Dollar wavers on US CPI, surges on hawkish Fed remarks

Dollar ascends as Fed wary after CPI report

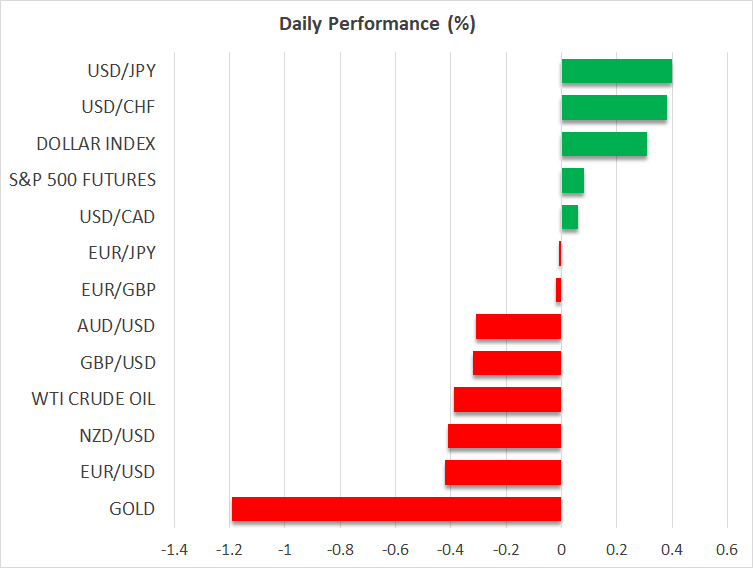

The US dollar’s post-election surge shows no sign of ending as it advanced to one-year highs against a basket of currencies on Thursday, causing fresh pain for its rivals. The latest gains come after yesterday’s CPI inflation numbers out of the US that were fully in line with expectations.

The headline rate of CPI ticked up from 2.4% to 2.6%, while core CPI remained steady at 3.3%, pointing to sticky price pressures. However, whilst investors initially cheered the fact that the data wasn’t hotter than anticipated, pushing the dollar slightly lower, it seems that Fed officials were not as impressed.

Dallas Fed chief Lorie Logan said the central banks should “proceed with caution” and St. Louis Fed President Alberto Musalem echoed the sentiment. Logan even went as far as saying that the Fed funds rate is at the top end of the estimated neutral rate, suggesting minimal scope for additional rate cuts. The Kansas City Fed’s Jeffrey Schmid also cast doubt on how much further interest rates can decline.

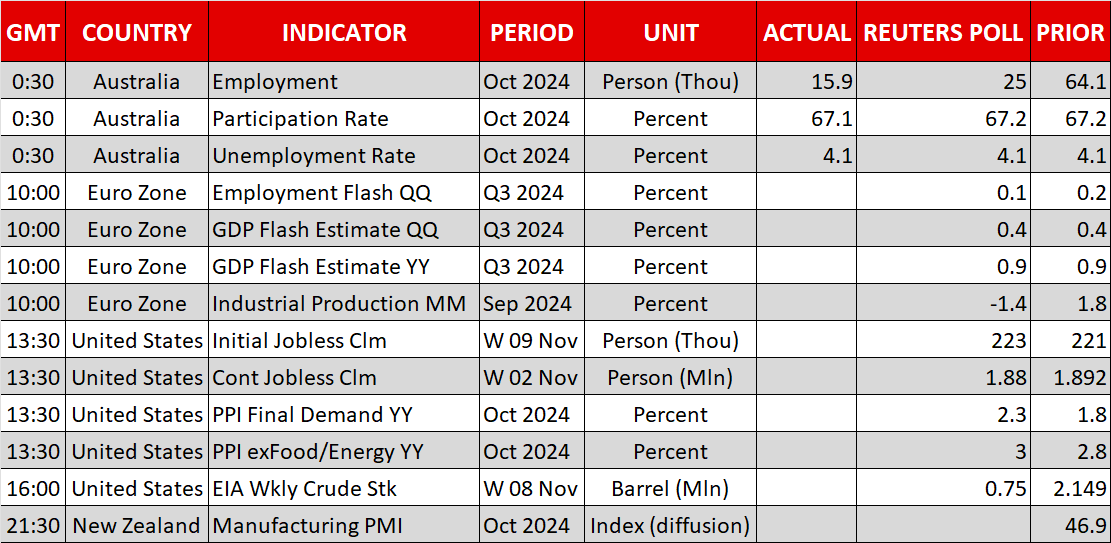

All eyes are now on the Fed Chair himself as Powell is due to participate in a panel discussion at the Dallas Fed at 20:00 GMT. US data will also be on investors’ radar as producer prices for October and the weekly jobless claims are on the agenda at 13:30 GMT.

Yen back in intervention zone

The greenback’s renewed strength is causing a headache for Japanese policymakers as the yen breached the 155 per dollar mark on Wednesday, entering last year’s intervention zone. However, there’s been no new warning yet by Japanese currency officials, and the dollar even briefly brushed the 156 yen level earlier today.

A weaker yen increases the likelihood of the Bank of Japan hiking rates again sooner rather than later, but for now, the yen will struggle for support.

The euro also remained under pressure, hitting a one-year low of $1.0528, while the Australian dollar fared somewhat better.

With the RBA not expected to join the rate-cut bandwagon before Q2 2025, the aussie has been able to avoid a sharper selloff despite disappointment about China’s lacklustre stimulus measures to boost its economy.

Equities still reeling from Trump victory

This has been weighing more heavily on Asian equities, however, with Trump’s triumphant return to the White House exacerbating the anxiety about the region’s growth outlook. European stocks also suffered losses in the aftermath of the US election but there is some positive momentum today, with US futures turning green too.

The rally on Wall Street has taken a bit of a pause as investors assess Fed rate cut expectations. December is back in the game but there’s a strong possibility of the Fed shifting gear and cutting rates once every quarter moving into 2025.

In the short term, optimism about Trump’s policies, which look set to fly through Congress as the Republicans have just gained control over the House of Representatives as well as the Senate, is holding up US shares. But with Treasury yields still rising, it’s hard to see how much longer the rally can last.

Gold’s woes deepen, cryptos soar again

Amid all the euphoria, there’s been no relief for gold, which is extending its losses today to around $2,540 - levels last seen in mid-September.

Cryptos, on the other hand, continue to soar. Bitcoin hit a fresh record of $93,483 on Wednesday before settling around $90,500. Elon Musk-backed Dogecoin has been another winner in the crypto world, skyrocketing by more than 130% since the election.

.jpg)