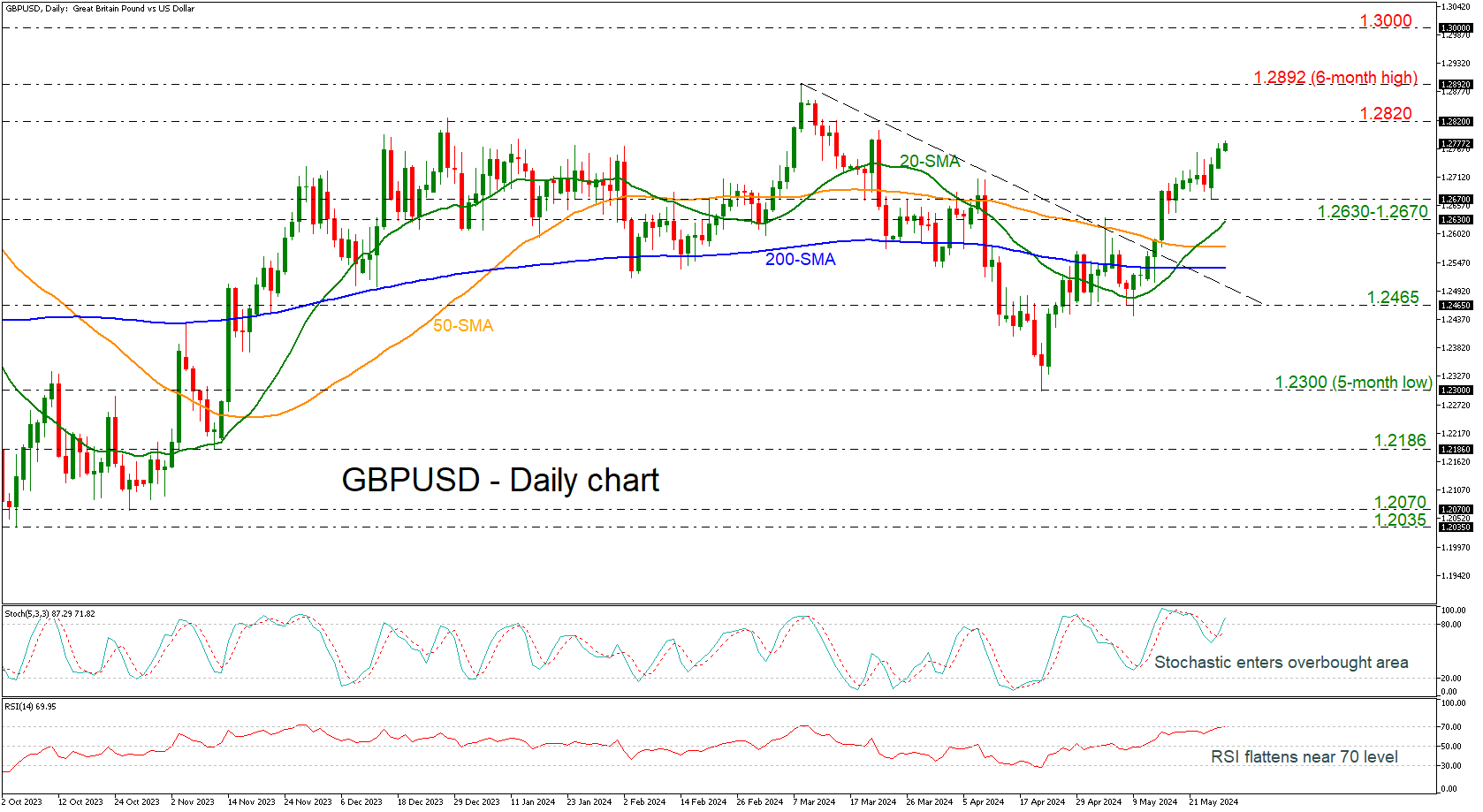

GBPUSD challenges new 2-month high

GBPUSD has been in a steady uptrend over the last month, posting a fresh two-month high of 1.2782 and remaining well above the short-term simple moving averages (SMAs). Technically, the pair is sailing near overbought waters according to the stochastic oscillator. The RSI is also flagging a potential downfall as it’s losing impetus near 70.

If buyers stay in play, the door will open for the 1.2820 resistance level ahead of the six-month high of 1.2892. Running higher, the outlook will be brighter, switching the long-term outlook to a more positive one, flirting with the 1.3000 round number.

Should the bears press the price below 1.2630-1.2670, the 50- and the 200-day SMAs at 1.2575 and 1.2537 respectively may be the first obstacles for traders to look for. If the latter gives way too, the decline could continue towards the support line of 1.2465 before plunging to the five-month low of 1.2300.

In a nutshell, despite the latest exciting rebound in GBPUSD, there are some obstacles to consider before a real bullish trend reversal takes place in the long-term view.

.jpg)