Iranian attacks put markets on edge, but fallout limited

Markets brush off Middle East escalation

Iran’s unprecedented attack on Israel over the weekend was met with an unusual calm in the markets on Monday as investors downplayed the risk of an Israeli counteroffensive. Warnings that a response by Tehran to Israel’s suspected strike on an Iranian consulate building in Syria was imminent had already put markets on alert on Friday.

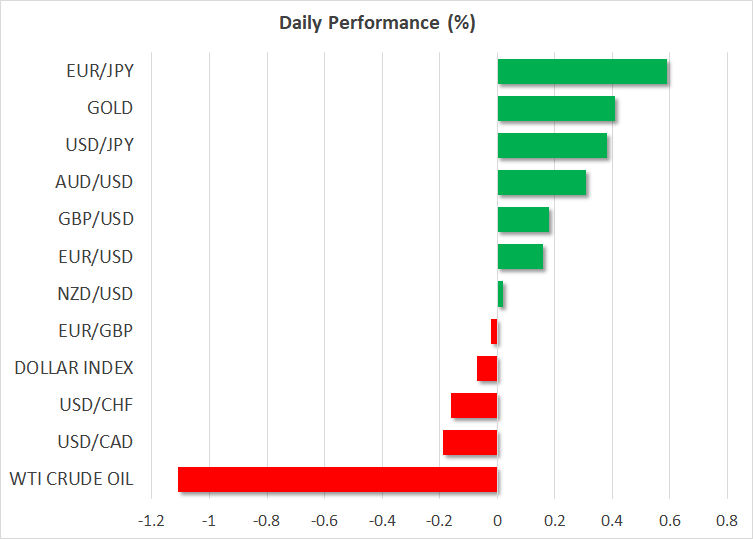

Oil futures and safe havens such as gold and the US dollar climbed to fresh highs, while Wall Street and Bitcoin plunged.

However, after Israel and its US-led allies managed to successfully shoot down 99% of the more than 300 missiles and drones launched by Iran, investors are hopeful this will be the end of the current standoff. More importantly, Washington has signalled it will not support a retaliatory strike by Israel, which would threaten to drag the entire region into a dangerous conflict.

As Israel ponders next move, risk-on takes over

Although it’s unclear if Israel will heed the Biden administration’s warning, markets appear to have already made up their minds and there doesn’t seem to be any rush towards safe havens. Gold is edging slightly up today after Friday’s pullback from all-time highs, while the US dollar is trading slightly below five-and-a-half-month highs.

US stock futures have started the day in positive territory despite a less than impressive start to the earnings season by the major Wall Street banks on Friday. Goldman Sachs’s earnings will be next to come into the spotlight later on Monday.

The only real panic sign from the weekend’s escalation came from cryptocurrency markets, which trade 24/7. Bitcoin tumbled by 4.6% on Saturday before recovering on Sunday.

Little reaction in oil prices amid relief

It seems that the immediate market reaction to Iran’s onslaught of missiles is relief, as the attacks were well telegraphed in advance, giving the Israelis and Americans plenty of time to prepare for defensive action. Even oil futures barely flinched, spiking modestly higher at Monday’s open before pulling lower.

In fact, there was more volatility in metal prices after the US and the UK announced fresh sanctions on Russian copper, aluminium and nickel. Copper futures were last trading 1% higher.

Yen under renewed pressure, Powell eyed

Still, the optimism in the markets in the face of the growing risk of an all-out war in the Middle East as well as fading expectations of aggressive policy easing by the Fed is very puzzling. Fed rate cut expectations for 2024 have fallen to less than 50 basis points following last week’s hot CPI report.

The renewed higher for longer bets are causing fresh pain for the yen, which has weakened past the 153 level against the US dollar, hitting new 34-year lows. Yet, the rhetoric from Japanese officials suggests intervention is not imminent.

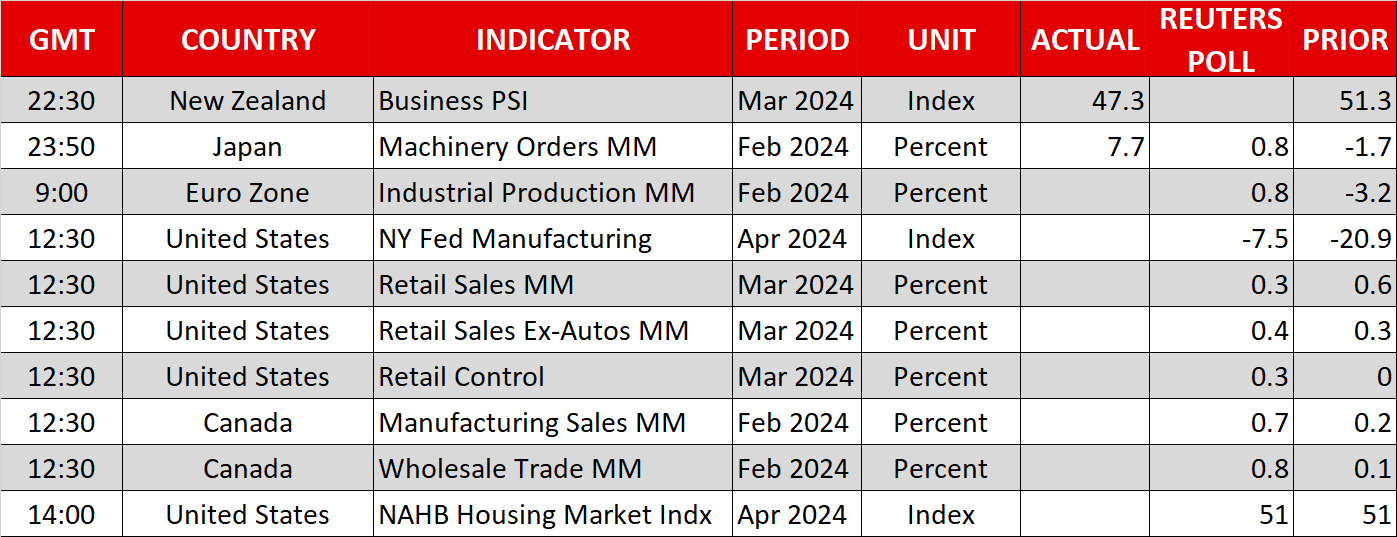

Investors will likely be focusing on Fed Chair Powell’s comments on Tuesday for more clues on the possible timing of the first rate cut. Ahead of that, US retail sales will be watched later today.

.jpg)