Trump delays tariffs on Mexico and Canada, China retaliates

Trump delays tariffs on Mexico and Canada; initiates conflict with China

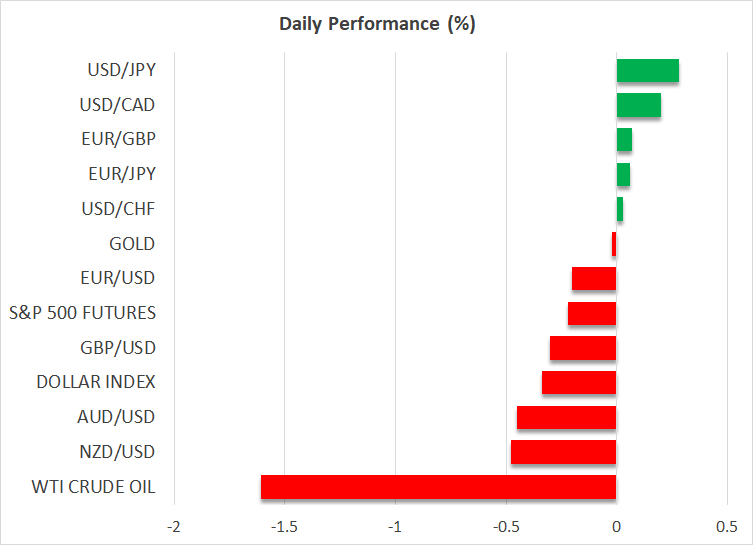

The US dollar began this week in a very volatile fashion, opening with a negative gap after US President Trump announced over the weekend the well-telegraphed tariffs on Canada, Mexico and China, with all three nations pledging to retaliate.

However, throughout the day, the greenback gave back most of its gains as leaders of Mexico and Canada agreed to step up efforts to battle drug trafficking, with the US President allowing for a 30-day reprieve on tariffs.

However, Trump did not postpone tariffs on China, with the world’s second largest economy responding today with levies on US goods that are set to take effect on February 10.

The result was a rebound in the US dollar due to diminishing hopes that a full-scale global war can be avoided, with three Fed policymakers already warning that trade tariffs come with inflation risks. With President Trump also targeting the European Union, investors decided to scale back their rate cut bets again. Currently, they are penciling in 40bps worth of rate cuts this year by the Fed, less than the Fed’s own projections of two quarter-point reductions.

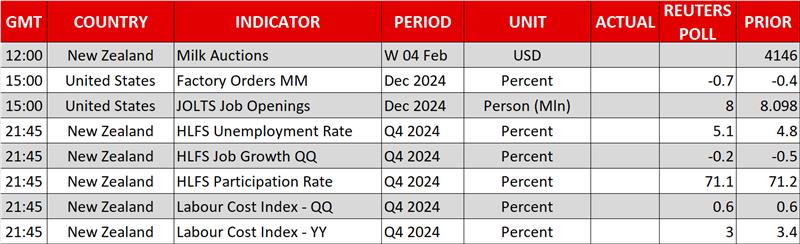

The better-than-expected ISM manufacturing PMI corroborated that view, while today, traders may pay extra attention to the JOLTS job openings data for December ahead of Friday’s NFP report for January. Given the Fed’s emphasis on the labor market and barring any new tariff-related headlines, anything pointing to further improvement in employment could prompt investors to push further back their Fed rate cut expectations.

Aussie and Kiwi the main losers, gold enters uncharted territory

The currencies that are hurting the most today are the aussie and kiwi as China is the main trading partner of both Australia and New Zealand. The uncertainty of how a new trade war will impact these two economies has prompted market participants to price in around 85bps worth of rate cuts by the RBA this year, and 115bps by the RBNZ.

With regards to the RBNZ, there is around a 30% chance for a back-to-back 50bps reduction at the February 19 gathering and a soft employment report tonight could take that probability higher.

Once again, gold continued to gain, hitting a new record high, and confirming that regardless of where the dollar goes, gold may be destined to keep trending north. A strong dollar due to Trump’s tariffs threats and actions is helping the metal through safe haven inflows, while a declining greenback due to expectations of lower interest rates is positive due to the reduced opportunity cost for holding gold.

Earnings season takes the back seat as tariffs drive Wall Street

Wall Street indices opened the week with negative gaps as well and slipped even lower to close the trading session in the red. In after hours, stock futures bounced in relief that Mexico and Canada reached common ground with the US and delayed the tariff hit, but the tensions between the US and China are weighing today.

Although the prevailing uptrends are not under threat yet, their continuation may be far from guaranteed as the financial community remains fixated on tariff-related headlines and the associated heightened uncertainty. While company earnings results may introduce some volatility, they are unlikely to be the decisive factor in shaping Wall Street's near-term outlook in this environment.

.jpg)