EBC Markets Briefing | Gold bulls gain confidence from Chinese buying

Gold prices hit a more than two-week high on Wednesday, underpinned by rising geopolitical tensions, PBOC’s renewed buying and expectations of a third rate cut by the Fed next week.

Chinese buying following a six-month hiatus partly due to Trump’s tariff threats may support demand. In 2023, the country was the world's largest official sector buyer of gold.

With two US rate cuts so far this year, traders predict an 86% chance of a further 25-bp cut next month, according to the CME FedWatch tool. Trumps said he will not replace Powell om Sunday.

The US will provide nearly $1 billion more in longer-term weapons support to Ukraine, Defense Secretary Lloyd Austin said. But Trump told NBC that Ukraine could receive less military aid during his second term.

Heraeus Precious Metals expects gold prices to range from $2,450 to $2,950 per ounce in 2025. It noted that industrial demand for silver is expected to surge, propelled by the continued growth in solar photovoltaic demand.

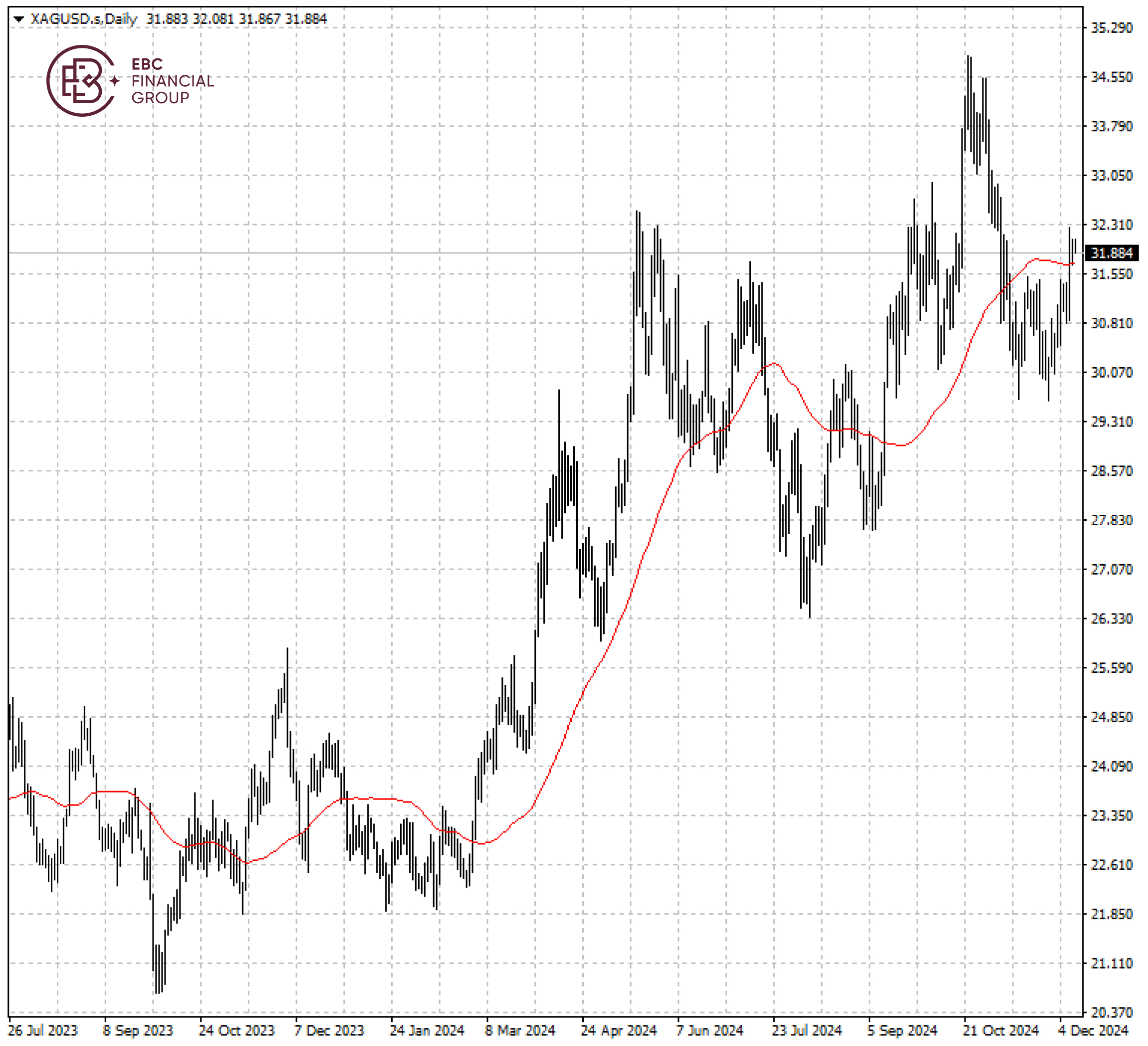

The current gold-silver ratio indicates suggested that silver may outperform gold in late bull markets, with expected prices between $28 and $40 an ounce, according to the refiner.

Silver has risen above its 50 SMA with technical indicators pointing to further rally. The resistance lies around $32.26, and a push above the level could lead to $33.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.