US labour market: normalisation, not recession

Fresh signs of a cooling labour market are boosting confidence in the Fed's policy turnaround but have so far had a mixed effect on the dynamics of major markets.

The labour market is in the spotlight this week as it has the power to decide when and by how much the Fed will cut its key interest rate. The highlight will be the official Nonfarm Payrolls report on Friday, but important pieces of the puzzle will be assembled throughout the week.

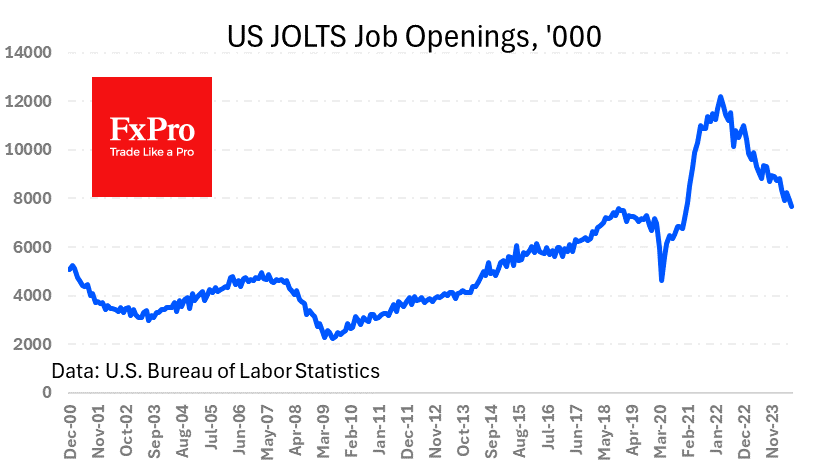

Wednesday's data showed that job openings fell to 7.67 million in July, the lowest since early 2021, against expectations for an increase from 7.91 million to 8.09 million. There was a historical peak of 12.2 million in March 2022, followed by a gradual normalisation. While the current readings look like a sharp drop from the peak, they represent a normalisation to the pre-pandemic peak of 7.5 million in early 2019.

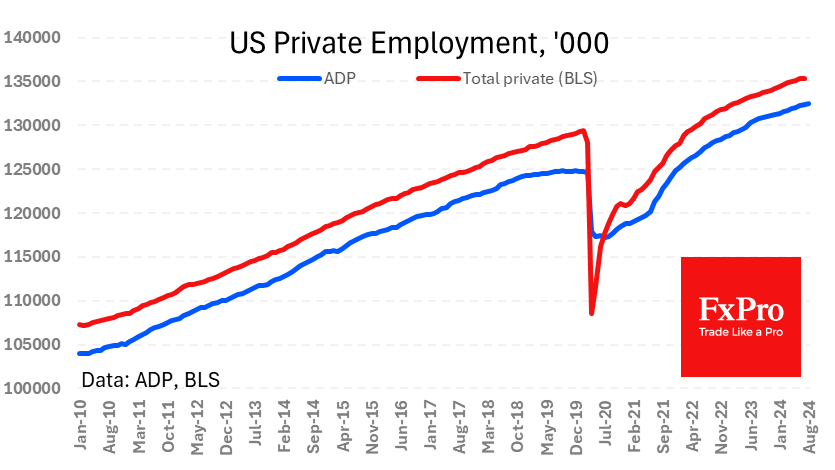

ADP estimates released on Thursday showed that the private sector added 99,000 jobs in August, down from 111,000 the previous month. That's the lowest level since the recovery began in 2020. US employment numbers have returned to the growth trend of the past fifteen years, climbing out of the hole created by COVID-19. It's a clear slowdown but not necessarily a recession.

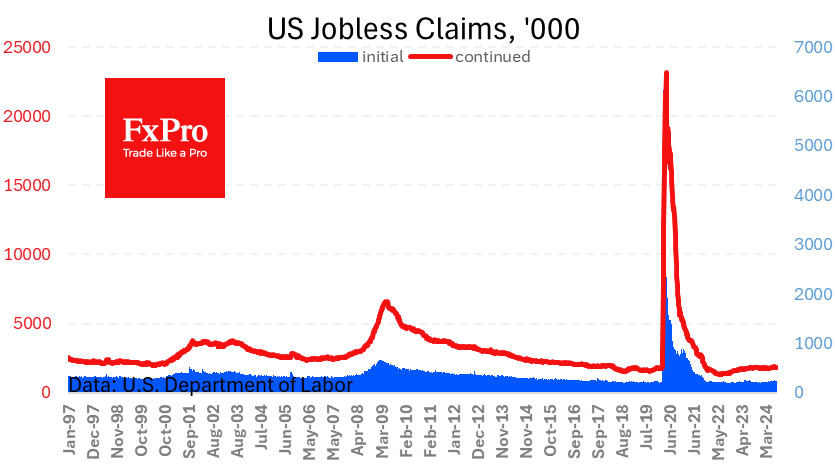

Weekly jobless claims also point to a slowdown in the labour market but not a recession. Initial claims fell to 227K last week, continuing a downward trend from a peak in July. Continued claims fell from 1860K to 1838K, against expectations for an increase to 1870K.

Apparently, the "most expected US recession" is about to be renamed the "most expected" recession. The big takeaway from the data is that there is still no need for the Fed to rescue the economy with a double cut in the Fed Funds rate. A 25-point cut in September, followed by a further assessment of the situation, looks like a much more prudent strategy for now. The Powell-led Fed has the chance to pull off a perfect policy reversal by smoothly lowering the rate to a neutral level, estimated at 2.8%.

On the other hand, with current growth rates lower than they were a quarter or a year ago, markets are betting on Fed dovishness with a 45% chance of a 50-point cut in September, up from 24% two weeks ago. Such a move could be a mistake, however, as it would confirm the risks of an overheating economy and lead to higher prices for commodities and services.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)