Spotlight turns to the ECB

OVERNIGHT

Asian equity markets rose following last night’s decision by the US Federal Reserve to raise interest rates. The outcome was widely expected, with the 25bps hike taking the policy interest rate range up to 5.25-5.50%, a 22-year high. The key focus was potential indications about future policy. On that, Fed Chair Powell stressed that any further action will be data dependent and that means it was currently unclear whether or not they would hike again in September. Markets seem to be attaching only a low probability of a September hike but there is a long 8-week period and lots of data to digest before then.

THE DAY AHEAD

After yesterday’s US Fed interest rate decision, attention turns to the ECB today and the Bank of Japan in the early hours of tomorrow. The ECB is due to announce its policy decision at 13:15BST and the press conference with President Lagarde starts at 13:45BST. It has already telegraphed its intention to raise interest rates by 25bps, which would bring them up by a total of 425bps since its tightening campaign began a year ago. Markets have priced in about 95% probability of a hike today. However, there seems to be growing uncertainty about what the ECB will do next, partly reflecting concerns that the growth outlook might be dimming after recent weaker business surveys.

There has also been some progress in the Eurozone in reducing headline inflation, which has fallen to 5.5%, although core inflation remains stickier. As a result, the ECB today may leave its options open for September by reiterating that it is data dependent and that new forecasts will be available then but refrain from giving a clear indication. As with the Fed, there will be lots of data to digest between today’s meeting and the September update, including two further months of inflation data and Q2 GDP.

For the Bank of Japan, there has been speculation that it might reconsider its ultra-loose monetary policy in the light of the recent rise in Japanese inflation. Indeed, the most recent June update showed an increase in annual CPI inflation to 3.3%, above its US equivalent. Despite that, BoJ Governor Ueda played down the likelihood of an early change, suggesting that more evidence was needed that the rise will be sustained. That suggests that policy will remain unchanged for now but the odds of a policy adjustment sometime this year do nevertheless seem to be rising.

On the data front, we expect today’s US Q2 GDP to post an annualised quarterly rise of 2.0%, the same as Q1. The detail may show inventory growth contributing more to the rise and final demand less than in Q1, but overall that is unlikely to provide hints the economy is heading for recession. Early tomorrow, France and Spain will release GDP and CPI data.

MARKETS

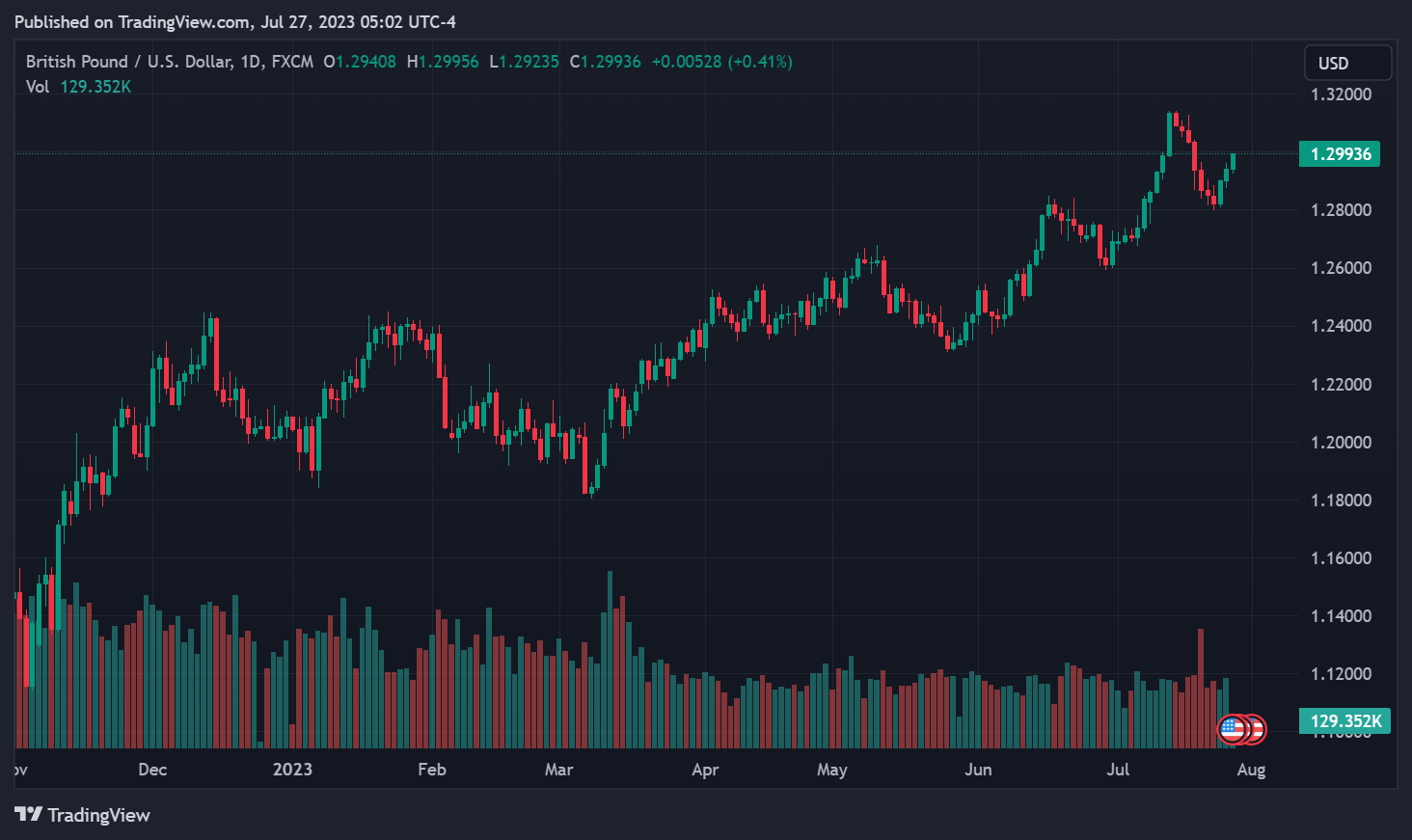

The US dollar and Treasury yields fell after last night’s Fed decision. Although the door was left open for more tightening, markets anticipate that interest rates may have peaked or are close to peaking. Both the pound and the euro are higher versus the greenback, as attention turns to the ECB today.