The dollar tests the strength of its 13-year growth trend

The dollar tests the strength of its 13-year growth trend

The US dollar finds itself at a crossroads during a rather dangerous season, when markets often form trends for the coming months.

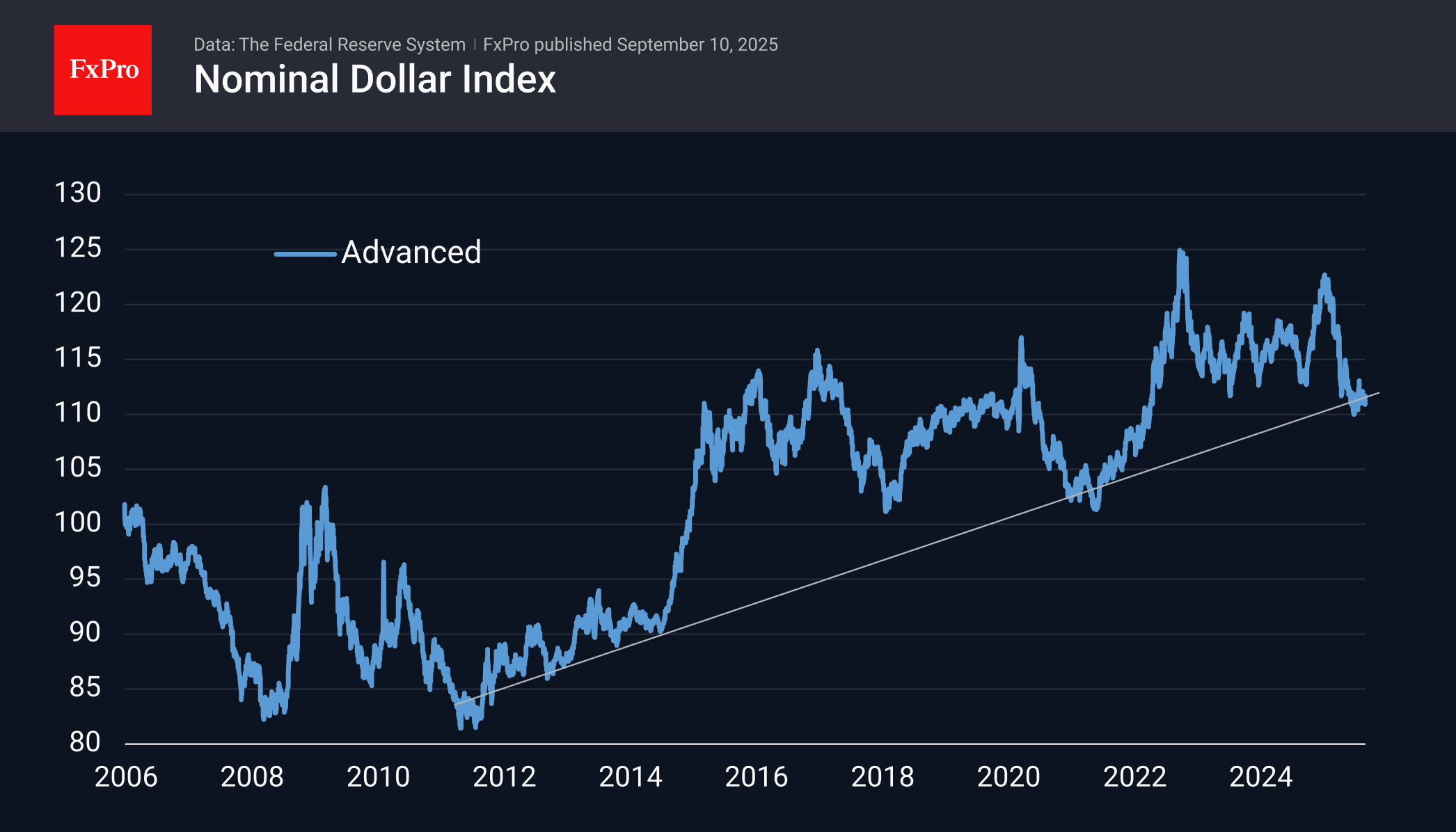

The short-term outlook for the DXY is quite alarming. At the end of last week, the trade-weighted basket of developed currencies broke the upward trend that had been gradually forming since July's lows due to weak labour market indicators and fell to 97.5. The final signal of a shift to a decline will be a renewal of July's lows at 96.3, which in turn were the lowest since March 2022.

The reasons for this are simple: the labour market is in much worse shape than previously estimated, leading to a rapid reassessment of monetary policy prospects. However, this relatively small step could have important technical significance.

Technically, this opens up the potential for the dollar to fall to its 2021 lows of 90, or to the 88 area, where the 161.8% Fibonacci target from the first half of the year's decline lies.

This could mark a significant decline for the dollar. The Fed's dollar index against a trade-weighted basket of developed countries is moving as if in stages, within wide ranges. Over the past three years, this has been a range of 110-120. From 2015 to 2022, it has mostly remained within 100-110, starting in 2014 from the 90 range. A further dip of a couple of per cent from current levels would break the upward trend that began back in 2012.

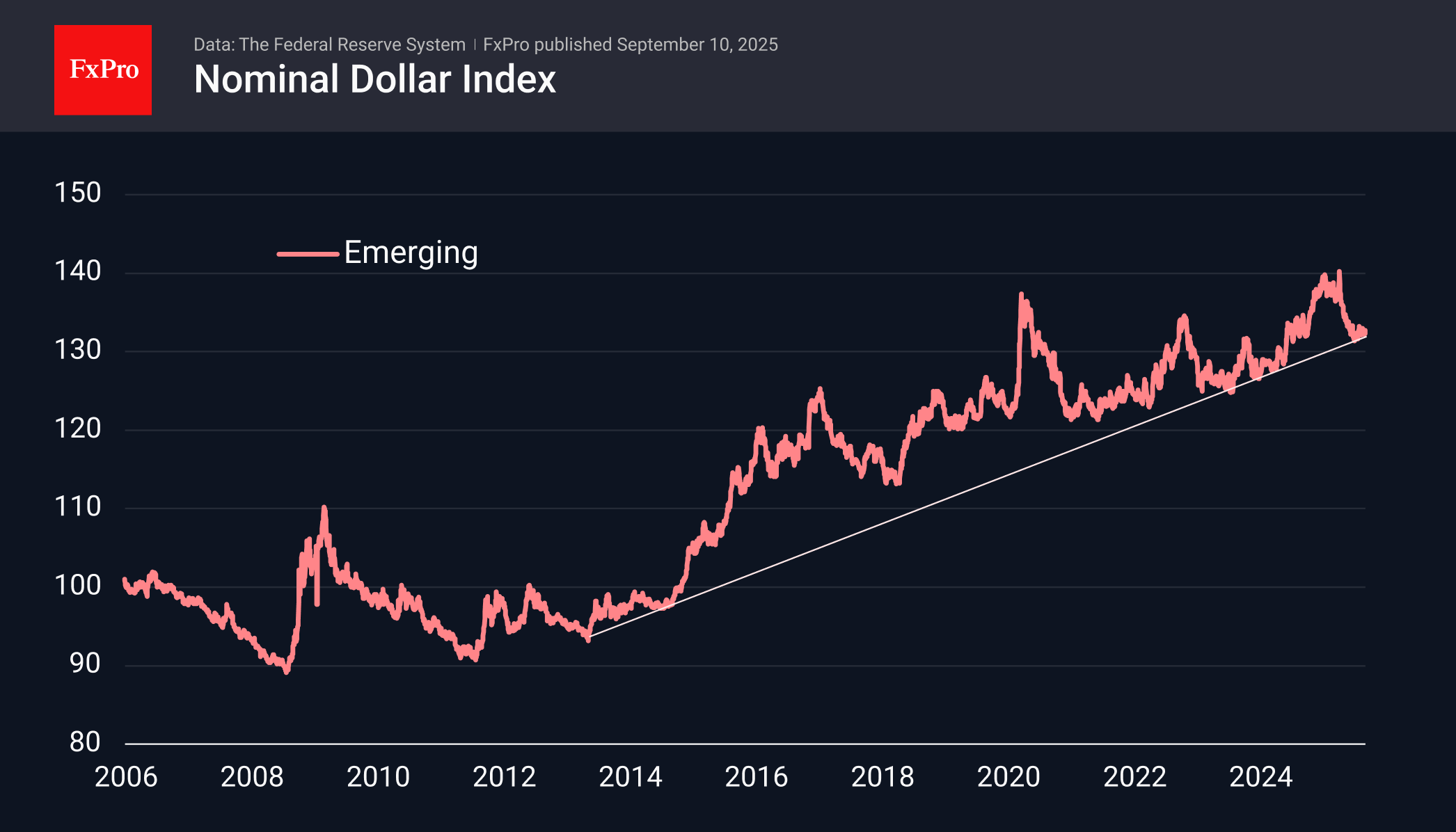

The situation with the dollar's dynamics against a basket of emerging market currencies is even more dramatic. Historically, they have lost against the American currency. The latest growth trend began in 2013, but the last two years have seen frequent tests of the support line. Since July, the index has been trading near this line again. A fall below this level would mean a transition to a multi-year downward cycle.

This is doubly true given that it is quite typical for markets to form new trends in August-September, when the financial year ends.

Strictly speaking, it would be premature to bury the dollar until it falls below support levels. From its current position, it could be an ideal entry point with long-term growth prospects.

However, dollar bulls will have to change a lot in the prevailing market narrative that the Fed will be more active in cutting rates. The further we go, the more this will be the case, given the growing share of Trump's new administration appointees in the Fed, including the change of the central bank's head in May.

This is by no means a populist move. Given the accumulated national debt and the impossibility of fiscal consolidation, the US government does not have many cards to play. What remains is a scenario of reducing the debt burden and correcting the trade balance through weakening the national currency and tolerating higher inflation — a path that the UK found itself on in 1938.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)