EBC Markets Briefing | Aussie dollar hits high in weeks; Boeing outlook brightens

The Australian dollar touched a three-week high in morning trade on Wednesday. Deutsche Bank strategist said there is scope for a roughly 2% drop in the US dollar through December.

Australia's Q3 economic growth of 2.1% missed analysts' expectations, but clocked its fastest expansion in about two years, driven by strong investment and consumer demand.

Meanwhile, net trade was a major drag, denting the reading by 0.1 percentage point, as imports growth outpaced rise in exports. Iron ore prices hit their 4-month lows this month in a sign of weak momentum.

They are expected to remain at October levels with a slight increase by the end of November-early December, supported by stable production in China and limited activity in the spot market.

China's property market will extend slump into 2026, according to Morgan Stanley. The anti-evolution campaign, which was aimed at fighting deflation, also put a lid on steel production.

RBA Governor Bullock cautioned earlier that the economy had likely hit its potential growth limit at a time when inflation remains sticky. CPI rose 3.8% in October from a year earlier, the fastest pace in 7 months.

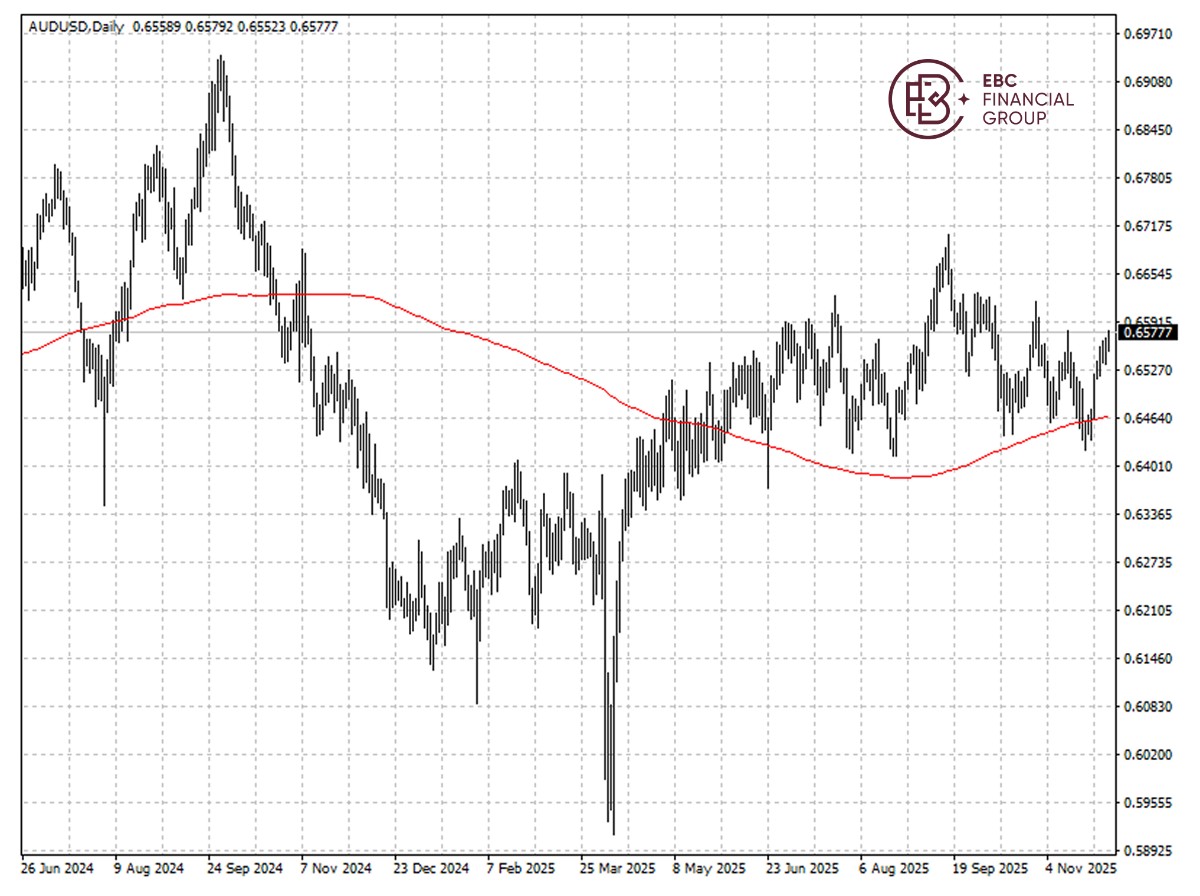

The Aussie dollar was still stuck in a tight range, so a moderate easing is expected at $0.6580. The first major support could lie around $0.6520, below which would expose 200 SMA.

Asset recap

As of market close on 2 December, among EBC products, Boeing shares led gains after CFO Jay Malave said that the company expects deliveries of both its 737 and 787 jets to be up next year.

Intel also surged after an analyst posted on X Friday that the company is expected to begin building Apple's M series chips for its MacBook Air and iPad Pro as soon as early 2027.

Oil prices declined 1% as markets weighed faltering Russia-Ukraine peace hopes against fears of oversupply. It is far from certain that Russia will accept a revised peace plan.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.