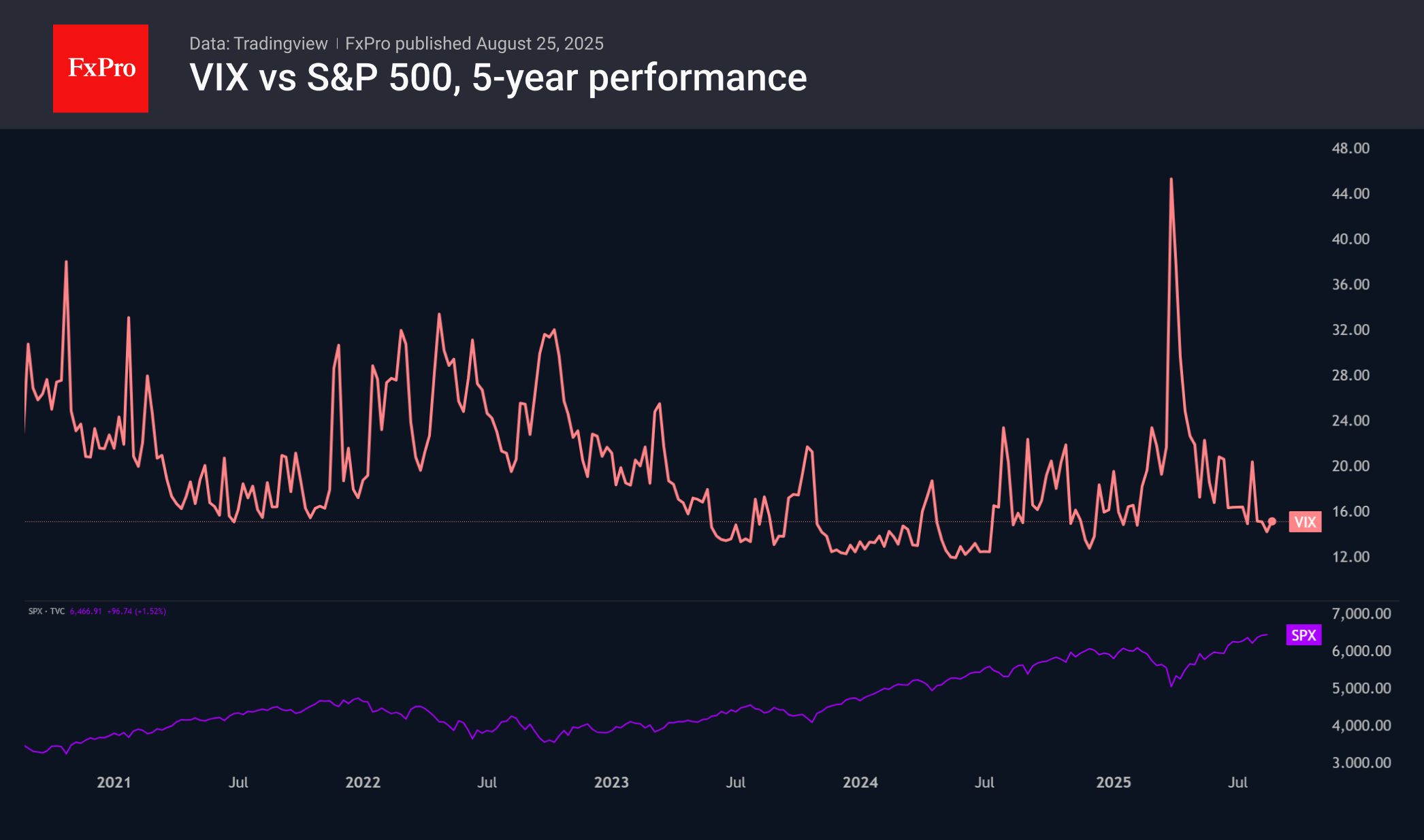

Noteworthy was the collapse of the VIX fear index, which lost 8.9% on Friday, falling to 14.22, its lowest level since the end of last year. At the same time, the absolute values are far from the minimum range (below 10), at which it would be legitimate to talk about excessive optimism.

The fear and greed index at 61 also indicates sentiment that is far from euphoric. Of its seven components, four are in a state of ‘greed’ and three are in neutral territory, leaving impressive potential for new buyers to enter the market.

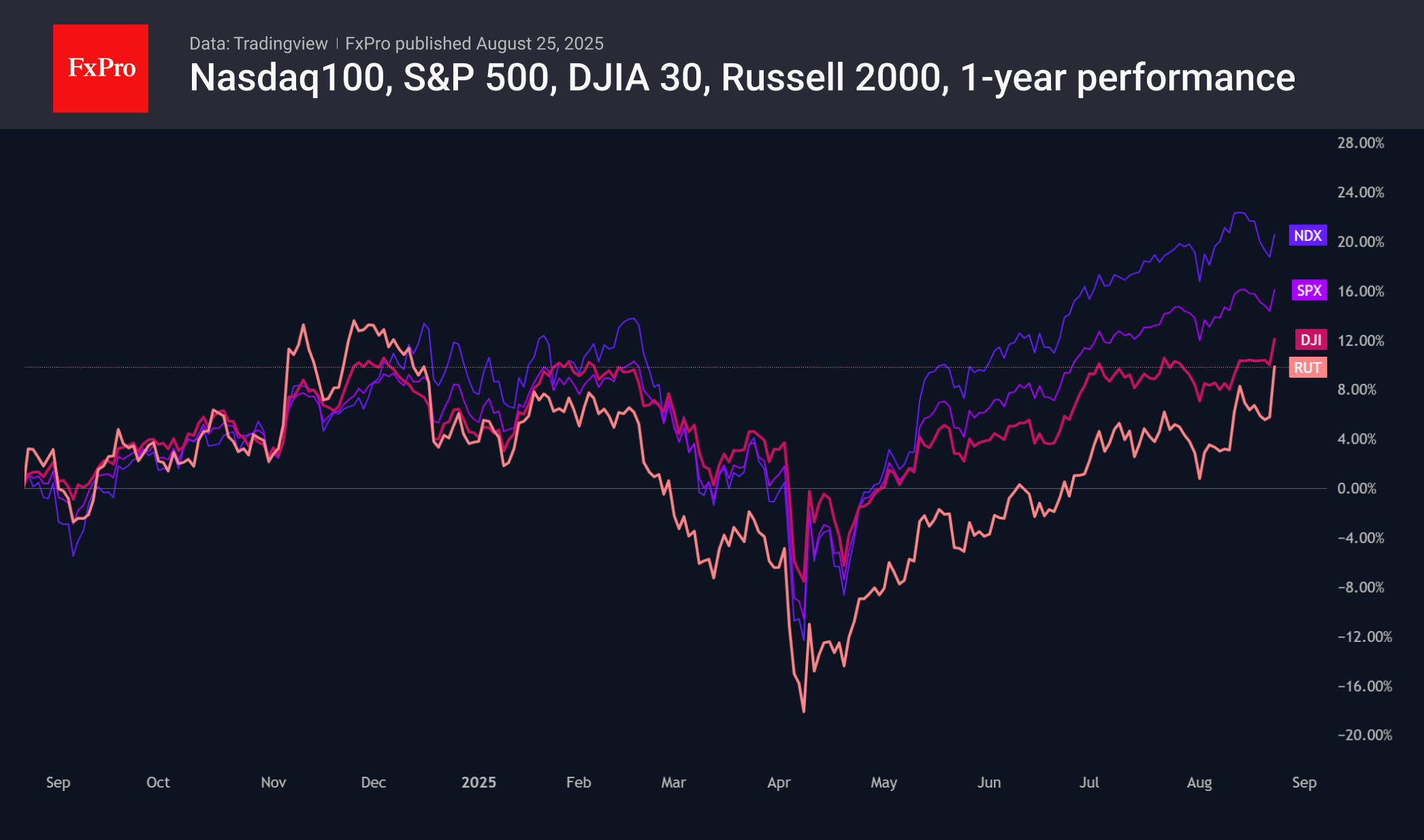

The resolution of the interest rate issue helped the Russell 2000 among the key US indices, which rose more than 4% on Friday, moving on to update this year's highs. At the same time, it needs to grow another 4.3% to update its historical highs.

Less dynamic but no less significant was the Dow Jones breakthrough, which jumped more than 2% to break through the resistance level near 45,000, which had been holding the index down since November last year.

These two indices outperformed the Nasdaq100 and S&P500 on Friday, as monetary policy easing can be safely considered a tide that lifts all boats at once. This contrasts with the growth of the market in high-tech heavyweights, whose dynamics are weakly correlated with the monetary regime.

In our view, cautious optimism is linked to the fact that markets fear seeing new signs of stagflation in the coming weeks, i.e., a combination of labour market weakness and accelerating inflation. This could paralyse the Fed.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)