The US labour market trend reverses

The US labour market trend reverses

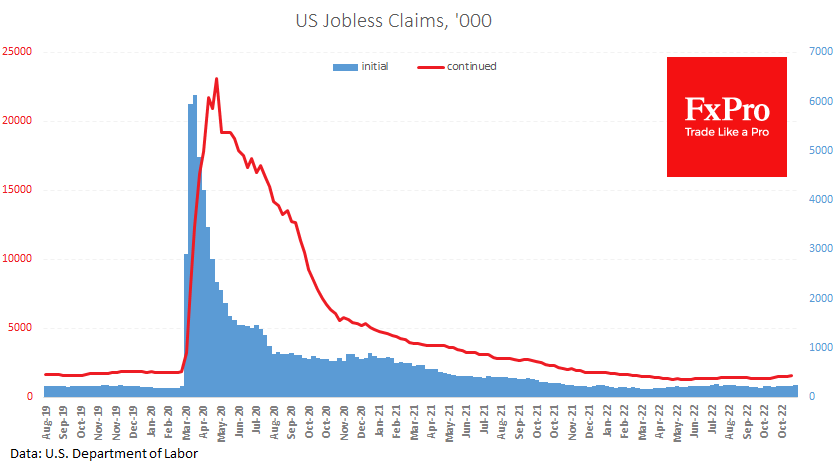

Weekly jobless claims in the USA rose to 240,000 last week, maintaining the upward trend since the end of September. The initial claims were the highest since August and exceeded expectations of 225k. The number of repeat claims was the highest since March at 1551k against 1503k a week earlier and expected 1517k.

Both indicators are at low absolute levels by historical standards, but we note a trend. This indicator suggests that the US economy is shifting from a slowdown to a contraction. The last time such a reversal occurred was at the end of 2019. However, the lockdowns severely disrupted (accelerated) the natural course of events. Even earlier, these indicators reversed in 2000 and early 2007, months before the start of the market downturn and quarters before the official recession.

A weakening labour market is just as important a signal for the Fed as slowing inflation. Both signs favour the US central bank reducing the rate hike. Even if a pause in the hikes is taken, the economy will digest the policy tightening already made for many months, nibbling at the nose in the coming months.

More signs of a reversal in the labour market and a less drastic slowdown in Europe than previously feared work in favour of EURUSD rising and are generally against the dollar index and in favour of the stock market, as it suggests a softer tone from the Fed in the coming weeks and months than previously expected.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)