Markets muted as Jackson Hole awaited for direction

Fed minutes show no widening split

With just a day to go before Fed chief, Jerome Powell, takes to the podium at the much-anticipated Jackson Hole gathering of central bankers, the minutes of the Fed’s July policy meeting set a hawkish tone ahead of the event. Following the dissents by Christopher Waller and Michelle Bowman, who voted for a 25-basis-point rate cut, the minutes disclosed that the two governors were alone in being more worried about the downside risks to employment than the impact of higher tariffs on inflation.

Despite acknowledging that economic activity had slowed, tariff concerns weighed heavily on most participants’ minds, with some highlighting the risk of longer-term inflation expectations becoming unanchored.

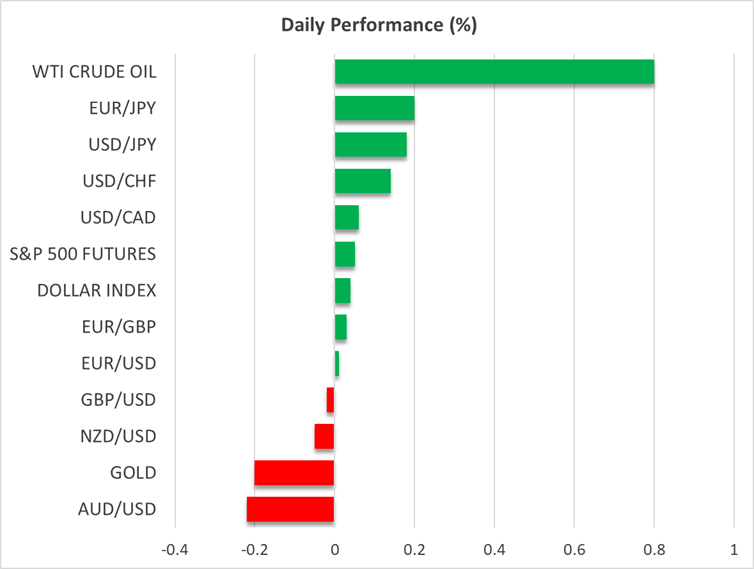

The US dollar bounced higher after the minutes were published and is extending its gains today, reversing the losses it recorded in the run-up to the minutes. The greenback’s appreciation weighed on gold, though not by much, while stocks on Wall Street mostly shrugged it off as buy-the-dip came into play following the significant pullback since Friday.

Spotlight is on Powell’s anticipated pivot

On the whole, markets are in waiting mode, as Powell’s stance has likely shifted since the last meeting, which took place a couple of days before the July payroll numbers came out. The July jobs report revealed cracks in the labour market that were unmasked by sharp downward revisions to the prior months’ prints.

But the CPI and PPI data that followed in the days after validated to some extent the concerns about tariff-induced inflation.

The question now is whether Powell will commit to a rate cut not just in September, but beyond, or will he make only a cautious tilt towards a more dovish position.

Tech stocks vulnerable to Jackson Hole disappointment

The US dollar could extend its modest rebound of the past week should Powell tomorrow disappoint those expecting a major pivot. But equities could be more at risk of volatility amid this week’s selloff in AI-related stocks on the back of renewed doubts about AI valuations. Although dip buyers have stepped in to stabilize the market, it’s too early to rule out a further slump in mega-cap tech stocks.

Having said that, many traders might prefer to wait for next week’s earnings by Nvidia before dumping stocks again.

However, the focus today will be on the retail sector, as Walmart is due to report its Q2 earnings before the market open.

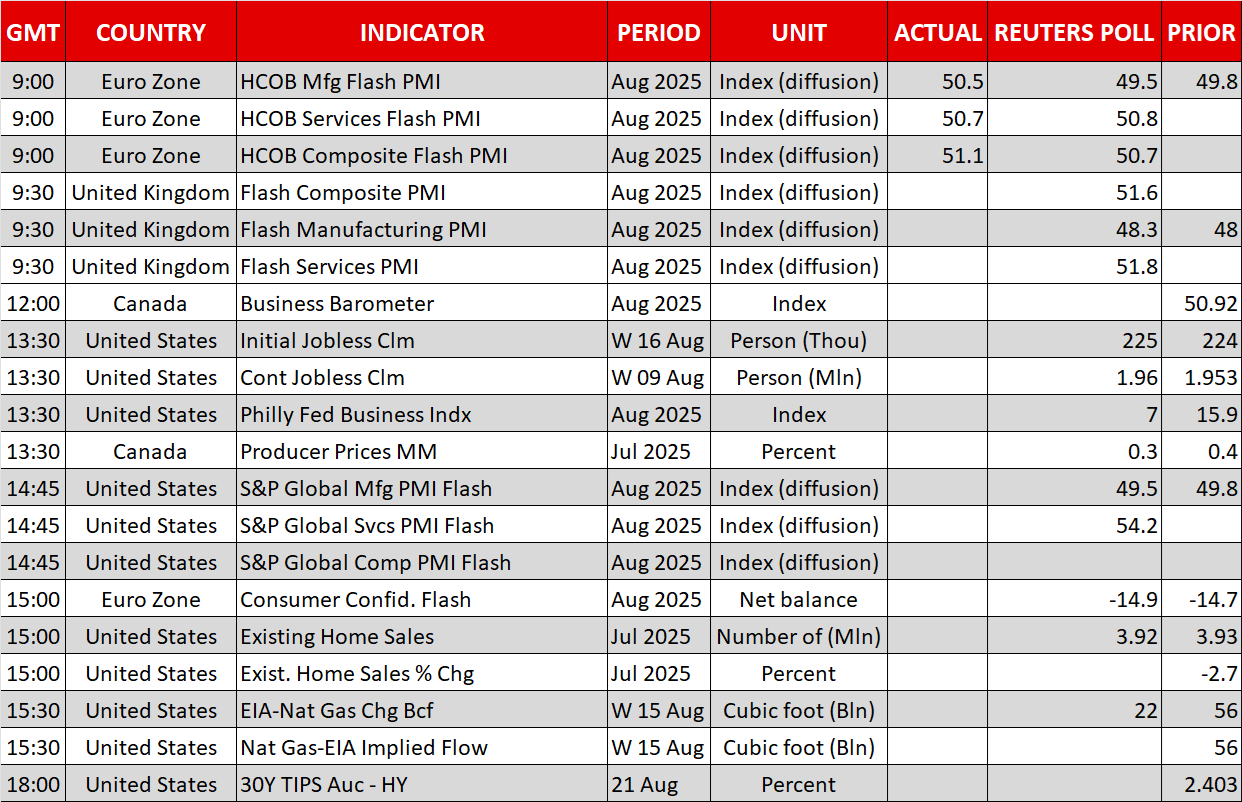

Euro and pound nudge higher after upbeat PMIs

Equities in Europe showed a mixed reaction to the stronger-than-expected PMI figures in the August flash readings, with the German Dax inching marginally higher. The euro was also little changed, holding withing a very tight range around $1.1650.

Sterling is attempting to halt a streak of negative sessions after UK PMIs surprised to the upside too, although only the services sector expanded. Yesterday’s hotter-than-expected CPI data failed to provide much of a lift.

US PMIs will also be watched at 13:45 GMT, as well as the weekly jobless claims at 12:30 GMT.

The yen is edging lower today, having benefited in recent days from a jump on long-dated Japanese government bond yields amid a spate of weak auctions lately. The 10-year yield hit a fresh 17-year high of 1.614% earlier in the day.

Gold eases from highs, oil perks up

Gold, meanwhile, is retreating from session highs just above $3,350, with that region once again proving to be a crucial support and resistance point for the precious metal.

But oil prices are climbing for a second day, boosted by the latest US inventories numbers that pointed to strong demand during the summer season.

.jpg)