The US Dollar Got the Needle

By RoboForex Analytical Department

The EUR/USD is trading at 1.0730 on Tuesday. The market is tense, and very much so. It's all about the fact that at 14:30 GMT+3 there will be a closed-door meeting of the US Federal Reserve's management, where the issue of rates for the Fed will be addressed. The topic is neutral, but given the current context, the event becomes more significant.

The US banking system is under severe stress and the aspect of bank balance sheets is likely to be discussed now. There could be a lot of unpleasant things lurking here for the capital markets because of the increasing risks.

The Fed is clearly ready to provide liquidity, but the main thing for investors - confidence in the stability of the whole system - is leaving the market.

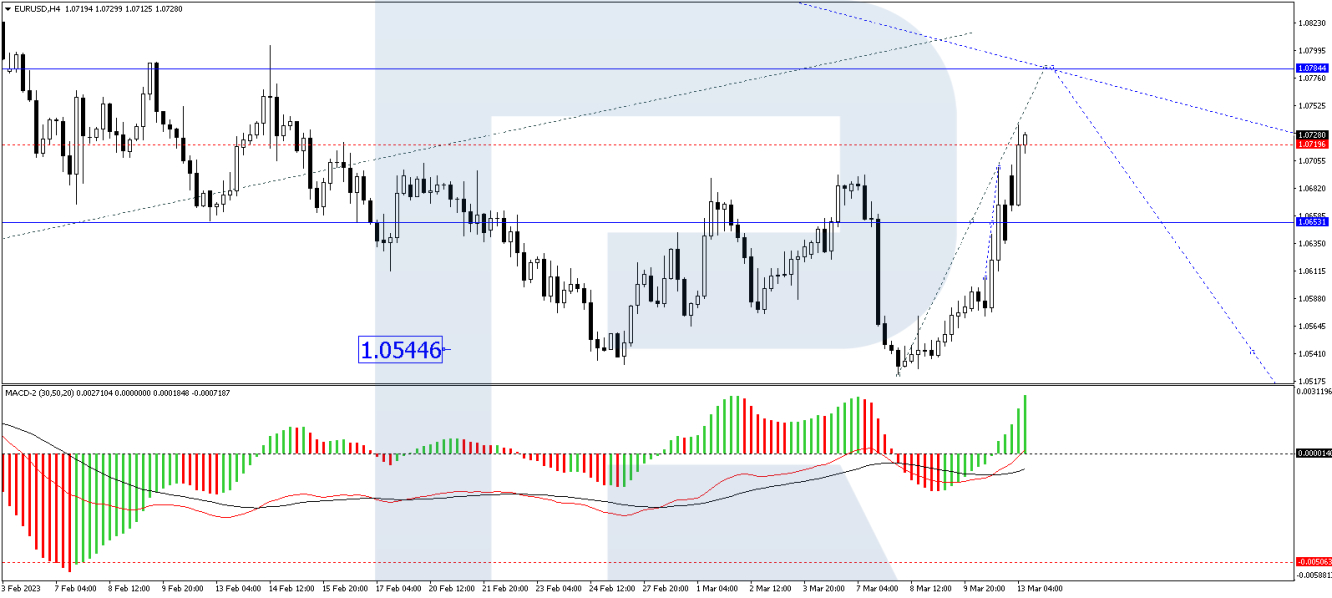

On the H4 EUR/USD chart a retracement pattern is forming towards 1.0784. A decline to 1.0655 is not ruled out today. Then the growth to the level of 1.0784. After its recovery we expect the beginning of the next downward wave to 1.0515. Technically, this scenario is confirmed by the MACD indicator. Its signal line is under the zero level and is directed strictly upwards. We expect an update of the highs.

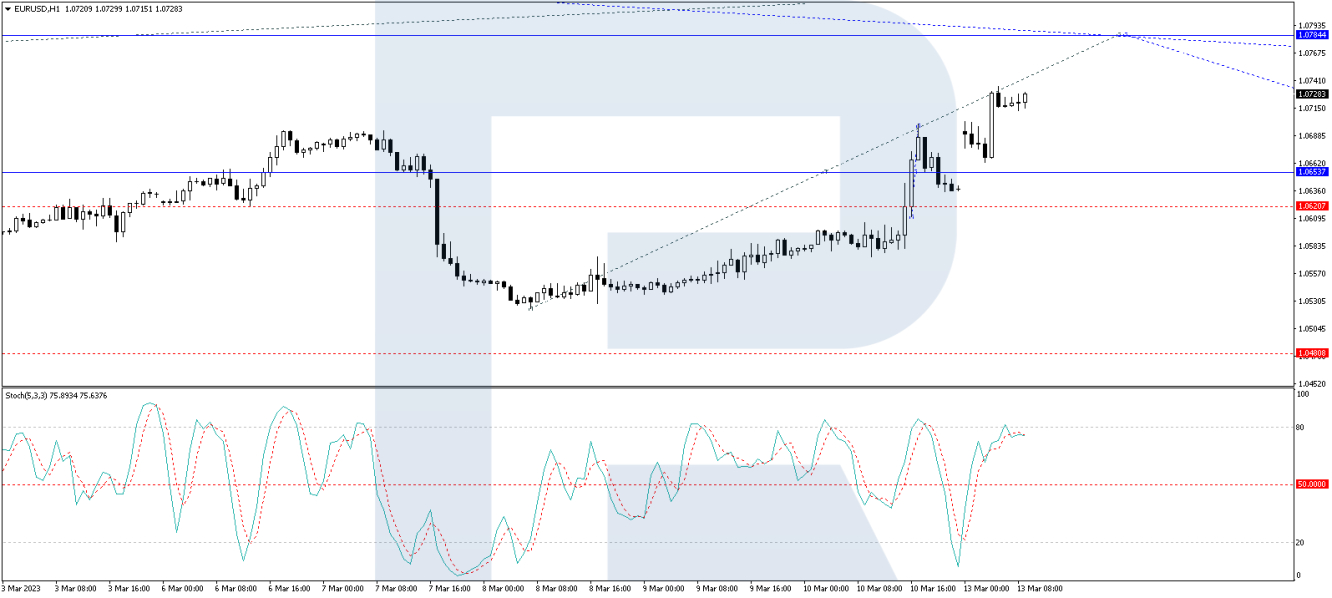

On the H1 EUR/USD chart, the upside wave to 1.0655 has been worked out. Today a consolidation range is formed around it and it is suggested to consider the probability of an upward exit from it. This will open up the potential for growth to the level of 1.0784. Futher, the decline to 1.0620. Breakdown of this level will open the potential to reach 1.0540. Technically, this scenario is also confirmed by the Stochastic oscillator. Its signal line is near the 80 mark. We expect it to reach 50 and the continuation of the decline to 20.

DisclaimerAny forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.