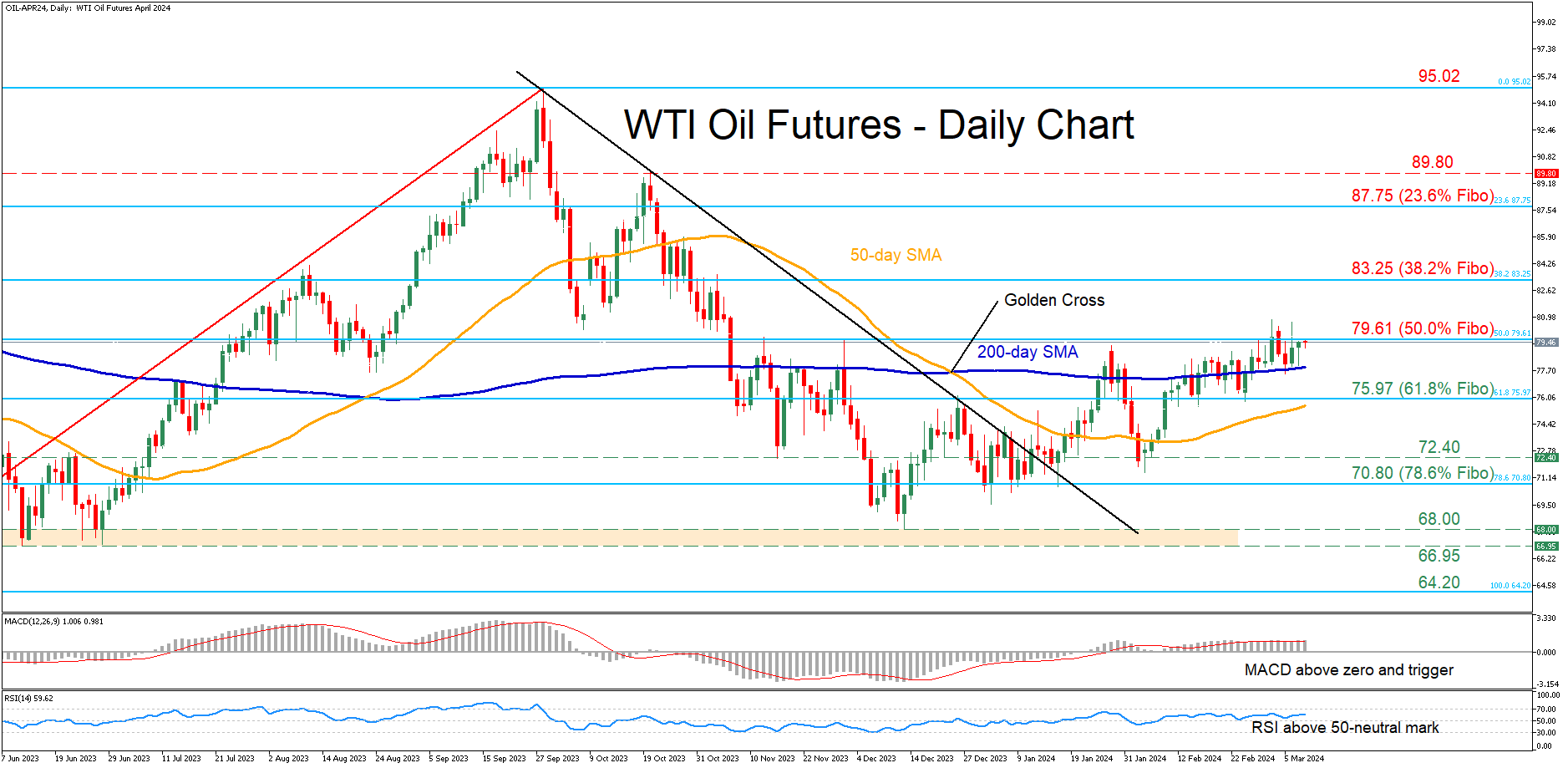

WTI oil futures in fierce battle with 50.0% Fibo

WTI oil futures (April delivery) have been staging a comeback after finding their feet at the 68.00 region in December. However, the recovery seems to have been on hold for the past few sessions as the 50.0% Fibonacci retracement of the 64.20-95.02 upleg has been curbing the price’s upside.

Given that both the RSI and MACD are tilted to the upside, the bulls might claim the 50.0% Fibo of 79.61, which has been holding its ground in the past few sessions. Further advances could then stall around the 38.2% Fibo of 83.25. Surpassing that zone, the price could ascend to face the 23.6% Fibo of 87.75.

On the flipside, if sellers re-emerge and push the price back below the 200-day simple moving average (SMA), initial support could be found at the 61.8% Fibo of 75.97. Lower, the November bottom of 72.40 could act as the next line of defence. A violation of that territory could set the stage for the 78.6% Fibo of 70.80.

In brief, WTI oil futures' recovery has stalled at the 50.0% Fibo of 79.61, a region that prevented further advances both in November and January. Therefore, a clear jump above that hurdle is needed for the short-term rebound to extend its course.

.jpg)