EBC Markets Briefing | Yen steadies with BOJ firm on position

The yen strengthened a bit in early trading on Thursday after minutes of the BOJ's July policy meeting showed some board members called for resuming interest rate hikes in the future.

Markets see a roughly 50% chance of a rate hike at the central bank's October meeting, when the board will also release fresh quarterly growth and inflation forecasts.

The S&P Global flash Japan PMI dropped to 48.4 in September, further below the 50.0 threshold that separates growth from contraction to the lowest reading since March. The service sector remains stable.

Governor Ueda has said they will continue to raise rates gradually if it becomes more convinced that underlying inflation will durably achieve its 2% target. At last week's news conference, he said it has yet to hit 2%.

The BOE is firming up a strategy to unload its huge holdings of risky assets that will likely centre on a plan to gradually sell ETF in the market, said three sources familiar with its thinking.

With the Nikkei index scaling record highs, policymakers could have seen an opportunity to decide in coming months. However, embarking on asset sales amid political turbulence could be risky.

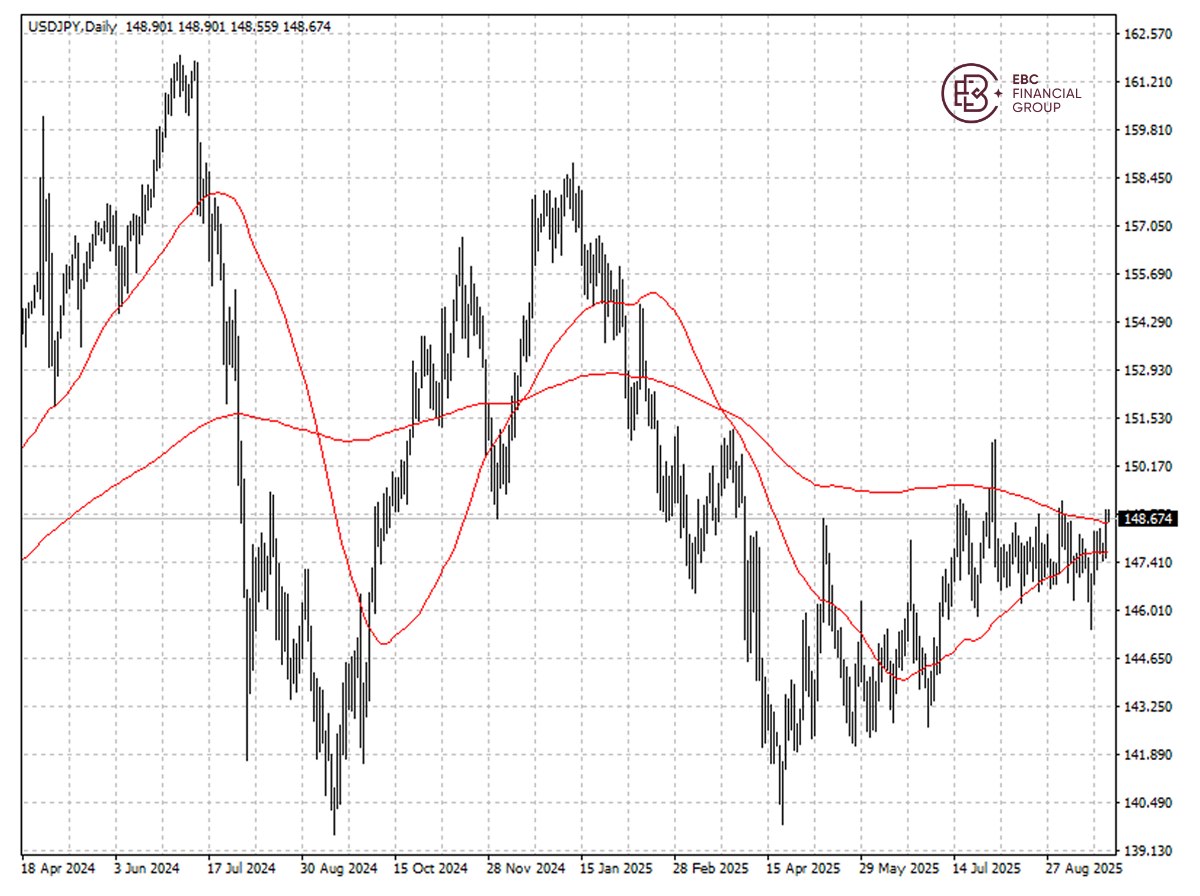

The yen has been largely stuck in a tight range since July with upper end around 50 SMA. As the currency has entered to the area, we see it rebound towards 146.8 per dollar soon.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.