USDJPY at a crossroads ahead of US CPI inflation

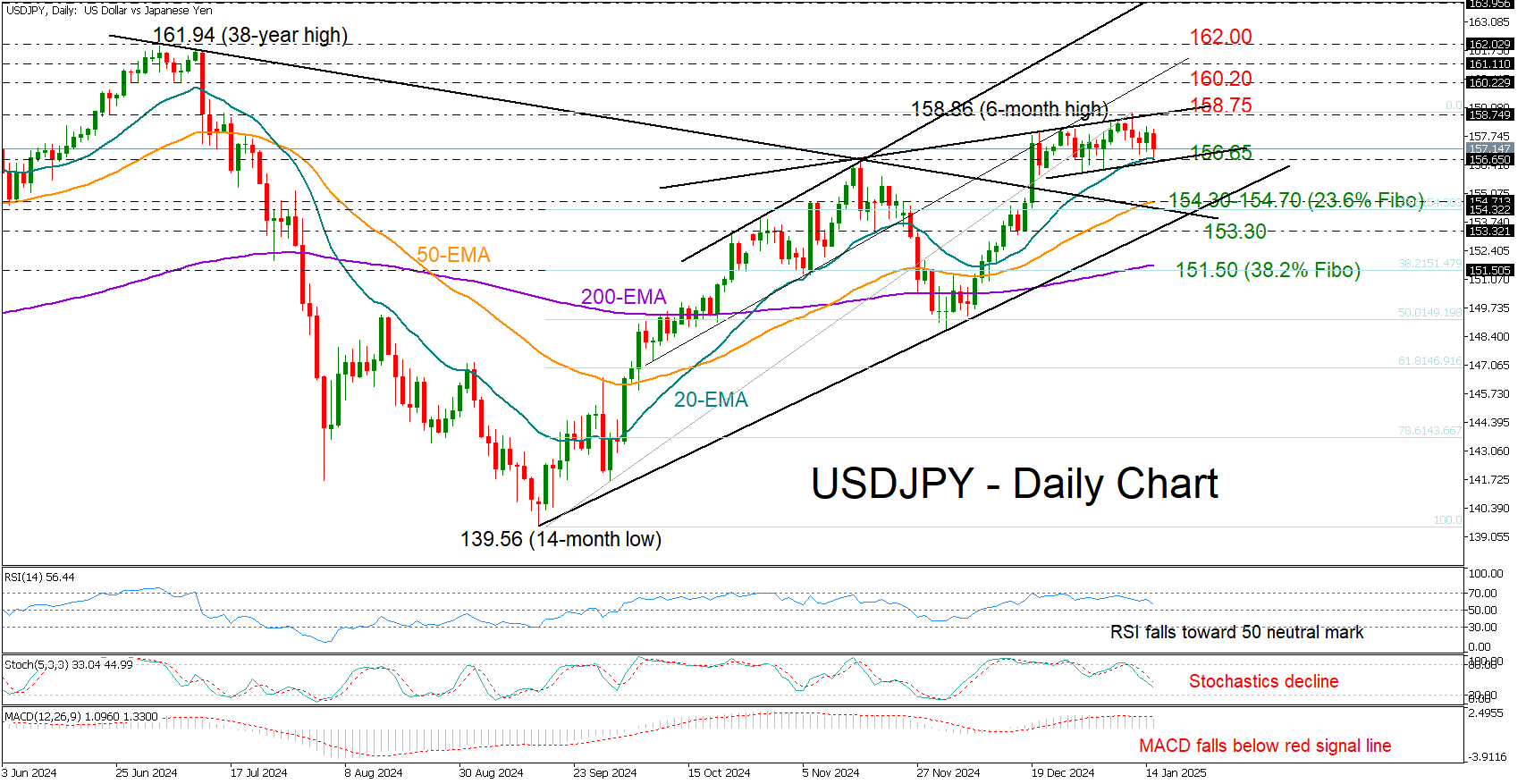

USDJPY is feeling the heat again after its soft upturn on Tuesday couldn’t surpass the 158.00 level, and with the US CPI inflation figures coming up later in the day, things could get interesting.

The pair pulled lower and is currently trading slightly above its 20-day exponential moving average (EMA) and the lower boundary of a short-term bullish channel, both seen around 156.65. If that base cracks, the bears could forcefully squeeze the price toward the 154.30-154.70 zone formed by the 50-day EMA and the broken resistance trendline drawn from July’s top. The 23.6% Fibonacci retracement of the latest uptrend is adding extra credence to this region, though a break below the tentative support trendline at 153.30 could be a bigger concern for the bulls. In fact, it could cause another steep downfall toward the 200-day EMA and the 38.2% Fibonacci mark of 151.50.

According to the falling technical indicators, the risk is skewed to the downside, though if the 156.65 floor stands firm, the bulls may stage another battle within the 158.00-158.75 zone. A victory there would brighten the outlook, likely fueling more buying toward the 160.20 number, and then if the 161.00 mark proves easy to pierce, the focus could turn to the 162.00 area.

In brief, the upward trend in USDJPY seems to be losing power, with sellers eyeing the 156.65 region for more downside. Yet, a real bearish signal could come once below 153.30.

.jpg)