Faster crypto market decline

Market picture

The cryptocurrency market has plunged 6% to a capitalisation of $2.08 trillion, its lowest level in nine days. Bitcoin is falling in line with the broader trend, while Ethereum and Solana are down 8.4% and 7.3%, respectively. Gold has also experienced an almost synchronised sell-off, losing around 1%, but equity markets remain generally positive and hopeful.

Bitcoin fell below $58K in thinly liquid trading early Wednesday afternoon but later recovered to $59K by the start of active trading in Europe. The sell-off intensified after a failed attempt to break above $65K early Monday afternoon, taking the price back below its 200- and 50-day moving averages. The first cryptocurrency may be heading towards the lower end of the trading range as it heads towards $54K. The market appears to be largely dragged down by automatic stop orders during light trading hours. Such sell-offs often take leveraged traders out of the market but also attract long-term buyers on dips.

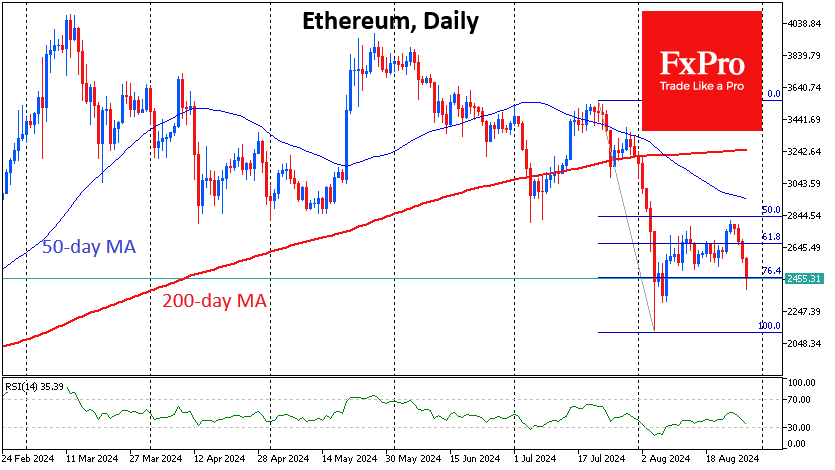

Ethereum briefly dipped below $2400, its lowest level since 8 August. There is a risk that this week's sell-off is a second leg lower, following the collapse and subsequent consolidation of previous weeks. A drop below $2100 could confirm this hypothesis.

News background

CryptoQuant doubted that the bullish scenario would materialise soon due to the activation of large sellers. The bitcoin futures market also shows that traders are cautious.

According to Henley & Partners' Crypto Wealth Report 2024, the number of investors holding at least one million dollars in cryptos reached 172,300, 95% more than a year earlier.

The trustee of Celsius, a bankrupt lending platform, distributed $2.5 billion in digital assets and fiat to creditors, paying off 93% of the company's financial obligations.

Mining company Rhodium Enterprises filed for bankruptcy with debts of up to $100 million.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)