Bitcoin’s not-so-soft landing

Market picture

The crypto market lost 6.4% in the last 24 hours to $1.063 trillion. The sell-off in illiquid trading after the close of the regular US session has intensified sharply after falling below the $1.1 trillion mark. At the peak of the sell-off, total capitalisation was down to $1.038 trillion, a two-month low.

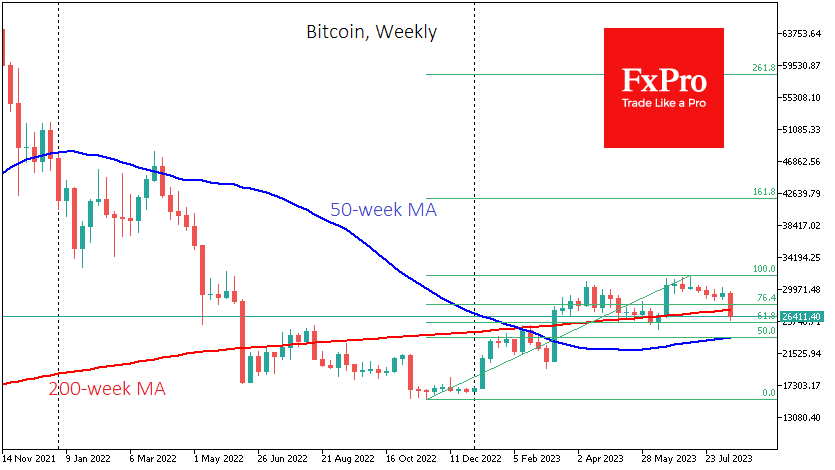

Bitcoin has lost 7.4% in 24 hours to $26.4K. The reduced traction of risk assets in traditional markets has coincided with increasing bearish signals we observed in the crypto over the past few days. BTCUSD’s downward slide quickly became a high-speed collapse upon the breach of local support at $28.8K.

There was little control over the subsequent decline, as it occurred during low liquidity hours when most participants were out of the market. This added to the negative momentum, and Bitcoin sold off to $25.924.

Intraday, BTCUSD traded below its 200-week and 200-day averages, centred around $27.3K. Alex Kuptsikevich, the FxPro Analyst, says this day and week close below this level would be an essential signal of a break in the uptrend of recent months, with faint hopes of stabilisation around $25.5K.

News background

CryptoQuant recorded several large BTC transfers to crypto exchanges Binance, Gate.io and Coinbase the day before. Whales typically send cryptocurrency to exchanges before selling it.

US institutional crypto platform Bakkt is seeing a substantial influx of new clients focused on trading and storing digital assets, its head Gavin Michael said.

Tether, the issuer of the largest stablecoin by capitalisation, announced that it would no longer support USDT on the Bitcoin blockchain, as well as Bitcoin Cash and Kusama.

The US Office of Government Ethics (CREW) reported that former US President Donald Trump invested over $2.8 million in the cryptocurrency - more than previously disclosed.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)