EBC Markets Briefing | OPEC+ helps oil prices steady at 14-month low

Oil prices edged up in early trading on Friday as investors weighed a big withdrawal from US crude inventories and a delay to production hikes by OPEC+ producers against mixed US employment data.

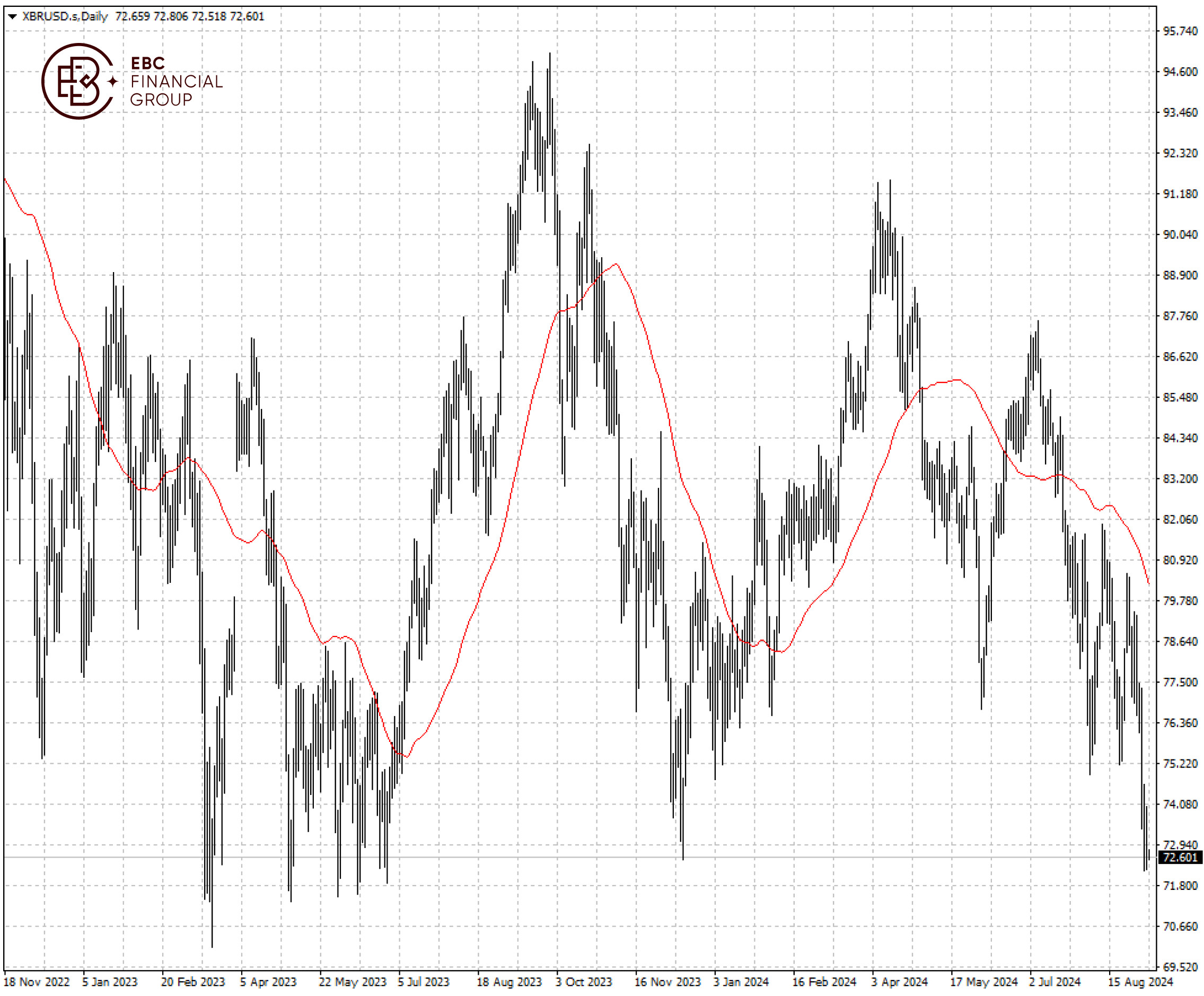

Brent closed at its lowest close since June 2023 on Thursday and WTI at the lowest close since December 2023 even though data showed that US crude stockpiles fell to a one-year low last week.

OPEC+ agreed to delay a planned oil production increase for October and November, the producers group said, adding that it could further pause or reverse the hikes if needed.

Jefferies said the OPEC+ decision has the effect of tightening fourth-quarter balances by about 100k – 200k bpd and should be sufficient to prevent material builds.

Goldman Sachs forecast continued weakness in Chinese oil demand as Iranian and Russian production strengthens. Its supply model suggests upside risks to non-OPEC crude supply growth in 2024.

Overall, stronger oil supply and continued global economic slowdown have reinforced the bank’s view of downside risks to Brent crude prices in the $70-85 range.

Brent crude plunged further below 50 SMA and traded near a key support around $72.5. It is more likely to rally towards $77, otherwise we see a risk of retesting $70.

EBC Institute Perspectives Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC International Business Expansion or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.