UK Earnings rise alongside employment drop

The UK market is showing further signs of a reversal in the labour market towards a fall in employment, but the increased pace of wage growth is keeping a close eye on the Bank of England's actions and comments.

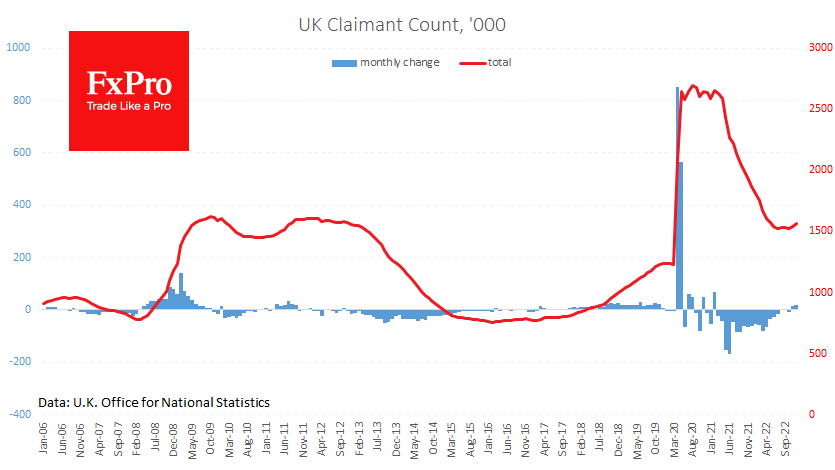

Jobless claims rose by 19.7k in December after climbing by 16.1k a month earlier, a logical development after a smooth stop to the decline earlier last year.

The unemployment rate remained at 3.7%. Here there is a 0.2 percentage point increase from the August lows, but these levels remain very low by historical standards. Unfortunately for policymakers, the low unemployment rate reflects a shrinking active workforce, which has forced the government to launch a programme of tax incentives for those back to work in the ages over 50.

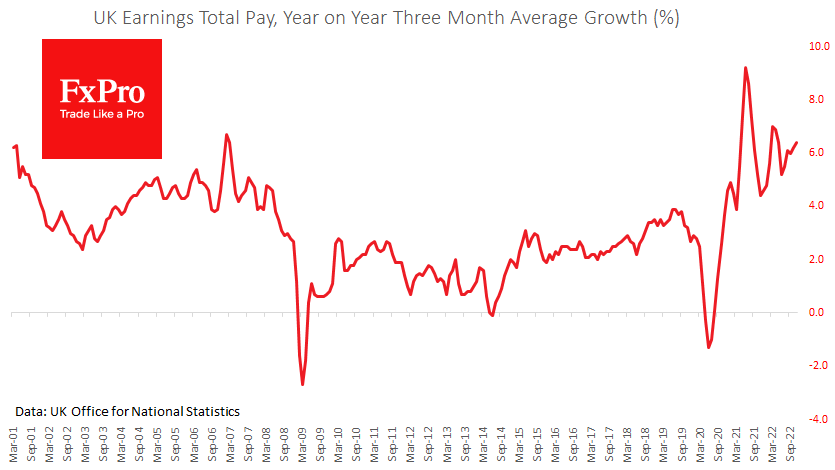

In theory, this should increase supply and curb wage growth, which now looks like the most dangerous part of the inflationary spiral. Wages in the last three months to November were 6.4% higher than in the same period a year earlier. This is below current inflation. However, this high rate of wage growth risks is the most significant factor in anchoring inflation expectations and overall inflationary pressure.

A fresh set of inflation data is published tomorrow morning, where a sharp fall in prices is not forecast on average. The combination of high consumer inflation and rising wages could force the Bank of England to push the economy harder into recession to suppress consumption and bring price growth under control, which would be positive for the pound.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)