Dollar slides amidst tariff rhetoric and soft US data

Dollar slips on soft CPI and tariff talk

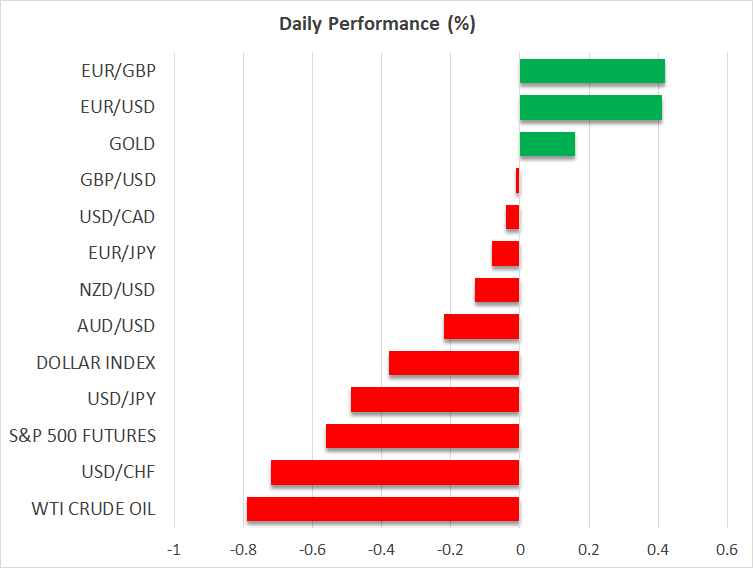

It feels like Groundhog Day, as the US dollar is once again losing ground across the board. Euro/dollar has climbed above 1.1500, while dollar/Swiss Franc has quickly erased last week’s rally, confirming the dollar’s inability to resist the prevailing market trends. Similarly, US equity indices experienced losses in Wednesday’s session, though they remain in positive territory on a weekly basis.

Notably, yesterday’s session began positively for risk assets. The conclusion of the London round of the US-China negotiations created some goodwill, supporting risk appetite and keeping euro/dollar rangebound. However, the sentiment shifted after the soft CPI report, mixed commentary about the US-China talks and Trump’s renewed tariff rhetoric.

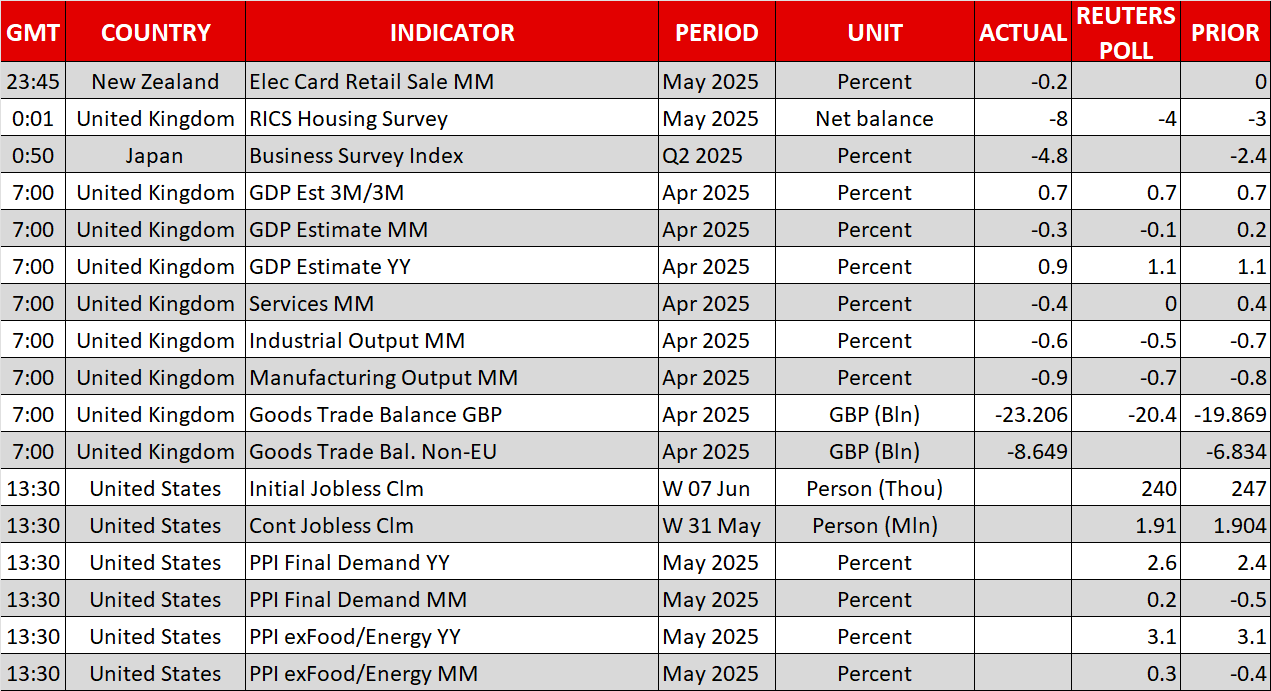

The US CPI report for May produced a downside surprise, allowing the market to boost its rate cut expectations for 2025 – it is currently fully pricing in 50bps of easing - and kicking off the dollar’s underperformance. The May PPI report will be released today, and another soft report could support marginal expectations of a slightly more dovish tone at next week’s Fed meeting.

When 30% tariffs are actually 55% effective tariffs

The decisive blow to risk assets, though, came from US President Trump and his top Secretaries. Despite celebrating the progress made in the US-China talks, Trump announced that the US will maintain an ‘effective’ 55% tariff on Chinese imports, while US exports to China will be subject to just a 10% tariff. Interestingly, China has already approved rare earth exports to the US but imposed a six-month limit, essentially stopping short of giving the US a carte blanche. On the surface, there has been progress in the negotiations, but in reality, both markets and corporates need a comprehensive and definitive agreement, not half-measures.

To make matters worse, Trump stated he will set unilateral tariff rates within two weeks, adding pressure on non-compliant countries. Negotiations with Japan, South Korea and India are progressing — with the July 8 deadline potentially being pushed back to allow time for agreements — making the EU the most likely candidate for extra trade restrictions. Canada is probably best positioned to avoid a new round of tariffs, as there are strong indications that a trade deal is imminent.

Pound is under pressure

The UK, which secured an early trade deal with the US, is watching its currency suffer once again against the euro. Following Tuesday's weak labour market report, today’s monthly GDP report and industrial production data were disappointing, further adding pressure on the Labour government to amend its fiscal plan of significant tax increases and stronger borrowing. Coupled with the market’s frustration about the ONS’ consistent failure to deliver accurate data, a dovish BoE meeting next week appears increasingly likely.

Gold and oil retreat after a strong rally

Meanwhile, the overall market sentiment has boosted both gold and oil prices overnight, with the former climbing to $3,370 and oil rising to the highest level since early April, when Trump announced his infamous reciprocal tariffs. The main culprit for these moves has been reports that Israel is preparing to strike Iran’s nuclear facilities. Putting aside the fact that such an action would completely negate any chance of an agreement between the US and Iran, it could also prompt Iran to respond, potentially starting a new wave of violence.

However, despite the escalation seen in the Ukraine-Russia conflict, where both sides appear unwilling to negotiate a ceasefire or a permanent pause, both commodities are giving back their gains today. Nevertheless, gold and oil are likely to remain supported, regardless of the dollar’s performance.

.jpg)