USDCAD: What’s next after a four-year high?

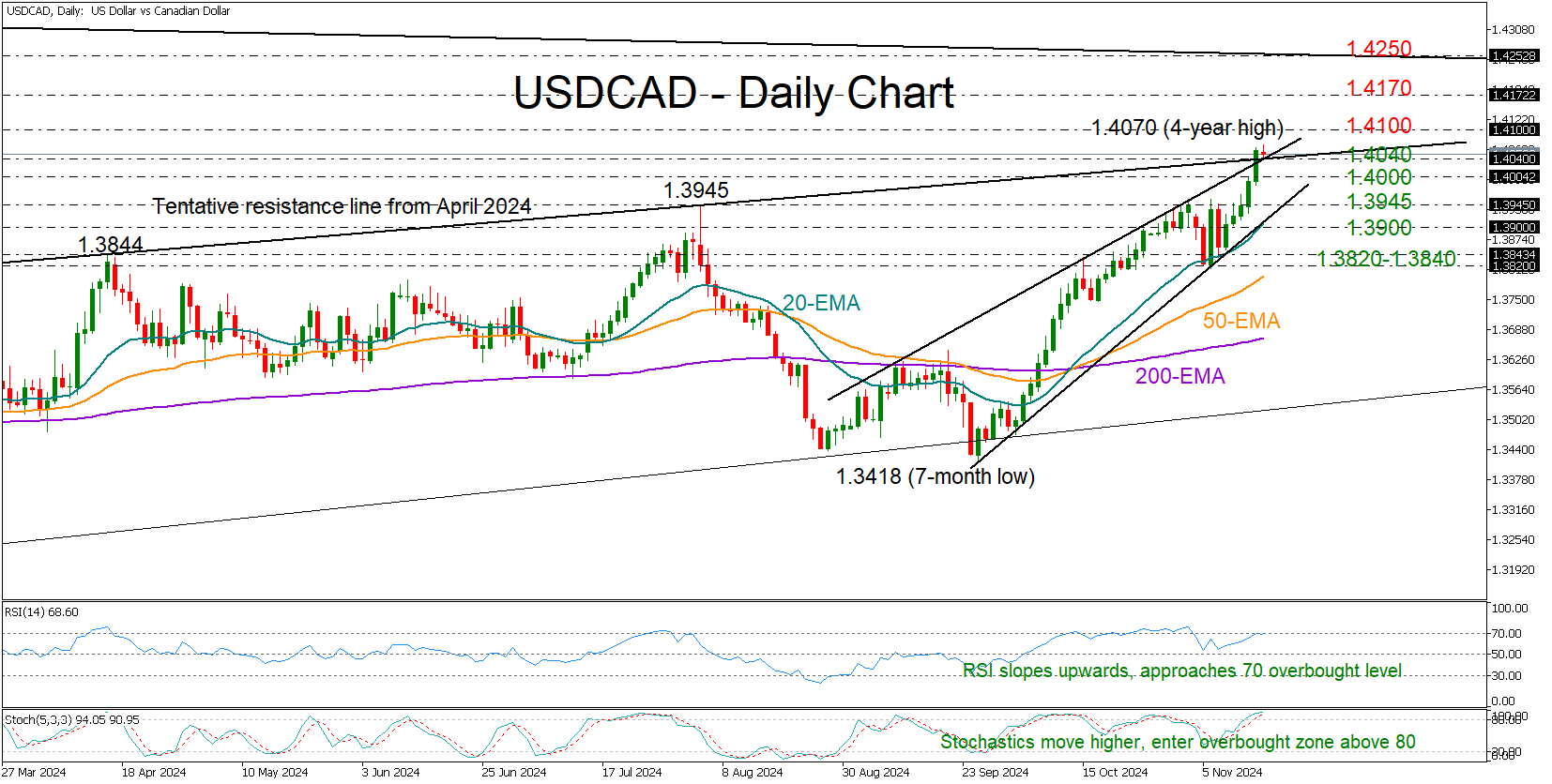

USDCAD enjoyed a lovely session on Thursday, and it even found fresh buying interest to tick to a new four-year high of 1.4070 on Friday after a four-day nonstop rally.

Technically, the pair broke through the trendline resistance zone around 1.4040, now acting as support, sparking renewed optimism that a new bullish cycle is underway. However, some consolidation could be on the horizon as both the RSI and stochastic indicators hover in overbought territory, signaling the current bull run may be overstretched.

Looking to the upside, the psychological 1.4100 level is the next hurdle, followed by the 1.4170 mark from May 2020. If the bulls maintain momentum, it would be interesting to see if they can successfully breach the tentative resistance line at 1.4250, which connects the 2002 and 2020 highs.

On the flip side, if the price slides below 1.4040, support could immediately emerge around the 1.4000 round level. The former resistance of 1.3945 and the 2022 high of 1.3976 could provide the next line of defense, while a break below the 20-day exponential moving average (EMA) and the 1.3900 number could send stronger bearish signals, threatening a deeper pullback to the 1.3820-1.3840 support region.

Overall, the pair has exited its two-year consolidation phase, suggesting the start of a new bullish cycle. That said, a brief pause or pullback is possible before the next leg higher.

.jpg)