Gold stands tall, stocks keep sinking despite solid US data

Dollar unable to gain on solid data

Another stormy week for global markets comes to an end as investors continue to grapple with a range of risk factors, from a lukewarm earnings season to the heightened volatility in bond markets to the unfolding geopolitical crisis.

On the bright side, economic growth in the United States clocked in at 4.9% in annualized terms in the third quarter, easily surpassing forecasts. Consumer spending and public investment did most of the heavy lifting, although there was also an element of inventory rebuilding by businesses.

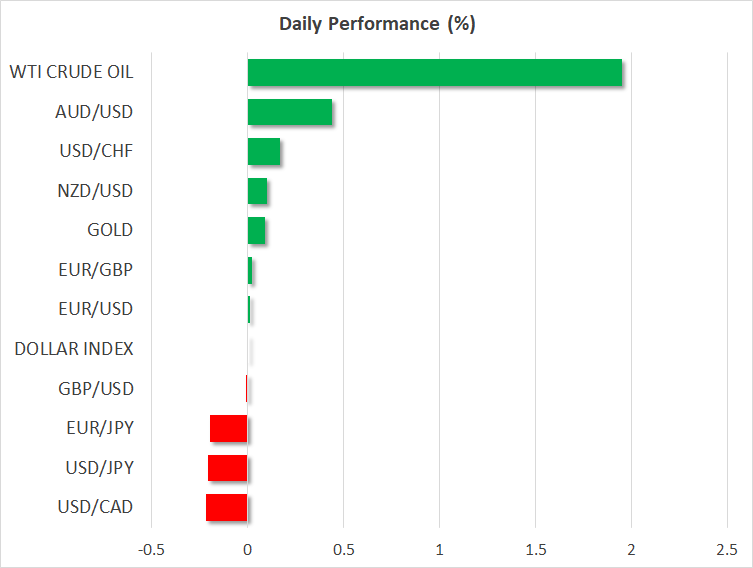

Hence, an encouraging GDP report overall. And yet, the dollar was unable to rally, as the implied probability for future Fed rate hikes declined somewhat and US yields retreated once the dust settled. It seems that traders attached greater emphasis on the core PCE inflation print, which came in cooler than expected, fueling speculation that the Fed has done enough for this cycle.

Either way, the dollar currently enjoys the strongest economic growth among the major economies and offers the highest real yields - a combination that can keep the reserve currency supported, especially when considering its safe-haven qualities and the lack of any attractive alternatives in the FX arena.

Stocks tumble, ECB says nothing new

Wall Street suffered more damage yesterday and is headed for losses of almost 2% this week. In a surprising twist, mega cap tech shares are leading the way lower this time following some disappointing earnings reports, which alongside sky-high yields have started to put pressure on stretched equity valuations.

The fact that equities tanked yesterday despite cheerful GDP data and the retreat in yields is worrisome, particularly with tech leadership falling out of favor. Investors are increasingly taking profits instead of chasing further returns, likely concerned about a deteriorating global macro environment putting the brakes on earnings growth next year.

Crossing into Europe, the ECB left interest rates untouched yesterday and signaled it will likely remain sidelined for some time, allowing high rates to work through the economy. President Lagarde highlighted the slowdown in growth, but didn’t sound too concerned about an imminent recession, something that business surveys warn is on the horizon.

Euro/dollar was relatively stable on the ECB decision and US data releases, closing the session little changed. Downside risks continue to dominate in euro/dollar as economic growth and real yield differentials favor the United States over Europe. Geopolitical tensions that result in higher energy prices can also put pressure on the pair.

Gold and oil prices gain after US strikes in Syria

In the geopolitical sphere, tensions continue to intensify after the United States carried out air strikes against Iran-backed targets in Syria, in retaliation to a series of attacks against US military personnel stationed in the Middle East since the Israel-Hamas conflict began.

Gold and oil prices moved higher in the aftermath, as these instruments have served as barometers for geopolitical market stress this month. Gold also received a boost from the retreat in real yields, although the $1,985 region continues to block any advances.

The question that’s keeping investors awake at night is whether Iran will somehow be dragged into this conflict. If that does not happen, then safe-haven demand for gold might begin to evaporate. As we saw after Ukraine was invaded, markets can learn to live with geopolitical tensions, as long as the situation does not escalate.

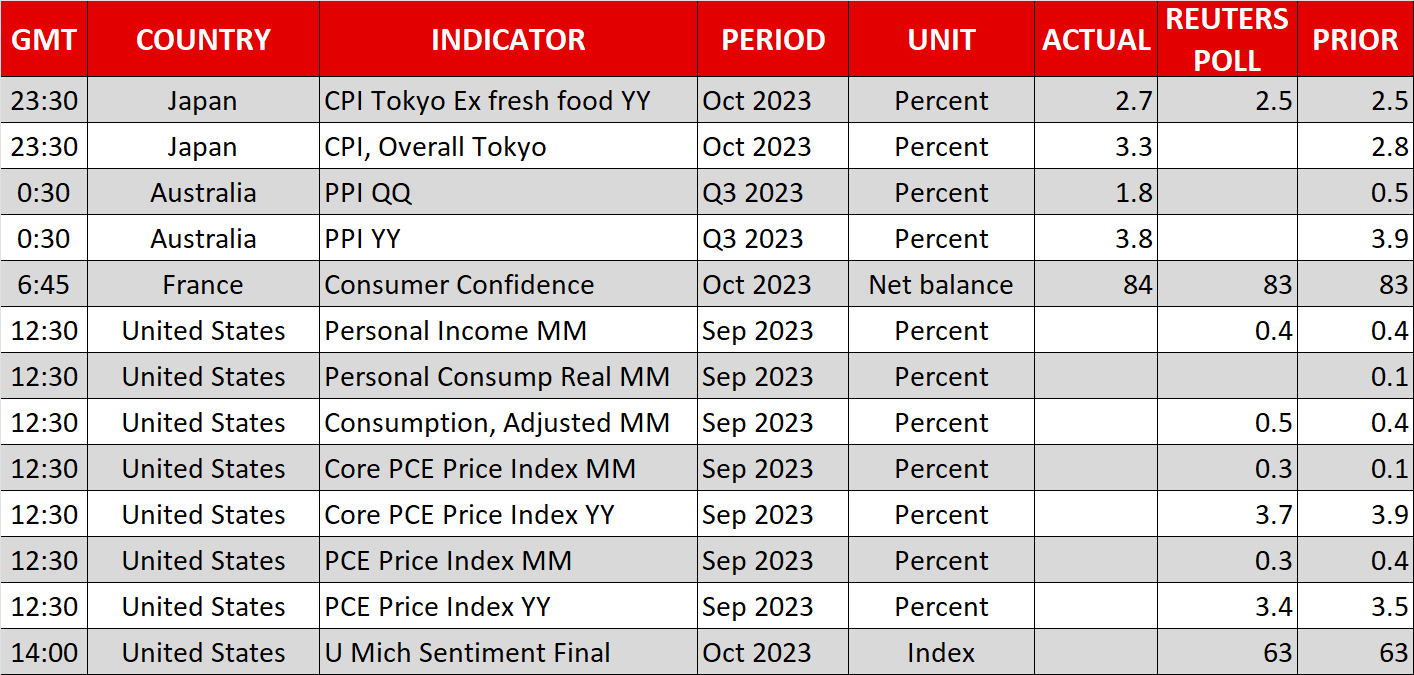

As for today, there’s a deluge of US data releases on the agenda that include the Fed’s favorite inflation metric - the core PCE price index.

.jpg)