Cambiar contraseña

Pips, Pippetes and Pip Value

Pips

The pip, also known as the point in percentage, is the smallest unit of price change for a currency pair. It is used to measure the movement in the value of a currency pair and is crucial for calculating profits or losses accurately.

When forex traders know how much a pip is worth, they can put a monetary value on their take profit goals and stop loss levels. Instead of just looking at changes in pips, traders can figure out how changes in the currency market will affect the value of their trading account (equity).

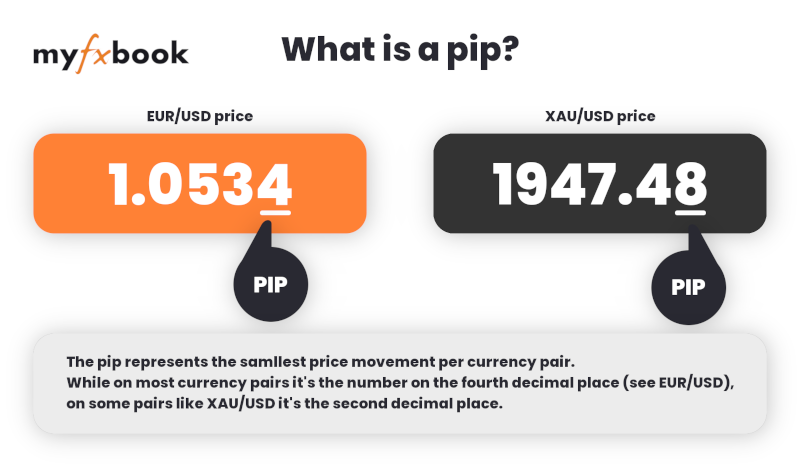

For the majority of currency pairs, a pip corresponds to the fourth decimal point, with the Japanese Yen (JPY) being the exception, where a pip corresponds to the second decimal place.

When corresponding to the fourth decimal point a pip represents a price fluctuation of 0.0001. For instance, if the EUR/USD exchange rate moved from 1.5000 to 1.5001, it has moved by one pip.

In currency pairs using the Japanese Yen (JPY), corresponding to the second decimal place a pip represents a price change of 0.01.

For example, if the USD/JPY exchange rate moved from 120.00 to 120.03, it has moved by 3 pips.

Pipettes

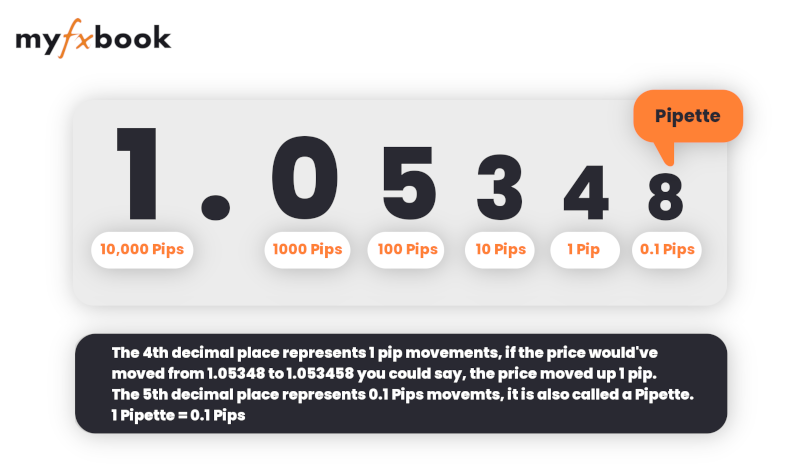

Pipettes are fractional units of measurement in forex trading that offer more precise pricing for currency pairs. They are particularly useful for tracking small price movements and are used by some forex brokers to provide more accurate pricing for their clients.

A pipette is one-tenth of a pip, this means that if the EUR/USD currency pair is priced at 1.34567, the last digit '7' would be considered a pipette.

Pip Value Calculation

To calculate the pip value, traders use the formula:

(pip value in the quote currency) x (number of units traded) = (pip value in the account currency).

Pips are also used to determine a trade's profit or loss.

For example, if a trader buys the EUR/USD at 1.2000 and sells it at 1.2010, they have made a 10 pip profit. On the other hand, if a trader buys the EUR/USD at 1.2000 and sells it at 1.1990, they have made a 10 pip loss.