- Inicio

- Comunidad

- Nuevos corredores

- is it possible to turn $100 to $1000 in 4 weeks ? (real acco...

Advertisement

Edit Your Comment

is it possible to turn $100 to $1000 in 4 weeks ? (real account)

Miembro desde Jan 25, 2010

posts 1288

Dec 17, 2014 at 01:44

Miembro desde Jan 25, 2010

posts 1288

Miembro desde Jan 25, 2010

posts 1288

Dec 17, 2014 at 01:47

Miembro desde Jan 25, 2010

posts 1288

togr posted:

@alexforex007

If you know when to enter and exit the trades as manual trader

then you can program EA that will do the same and execute the system better than you.

If you dont have such rules you should not trade even manually

alexforex007 posted:

There is a possibility of making very nice returns, but a lot of discipline and patience must be applied.

No one can beat a computer for discipline and patience!

Miembro desde Jan 25, 2010

posts 1288

Dec 17, 2014 at 01:54

(editado Dec 17, 2014 at 01:57)

Miembro desde Jan 25, 2010

posts 1288

togr posted:BoneTrader posted:

@togr still I doubt that marketmakers use an EAs for trading. That outbalances all the trades that EAs execute at the moment.

@BoneTrader

An automated trading system (ATS) is a computer trading program that automatically submits trades to an exchange. Automated trading systems are often used with other forms of electronic trading, such as electronic communication network, "dark pools" and algorithmic trading.[1] As of the year 2010 more than 70% of the stock shares traded on the NYSE and NASDAQ are generated from automated trading systems.[citation needed] They are designed to trade stocks, futures and forex based on a predefined set of rules which determine when to enter a trade, when to exit it and how much to invest in it.Trading strategies come in many different shapes and sizes, some preferring to pick market tops and bottoms, others coded to ride the daily trend, and everything in between. [2]

Algorithmic trading may be used in any investment strategy, including market making, inter-market spreading, arbitrage, or pure speculation (including trend following). The investment decision and implementation may be augmented at any stage with algorithmic support or may operate completely automatically. One of the main issues regarding HFT is the difficulty in determining how profitable it is. A report released in August 2009 by the TABB Group, a financial services industry research firm, estimated that the 300 securities firms and hedge funds that specialize in this type of trading took in a maximum of US$21 billion in profits in 2008,[6] which the authors called "relatively small" and "surprisingly modest" when compared to the market's overall trading volume. In March 2014, Virtu Financial, a high-frequency trading firm, reported that during five years it made profit 1,277 out of 1,278 days, losing money just one day.[7]

@togr : Yes, good definition (albeit direct from Wikipedia!). I totally agree - still surprising how many people underestimate the (real) potential of algorithmic (automated) trading. But then, I guess we are in a forum... and only certain people hang out in a forum (the 90% of losing traders). "It is impossible to soar like an eagle when you hang out with chickens." My question is: where do the "eagles" hang out? 😉

Despite the very real and evidenced potential of computers for executing trades automatically, I seriously do not think MQL5 are smart enough to do something like Big Brother (heck, MQL5 keep messing things up - can they do anything right?)

forex_trader_202879

Miembro desde Aug 07, 2014

posts 378

Dec 17, 2014 at 04:41

Miembro desde Aug 07, 2014

posts 378

BluePanther posted:togr posted:BoneTrader posted:

@togr still I doubt that marketmakers use an EAs for trading. That outbalances all the trades that EAs execute at the moment.

@BoneTrader

An automated trading system (ATS) is a computer trading program that automatically submits trades to an exchange. Automated trading systems are often used with other forms of electronic trading, such as electronic communication network, "dark pools" and algorithmic trading.[1] As of the year 2010 more than 70% of the stock shares traded on the NYSE and NASDAQ are generated from automated trading systems.[citation needed] They are designed to trade stocks, futures and forex based on a predefined set of rules which determine when to enter a trade, when to exit it and how much to invest in it.Trading strategies come in many different shapes and sizes, some preferring to pick market tops and bottoms, others coded to ride the daily trend, and everything in between. [2]

Algorithmic trading may be used in any investment strategy, including market making, inter-market spreading, arbitrage, or pure speculation (including trend following). The investment decision and implementation may be augmented at any stage with algorithmic support or may operate completely automatically. One of the main issues regarding HFT is the difficulty in determining how profitable it is. A report released in August 2009 by the TABB Group, a financial services industry research firm, estimated that the 300 securities firms and hedge funds that specialize in this type of trading took in a maximum of US$21 billion in profits in 2008,[6] which the authors called "relatively small" and "surprisingly modest" when compared to the market's overall trading volume. In March 2014, Virtu Financial, a high-frequency trading firm, reported that during five years it made profit 1,277 out of 1,278 days, losing money just one day.[7]

@togr : Yes, good definition (albeit direct from Wikipedia!). I totally agree - still surprising how many people underestimate the (real) potential of algorithmic (automated) trading. But then, I guess we are in a forum... and only certain people hang out in a forum (the 90% of losing traders). "It is impossible to soar like an eagle when you hang out with chickens." My question is: where do the "eagles" hang out? 😉

Despite the very real and evidenced potential of computers for executing trades automatically, I seriously do not think MQL5 are smart enough to do something like Big Brother (heck, MQL5 keep messing things up - can they do anything right?)

Excellent point about eagles and chickens. The reality is the internet (especially sites like these) are filled with mostly untalented traders. If in reality we had some serious talent here, then we would have someone who can keep his or her drawdown% and Pip - drawdown DOWN, and keep the profits coming in, how ever much profit it is.

Yet, we want to feel as if we can predict the future and we say things like the market is over bought or under sold, and look to take positions that way, when the reality is the market doesn't move based on over or under anything. If simply looked at th market for what it is "supply and demand" then trading would be so much easier.

Think about the very first minute of forex being public..... How did the price shift either upward or downward, if there were no HIgher TF to come by? In forex if you believe the chicken came before the egg or visa versa will determine your perception of how the market works, your perception of the market will determine your bias, and your bias will determine how quickly you margin call.

So until you so called GURUS stop margin calling accounts, and stop having 300+ pip draw down, then your simply taking educated guesses, instead of rational ones. Stick to the damm script, and learn how to read the lower tf. Lower TF's create what you see on the higher TF. We think fundamentals run the market, when all it does is create bias. Simply ask the people who have been buying UJ the last week, and buying everytime it goes up. Oh won't their Christmas holiday be much brighter if they were not in red over 500 pips.

Miembro desde Jan 25, 2010

posts 1288

Dec 17, 2014 at 04:52

(editado Dec 17, 2014 at 04:55)

Miembro desde Jan 25, 2010

posts 1288

Cholipop posted:

So until you so called GURUS stop margin calling accounts, and stop having 300+ pip draw down, then your simply taking educated guesses, instead of rational ones. Stick to the damm script, and learn how to read the lower tf. Lower TF's create what you see on the higher TF. We think fundamentals run the market, when all it does is create bias. Simply ask the people who have been buying UJ the last week, and buying everytime it goes up. Oh won't their Christmas holiday be much brighter if they were not in red over 500 pips.

Haha! You just reminded me of "A1 Superman" signal on MQL... "Just buy the UJ, it'll keep going up!" Boy is he wrong (for now)... 😉 But you are right - that is almost "uncharted" territory for the UJ (you have to go back to 2006 for these prices).

Price action is definitely important, but one cannot discard historical price levels (SR), because previously the market viewed those levels as "fair price" and this facilitated commerce efficiently (as indicated by the volume in those price areas). Though that said, as time goes on each SR can become "obsolete" as the market finds new SR levels which facilitate commerce more efficiently. I'm thinking of the ebook "Secrets of a Pivot Master". But you can see prices are attracted to those levels even after extended periods of time!

Miembro desde Jan 25, 2010

posts 1288

Dec 17, 2014 at 07:59

Miembro desde Jan 25, 2010

posts 1288

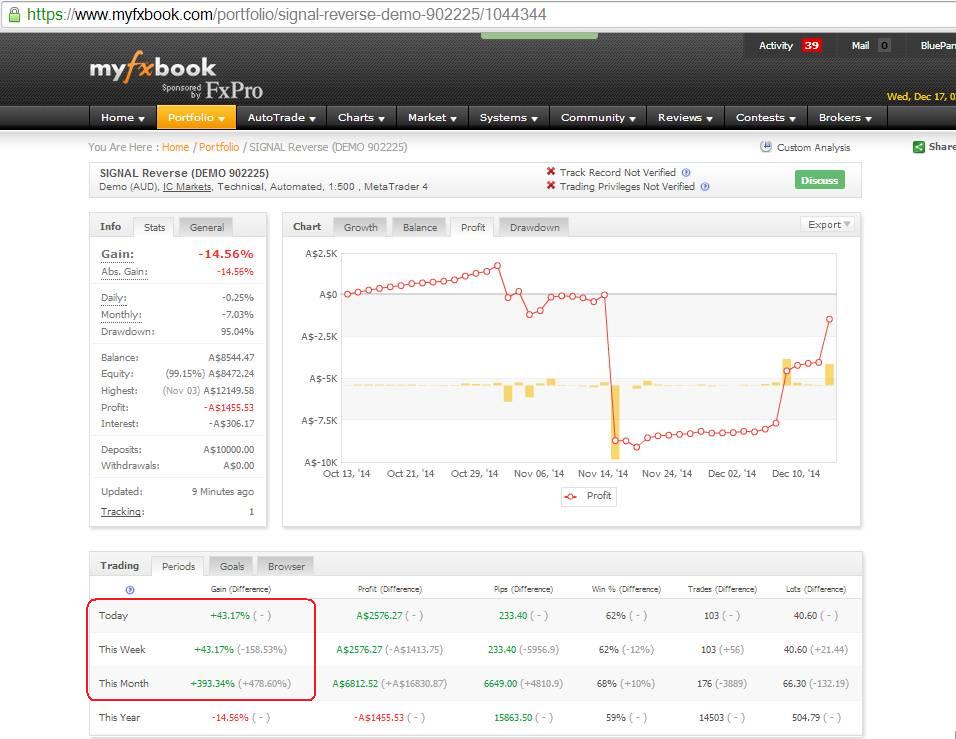

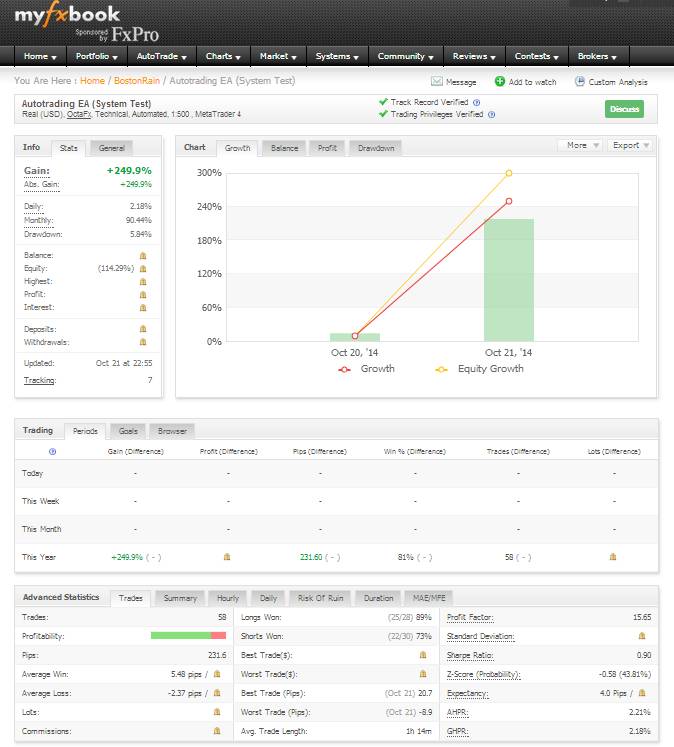

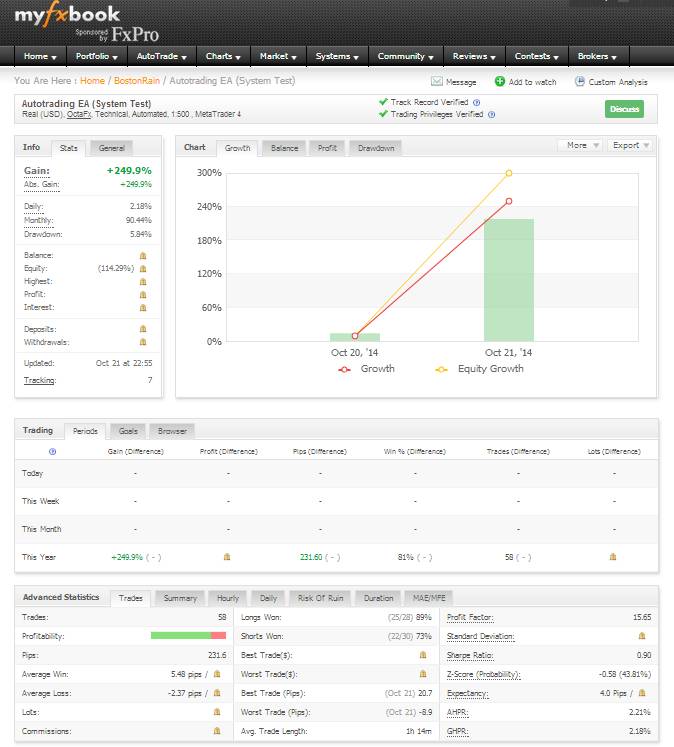

You don't need 4 weeks to turn $100 into $1000... at 250% per day you can achieve this in less than a week! 😉

http://www.myfxbook.com/members/BostonRain/autotrading-ea-system-test/1051188

http://www.myfxbook.com/members/BostonRain/autotrading-ea-system-test/1051188

Miembro desde Jan 25, 2010

posts 1288

Dec 17, 2014 at 08:04

(editado Dec 17, 2014 at 08:07)

Miembro desde Jan 25, 2010

posts 1288

...but I'm not sure if your broker would "approve" of such returns.

Even 35% a day may be too much for some brokers!

Notice this is a real account by the same guy with the same broker, and he has named it "Quiet Invest" - probably hoping to stay "under the radar" with the broker. The one day of history perhaps indicates that his efforts were in vain and the broker shut him down - again!

It is a sin to win against a broker! 😂

http://www.myfxbook.com/members/BostonRain/quiet-invest/1060569

Even 35% a day may be too much for some brokers!

Notice this is a real account by the same guy with the same broker, and he has named it "Quiet Invest" - probably hoping to stay "under the radar" with the broker. The one day of history perhaps indicates that his efforts were in vain and the broker shut him down - again!

It is a sin to win against a broker! 😂

http://www.myfxbook.com/members/BostonRain/quiet-invest/1060569

Miembro desde Oct 27, 2012

posts 35

Dec 17, 2014 at 09:40

Miembro desde Oct 27, 2012

posts 35

100USD with 1:500 leverage = 50000USD, EUR/USD @1.25 = ~40000EUR = 0.4 lot, if you manage to catch 100pips movement it is equal to 4000USD profit :) but just 1-1.5 pips against your position and considering spread - it will blow your starting deposit in a moment.

¡ŋ ђθς ş¡ģŋθ ұ¡ŋςəş /

Miembro desde Jan 25, 2010

posts 1288

Dec 17, 2014 at 09:57

(editado Dec 17, 2014 at 09:59)

Miembro desde Jan 25, 2010

posts 1288

BoneTrader posted:

100USD with 1:500 leverage = 50000USD, EUR/USD @1.25 = ~40000EUR = 0.4 lot, if you manage to catch 100pips movement it is equal to 4000USD profit :) but just 1-1.5 pips against your position and considering spread - it will blow your starting deposit in a moment.

"Don't put all your eggs in one basket": you should spread your risk among many trades, not just one trade. 😉

But thank you for your accurate risk analysis. Newbies take note: calculate your risk when trading! 😎

forex_trader_202879

Miembro desde Aug 07, 2014

posts 378

Dec 17, 2014 at 13:15

Miembro desde Aug 07, 2014

posts 378

BluePanther posted:Cholipop posted:

So until you so called GURUS stop margin calling accounts, and stop having 300+ pip draw down, then your simply taking educated guesses, instead of rational ones. Stick to the damm script, and learn how to read the lower tf. Lower TF's create what you see on the higher TF. We think fundamentals run the market, when all it does is create bias. Simply ask the people who have been buying UJ the last week, and buying everytime it goes up. Oh won't their Christmas holiday be much brighter if they were not in red over 500 pips.

Haha! You just reminded me of "A1 Superman" signal on MQL... "Just buy the UJ, it'll keep going up!" Boy is he wrong (for now)... 😉 But you are right - that is almost "uncharted" territory for the UJ (you have to go back to 2006 for these prices).

Price action is definitely important, but one cannot discard historical price levels (SR), because previously the market viewed those levels as "fair price" and this facilitated commerce efficiently (as indicated by the volume in those price areas). Though that said, as time goes on each SR can become "obsolete" as the market finds new SR levels which facilitate commerce more efficiently. I'm thinking of the ebook "Secrets of a Pivot Master". But you can see prices are attracted to those levels even after extended periods of time!

Now that is just it. If you one makes decisions about taking a position based on "support/resistance" the reality is once it gets there, the price still HAS to do one of three things..... Accumulate, continue to break out, or reverse. Basically what I have noticed is when most people make trades is when they have the lowest probability of hitting their"expected R:R" as when you enter in a position when the market is breaking out (on lower tf), then you have about a 33% chance of hitting a 1:1 ratio if your simply trying to obtain 15 pips. The higher amount of pips you are trying to obtain, the lower your chances are of hitting your goal, as we all would agree that DAILY PIVOTS are the specific prices attacked inter day. So if you are aiming for say 100 pips, the reality is you would have to not only fight against all the pivots from the same day you entered, but the pivots which will come in the days to come which you have no idea what it would be.

As for EA's not being profitable, I would have to disagree. The EA or the code is only as good as the person who wrote it. In other words if the EA was created by a scalper or a price action junkie, then everything he or she has set out as rules should be applied to the EA. The problem I have noticed is when the market has over extended (say a 5+ daily pivot move) then for some reason EA's take positions they would not normally take........Of course human tends to intervene and that causes those massive losses, which you see on myfxbook, especially when their equity curve was so perfect.

To sum it up, if you seriously are looking for a system which works, STAY AWAY FROM SYSTEMS WITH HIGH PIP-DRAWDOWN. As eventually people who take trades with high pip - drawdowns are bias, emotional traders who have no respect for price action. Price action trumps EVERYTHING, and the moment you decide to ignore it, you can kiss all your hard work away.

Miembro desde Oct 27, 2012

posts 35

Dec 17, 2014 at 13:25

Miembro desde Oct 27, 2012

posts 35

BoneTrader posted:

100USD with 1:500 leverage = 50000USD, EUR/USD @1.25 = ~40000EUR = 0.4 lot, if you manage to catch 100pips movement it is equal to 4000USD profit :) but just 1-1.5 pips against your position and considering spread - it will blow your starting deposit in a moment.

My bad! 0.4lot per 100 pips = 400 usd, not 4000, and there are ~25pips to lose it.

¡ŋ ђθς ş¡ģŋθ ұ¡ŋςəş /

forex_trader_202879

Miembro desde Aug 07, 2014

posts 378

Dec 17, 2014 at 14:10

Miembro desde Aug 07, 2014

posts 378

BluePanther posted:BoneTrader posted:

100USD with 1:500 leverage = 50000USD, EUR/USD @1.25 = ~40000EUR = 0.4 lot, if you manage to catch 100pips movement it is equal to 4000USD profit :) but just 1-1.5 pips against your position and considering spread - it will blow your starting deposit in a moment.

"Don't put all your eggs in one basket": you should spread your risk among many trades, not just one trade. 😉

But thank you for your accurate risk analysis. Newbies take note: calculate your risk when trading! 😎

Matt what if based on your calculations, the probability of your R:R is much higher to get hit based on current market conditions? Under those circumstances would you be willing to risk all your eggs on that one trade?

Miembro desde Jan 25, 2010

posts 1288

Dec 17, 2014 at 22:56

(editado Dec 17, 2014 at 23:01)

Miembro desde Jan 25, 2010

posts 1288

Cholipop posted:

To sum it up, if you seriously are looking for a system which works, STAY AWAY FROM SYSTEMS WITH HIGH PIP-DRAWDOWN. As eventually people who take trades with high pip - drawdowns are bias, emotional traders who have no respect for price action. Price action trumps EVERYTHING, and the moment you decide to ignore it, you can kiss all your hard work away.

From a different perspective: drawdown is a measure of the accuracy of a system. ie. the higher the drawdown, the less accurate the entry of a trade was.

Cholipop posted:BluePanther posted:"Don't put all your eggs in one basket": you should spread your risk among many trades, not just one trade. 😉

Matt what if based on your calculations, the probability of your R:R is much higher to get hit based on current market conditions? Under those circumstances would you be willing to risk all your eggs on that one trade?

The short answer: No. Because no matter how "good" R:R is, there is no 100% guarantee of a win.

Risking everything on one trade = the "all or nothing" principle associated with a gambler's mindset and not a shrewd, risk-averse trader. 😉

Of course, my track record is anything BUT risk-averse and shrewd! Trading is a learning curve and you can't learn without making mistakes... and I am still learning! 😝

Miembro desde Oct 11, 2013

posts 769

Dec 23, 2014 at 07:49

Miembro desde Mar 12, 2012

posts 1

Hello everyone. I write this to make known the identity of Cholip. His Name is Alexis Ampudia, he is a person who knows a lot in theory, but in practice does not know how to manage accounts or do trading.

I am one of those who have placed full confidence in him and in one day has dropped 50% since that day did not return to answer and disappeared like a coward.

All his accounts are 1 month or two at most. No consistency and stability and not know how to properly manage the risk. He can put trades which each pip can be 1% of the account and hold the loss floating more than 50pips !!

I wish you great Xmas to all

I am one of those who have placed full confidence in him and in one day has dropped 50% since that day did not return to answer and disappeared like a coward.

All his accounts are 1 month or two at most. No consistency and stability and not know how to properly manage the risk. He can put trades which each pip can be 1% of the account and hold the loss floating more than 50pips !!

I wish you great Xmas to all

forex_trader_169857

Miembro desde Dec 31, 2013

posts 164

Dec 23, 2014 at 10:08

Miembro desde Dec 31, 2013

posts 164

HaykFX posted:

Hello everyone. I write this to make known the identity of Cholip. His Name is Alexis Ampudia, he is a person who knows a lot in theory, but in practice does not know how to manage accounts or do trading.

I am one of those who have placed full confidence in him and in one day has dropped 50% since that day did not return to answer and disappeared like a coward.

All his accounts are 1 month or two at most. No consistency and stability and not know how to properly manage the risk. He can put trades which each pip can be 1% of the account and hold the loss floating more than 50pips !!

I wish you great Xmas to all

This sounds familiar?

U.S. SECURITIES AND EXCHANGE COMMISSION

Litigation Release No. 20071 / April 6, 2007

SEC v. Alexis Ampudia, a/k/a Alexis Geancarlos Ampudia Navalo, a/k/a Alexis Emias, a/k/a Alexis Rojas, Civil Action No. 07-CV-2762 (HB) (S.D.N.Y.)

SEC Files Emergency Action Against Alexis Ampudia to Stop an Identity Theft "Pump and Dump" Scheme

The Securities and Exchange Commission announced that it obtained a temporary restraining order and an emergency asset freeze to halt a market manipulation scheme that used stolen identities of innocent victims to manipulate the markets.

In an emergency federal court action filed April 5, 2007, in the United States District Court for the Southern District of New York, the Commission charged Alexis Ampudia, a 22-year old Panamanian citizen and resident of Brooklyn, New York, with conducting a fraudulent scheme involving the manipulation of the prices of numerous securities by using brokerage accounts he had opened in the names of identity theft victims, without their knowledge or consent. The Commission alleges that, since November 2006, Ampudia made at least $140,000 in unlawful profits by manipulating the securities of at least five publicly traded companies.

Acting on the Commission's request, the Court issued a temporary restraining order which, among other things, prohibits Ampudia from further violations of the federal securities laws, freezes his assets and orders the repatriation of funds taken out of the United States.

The Commission's complaint alleges that Ampudia first purchased shares of small, thinly-traded companies, with low share prices, through his own online trading account. Immediately or soon thereafter, using online brokerage accounts Ampudia had opened in the names of identity theft victims, Ampudia placed a series of large purchase orders for the targeted securities, for the sole purpose of artificially increasing the price of the securities he had just purchased at lower prices. These purchases created buying pressure and the false appearance of legitimate trading activity, which caused the price of the securities to greatly increase. Ampudia then, at a profit, sold the shares he had earlier purchased in his own account.

The complaint charges Ampudia with violating Section 17(a) of the Securities Act of 1933, Section 10(b) of the Securities Exchange Act of 1934 and Exchange Act Rule 10b-5. The Commission's Complaint seeks permanent injunctions against future violations of the foregoing federal securities laws, disgorgement of ill-gotten gains plus pre-judgment interest thereon, and civil penalties.

The Commission acknowledges the assistance of the New York County District Attorney's Office, New York City Police Department, and United States Secret Service in this matter.

Dec 24, 2014 at 01:52

Miembro desde Aug 21, 2010

posts 169

http://www.myfxbook.com/members/tankbeta/jarvis-2014-client1-revive/1001615

5months = 2000%

200$ = 1000$++

can be done in 4 weeks but depends on market conditions

5months = 2000%

200$ = 1000$++

can be done in 4 weeks but depends on market conditions

Plan your trades and trade your plans.

Dec 24, 2014 at 02:11

Miembro desde Aug 21, 2010

posts 169

MyFxTrader posted:BluePanther posted:MyFxTrader posted:BluePanther posted:marran posted:

will you be releasing your EA to everyone?

I am surprised you think it is an EA. The first conclusion most people say is: "this is only possible with manual trading. There is no such thing as a Holy Grail EA."

But if it works manually, why would it not work automatically? Bad programming? Or fundamental analysis (lack of)?

EA is predictable. Metaquotes has ability to read the codes once the EA is running. They know exactly what the EA will do. Thus, broker is always ahead of EA. Manual trading is less predictable.

Thank you for your input. So you are saying that MQL5 (developer of MT4) receives all the information from every / any MT4, and then colludes with the broker to work against the trader using an EA? There are a lot of MT4 accounts with hundreds of brokers, with thousands of EAs out there, all doing different things when the market moves on different instruments (forex, indexes, stocks)...

Can you provide some evidence to backup your knowledge? How do you know this? MQL5 must have an awfully big task being Big Brother! 😲

If MetaTrader could cope with the tens of thousands of transactions across a wide latitude of instruments simultaneously with ease, there's no reason to think that to deal with every single trade individually is too big a task for them and is beyond their means. Many forums have brought into light regarding the MetaTrader individual 'plugin' which makes life difficult for traders.

By coding a system into an EA and then running it on the chart, we effectively revealed the blueprint of entire trading system to the broker. Even though we coded the EA, the fact remains that both the Metatrader & the MQL are proprietary of MetaQuotes. They are the boss. We are merely playing at their tuft. And to reveal our every move to them in the form of an EA makes matter worse.

What I'm saying is it easy for them to manipulated the feed if they choose to and whenever the opportunity is presented to them with this individual 'plugin' to mitigate an EA from making profits as they already know all the moves in advance. Manual trading on the other hand suffers no such deficiency. That's why a successful manual system very often become less profitable once it's running on an EA. But of course there is only so much they can do because there is definitely a threshold on how much the feed can be manipulated.

100% sure this guy is not making money in forex.

Plan your trades and trade your plans.

*El uso comercial y el spam no serán tolerados y pueden resultar en el cierre de la cuenta.

Consejo: Al publicar una imagen o una URL de YouTube, ésta se integrará automáticamente en su mensaje!

Consejo: Escriba el signo @ para completar automáticamente un nombre de usuario que participa en esta discusión.