- Inicio

- Comunidad

- Sistemas de Trading

- Funnel Trader Turnkey

Advertisement

Funnel Trader Turnkey (de ryang123 )

| Ganancia : | -90.03% |

| Disminución | 58.24% |

| Pips: | -10363.6 |

| Transacciones | 462 |

| Ganado: |

|

| Perdido: |

|

| Tipo: | Real |

| Apalancamiento: | 1:200 |

| Trading: | Automatizado |

Edit Your Comment

Discusión Funnel Trader Turnkey

Miembro desde Aug 22, 2012

posts 165

Jan 02, 2019 at 19:21

Miembro desde Sep 23, 2016

posts 77

Oh, i'm actively managing at this point. This DD sucks. Last night I threw on a full hedge and picked up a quick nickel this morning because it was clear the aussie and kiwi were getting killed the and the yen is strong. However, equities look to be headed back up, for now. Once the S&P 500 hits 2600, I'm going to look to exit all trades because I see a good short opportunity there. When this algo is short EURUSD and long all others, its basically long AUDJPY and short NZDJPY which are in heavy correlation with equities. So if the stock market crashes, I'm dead.

My max lots doesn't seem to be working but thats ok because I think the yen strength is gonna die out a bit. AUDJPY and NZDJPY are both looking like they are trying to bottom. I just need to be careful because with a small account like this, its easy to get blown out.

My max lots doesn't seem to be working but thats ok because I think the yen strength is gonna die out a bit. AUDJPY and NZDJPY are both looking like they are trying to bottom. I just need to be careful because with a small account like this, its easy to get blown out.

Choose a good reputation over great riches (PROVERBS 22:1)

Jan 02, 2019 at 19:56

Miembro desde Sep 23, 2016

posts 77

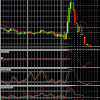

Ok, just did some major analysis of this AUDJPY chart. NZDJPY should trade similar. Anyway, audjpy has fallen so far its hard to find a support zone on the daily. Last night I looked at the weekly and set my PT at .76 which turned out to be perfect. I posted a couple charts for you showing why I think the bias may switch to long very soon. Again, need to zoom all the way out to weekly but its strong support at 7600. On the hourly, you can see we closed this morning with a nice , perfect 38.2% pin bar right at support which is EXTREMELY bullish. If equities stay strong and the 7600 level holds, down to an hourly level, we could see momentum switch this week. The sticking point will be Thursday's Chinese data. If that comes out anywhere near strong, we're gonna be closer to getting outta the woods. Again, it all depends on this 7600 level hodling. If that support fails tonight, its game over and hedge needs to be back on, possibly down to 7250. NZDJPY support comes in strong, coincidentally, at .7250. Lets hope they hold!

Choose a good reputation over great riches (PROVERBS 22:1)

Miembro desde Aug 22, 2012

posts 165

Miembro desde Aug 22, 2012

posts 165

Jan 03, 2019 at 01:38

Miembro desde Sep 23, 2016

posts 77

No I'm blown. Dang I lost 5k. That's all the profit I ever made from funnel. I know better too. These types of systems will always get wrecked. My analysis was spot on. AUDJPY came right down to monthly support and bounced. Time to short it

Choose a good reputation over great riches (PROVERBS 22:1)

Miembro desde Aug 22, 2012

posts 165

Miembro desde Apr 06, 2018

posts 242

Jan 04, 2019 at 09:55

Miembro desde Apr 06, 2018

posts 242

chnp posted:

It looks like a big whale bust its account by buy audjpy, which caused the whole market jpy and aud shocking at the same time. Bitter lesson: never trading during the liquid-less days.

There is nothing wrong in trading low liquidity market. I am trading with my own Asian session scalper yesterday my two positions on GBPAUD and EURAUD hit Stoploss but I only loss 6% due to strictly using stoploss per trade and keep my leverage below 1:10 for all open position.

Highly leveraged account which use strategy like Grid, Averaging or Martingale like this will blow trading account sooner or later.

The market will trade through it’s path of least resistance .

*El uso comercial y el spam no serán tolerados y pueden resultar en el cierre de la cuenta.

Consejo: Al publicar una imagen o una URL de YouTube, ésta se integrará automáticamente en su mensaje!

Consejo: Escriba el signo @ para completar automáticamente un nombre de usuario que participa en esta discusión.