US dollar struggles continue ahead of Fed meeting

Risk appetite retreats today

Despite the major US stock indices’ failure to achieve a historical tenth consecutive positive session, the overall sentiment remains cautiously optimistic. Risk appetite is clearly on the mend, with cyclical stocks from both the technology and consumer discretionary sectors leading the recovery, although most stocks are still below their mid-February highs.

This positive sentiment is also getting a vote of confidence from various investment banks pointing to a robust medium-term outlook for the S&P 500 index, thus hinting that there is a strong possibility that the worst is behind us. This looks rather optimistic considering the wider environment and the US President’s focus on trade restrictions.

Having said that, short-term implied volatilities across major assets have eased aggressively, feeding into the more positive outlook projections. Specifically, the one-month implied volatility of both the S&P500 and DAX 40 indices has dropped to the lowest level in the past 30 days, while major FX pairs are experiencing below-average volatility.

Gold rallies again, oil remains near recent lows

Contrary to the improved mood in equities, both gold and oil prices are sending alarming messages. Gold is edging higher today, capitalizing on yesterday’s sizeable rally and recovering half of the late April correction. Strong gold uplegs are usually a sign of uncertainty, especially if they occur amidst improved risk appetite.

Similarly, while WTI oil is edging higher today, it is still slightly above its recent lows, with its overall outlook remaining bearish. The OPEC+ alliance is continuing its production increases, with Saudi Arabia determined to keep the pressure up on specific noncompliant countries. While the true motivation behind increased supply jumps during a period of very low demand growth has yet to be fully understood, central banks appear to enjoy the current weakness.

Fed and BoE meetings in sight

Both the Fed and BoE are frantically preparing for their gatherings on Wednesday and Thursday, respectively. Both economies experienced a weak first quarter of 2025, with business sentiment taking a significant hit amidst inflation concerns. The BoE is expected to announce its second rate cut in 2025, while the Fed will most likely stand pat for a third consecutive meeting.

Despite their best efforts though, last minute developments, such as trade deals and tariff talks, could upset markets and influence their behind-closed-doors discussion. In this context, US President Trump has returned to his favorite subject of tariffs overnight. Following his comments about tariffs on foreign-produced films, Trump moved on to more important sectors such as pharmaceuticals, claiming to impose tariffs over the next two weeks.

Meanwhile, the various trade deals that were supposed to be announced by the US President last week have yet to materialize. Investors might get an update on this front following today’s meeting between Trump and Canadian PM Carney at 15:45 GMT.

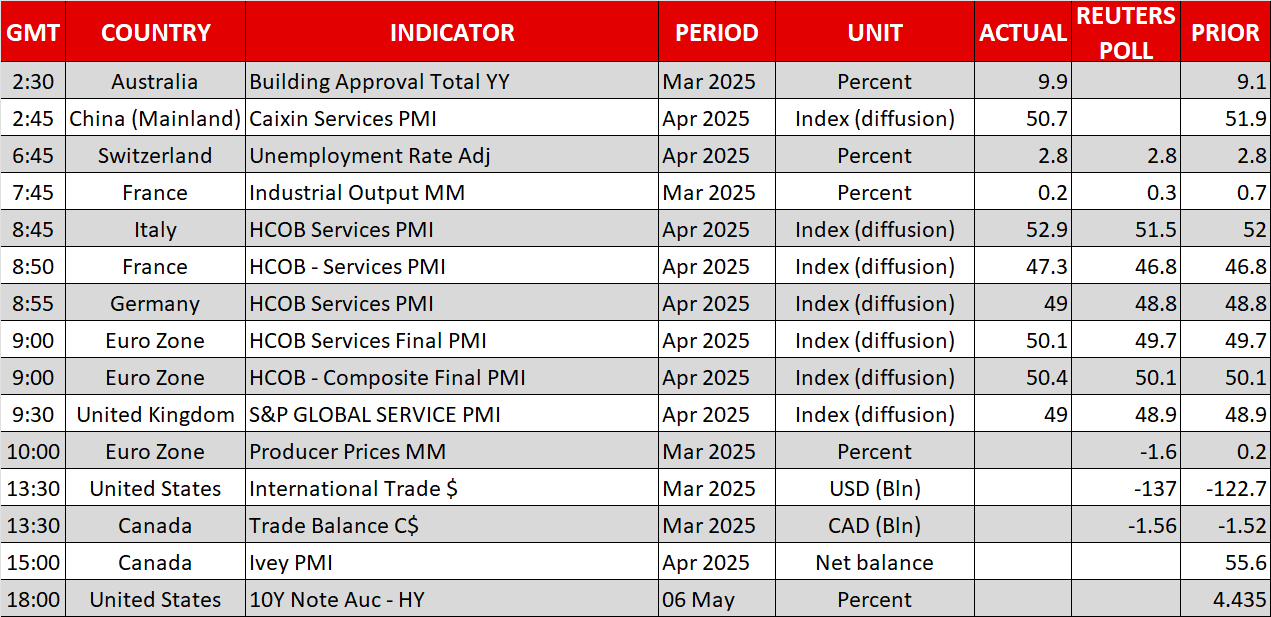

Quiet calendar; spotlight on US trade balance and the 10-year US auction

With the US dollar gradually chipping away at the euro’s recent outperformance, and dollar/yen’s latest uptrend remaining intact, investors will face a lighter data calendar today. Following the weaker Caixin Services PMI survey conforming to Monday’s softer ISM Services print, the focus turns to March US trade balance numbers and the 10-year US Treasury auction. The latter will be another test of international demand, with the most recent auctions largely failing to impress.

.jpg)