The dollar risks losing support from tariff revenues

The US dollar retreated against major world currencies after further evidence of labour market weakness and a decline in Donald Trump's chances of winning in the Supreme Court to 20%, according to Polymarket. There is a lot at stake. The Treasury estimated budget revenues from tariffs at $750 billion by mid-2026. The president spoke of trillions of dollars in investment from other countries. The cancellation of tariffs does indeed risk being devastating for the US economy.

Donald Trump claims that his defeat in the Supreme Court will plunge the whole world into depression and is preparing a plan B. After all, the tariffs were introduced to counter China's restrictions on the export of rare earth elements.

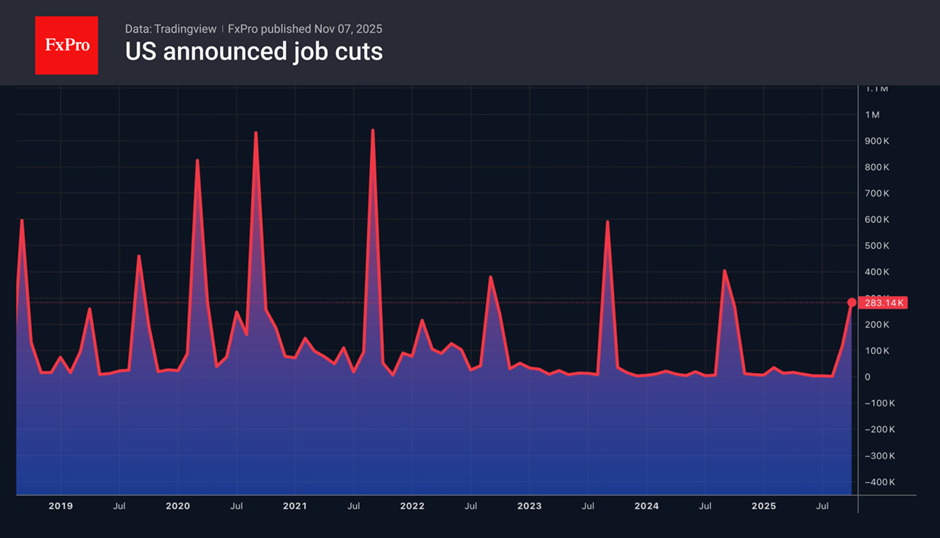

Indeed, the removal of tariffs will accelerate both international trade and global GDP. The primary beneficiaries will be the currencies of exporting countries, including the euro. Unsurprisingly, Reuters experts predict that the EURUSD will strengthen to 1.18 and 1.20 in one and three months, respectively, and to 1.21 in six months.The US economy is cooling even without the cancellation of tariffs. In the absence of official data from the BLS, investors have to pay attention to alternative sources of information. They signal structural weakness in the labour market. This will most likely force the Fed to continue cutting rates. According to Challenger, US companies planned to cut more than 150,000 jobs in October, the highest number for that month in 22 years. This is bad news for the dollar.

Indeed, the removal of tariffs will accelerate both international trade and global GDP. The primary beneficiaries will be the currencies of exporting countries, including the euro. Unsurprisingly, Reuters experts predict that the EURUSD will strengthen to 1.18 and 1.20 in one and three months, respectively, and to 1.21 in six months.The US economy is cooling even without the cancellation of tariffs. In the absence of official data from the BLS, investors have to pay attention to alternative sources of information. They signal structural weakness in the labour market. This will most likely force the Fed to continue cutting rates. According to Challenger, US companies planned to cut more than 150,000 jobs in October, the highest number for that month in 22 years. This is bad news for the dollar.

Even the pound, frightened by the BoE's resumption of its monetary expansion cycle, as well as imminent tax increases and government spending cuts, managed to counterattack against the greenback. The Bank of England kept its repo rate at 4% by a vote of five to four. However, the word ‘caution’ was removed from the accompanying statement. In addition, the MPC stated that the recent 3.8% consumer inflation rate would be the peak. Andrew Bailey argues that inflation risks have declined and become more balanced.The dovish rhetoric suggests a high probability of a cut in the repo rate in December. Coupled with concerns about the Labour Party's draft budget presentation at the end of November, this will put pressure on the pound.

Even the pound, frightened by the BoE's resumption of its monetary expansion cycle, as well as imminent tax increases and government spending cuts, managed to counterattack against the greenback. The Bank of England kept its repo rate at 4% by a vote of five to four. However, the word ‘caution’ was removed from the accompanying statement. In addition, the MPC stated that the recent 3.8% consumer inflation rate would be the peak. Andrew Bailey argues that inflation risks have declined and become more balanced.The dovish rhetoric suggests a high probability of a cut in the repo rate in December. Coupled with concerns about the Labour Party's draft budget presentation at the end of November, this will put pressure on the pound.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)