Steady Recovery Signals Strength Amid Market Cautiousness

Market picture

Crypto market capitalisation has changed little over the past 24 hours, standing at $1.61 trillion with fluctuations between $1.57 trillion and $1.62 trillion. The cryptocurrency market remains cautious, which can easily be explained by the perception that cryptocurrencies have grown far more than expected in the past year. But the correction is no longer prevalent.

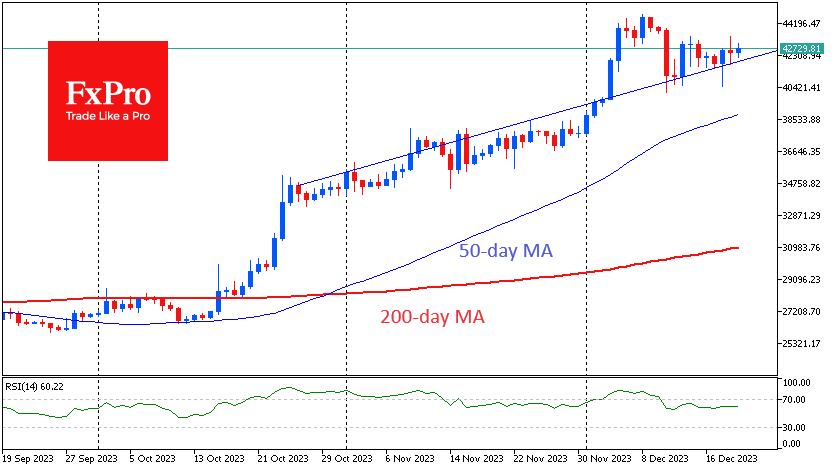

Bitcoin is losing 0.6% in 24 hours, trading at $42.8K. The resistance of the ascending channel from late October has recently got support, marking the persistence of the buy-the-dip pattern. This behaviour is setting up for a quick retest of the December highs near $45K.

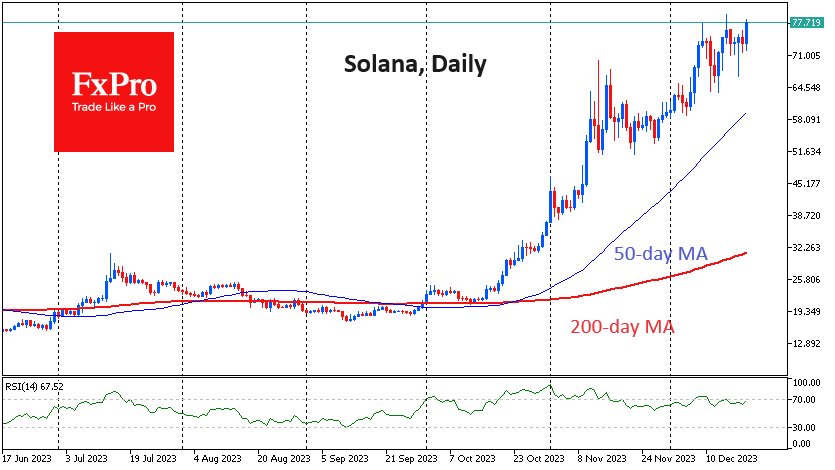

Solana is already testing the December highs near $78. The coin's price has almost tripled from the start of the rally on 13 October, but it's 70% below the peak. By comparison, Bitcoin is 37% lower, and the entire crypto market is 42% lower. The fact that Solana is recovering more steadily than most major competitors shows more interest in it in the community, which promises to keep its performance above the market in the coming months.

News background

Google searches on Solana have soared 250% in the past two months. User interest has coincided with the explosive growth of the asset and rising prices of related meme coins. The Solana blockchain continues to grow strongly with the background of new protocols and related airdrops.

MicroStrategy founder Michael Saylor described Bitcoin as an asset that has the potential to change investment strategies around the world. He said, "If Bitcoin doesn't aim for zero, it will reach $1 million. If it's a legitimate asset for institutional investors, it's not getting enough attention."

BlackRock conceded to the SEC and updated its application for a spot bitcoin ETF. The company's proposal now includes a mechanism to redeem units for fiat money. This is a redemption model that the SEC considers safer for investors compared to redemption in BTC.

The U.S. District Court for the Northern District of Illinois approved a settlement in the Binance case - the exchange will pay the CFTC $2.7 billion, and Changpeng Zhao will pay $150 million. Zhao is still under investigation for his involvement in money laundering, and so far, the former Binance CEO has been unable to leave the U.S. He faces up to 18 months in prison.

Circle, the issuer of USDC, the second largest stablecoin by market capitalisation, has announced plans to launch a stablecoin cryptocurrency, EURC, pegged to the euro, on the Solana blockchain.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)