USDCAD holds steady as BoC decision looms

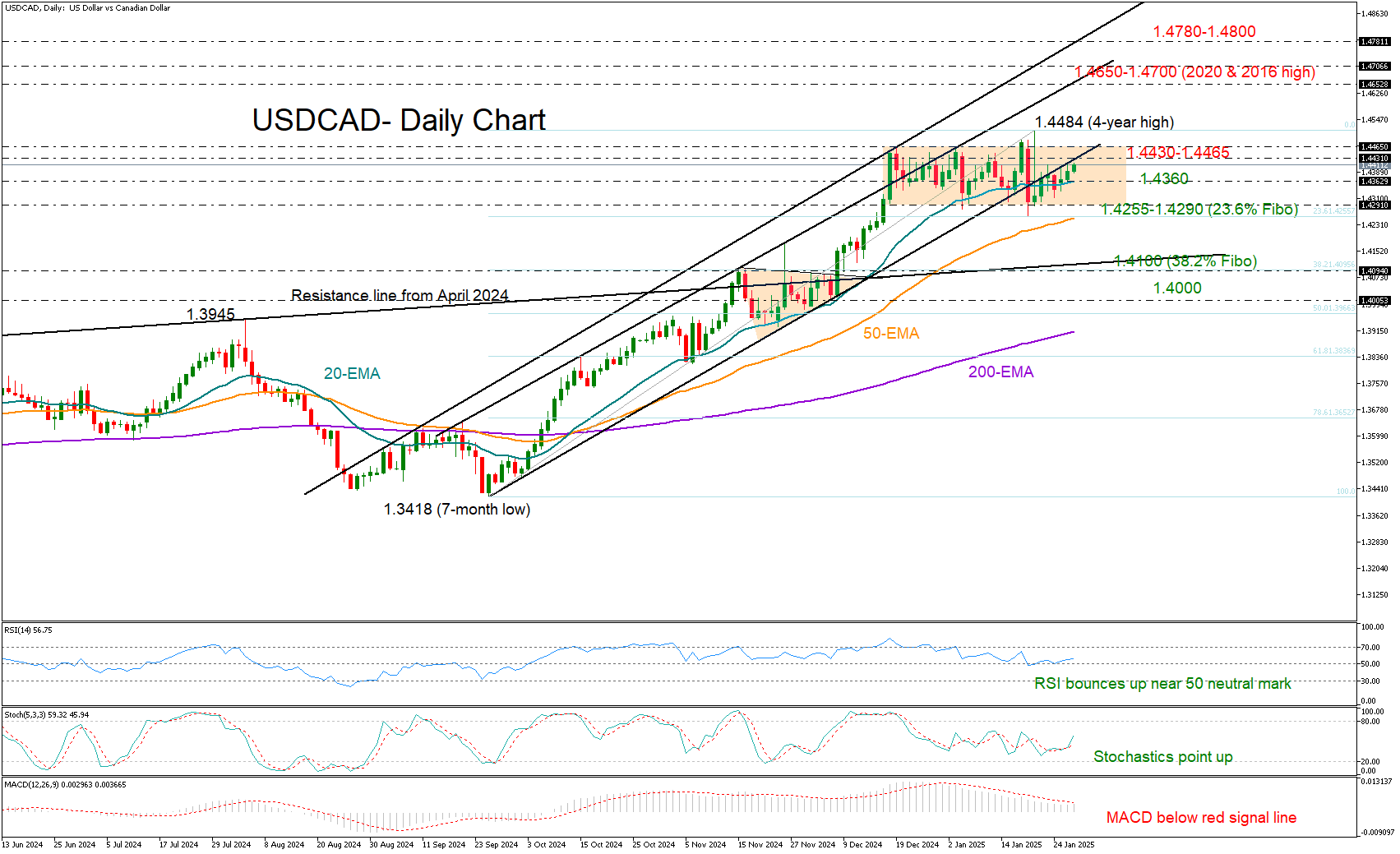

USDCAD has been in a gradual recovery phase over the past week, resuming its sideways structure from mid-December after a temporary drop to 1.4259.

With the clock ticking down to the BoC policy announcement (14:45 GMT), which could reveal the sixth consecutive reduction to 3.0%, investors are wondering whether the bulls can lift the pair beyond its four-year high of 1.4484.

The upturn in the RSI and the stochastic oscillator looks promising, though the broken support trendline from September, which is now acting as resistance near 1.4430, remains a struggle. The upper band of the rectangle seen around 1.4465 will be closely watched as well. A break above this zone could trigger a surge towards the 2020 and 2016 highs encapsulated within the 1.4650-1.4700 zone, with the next major target seen near the constraining ascending line around 1.4780-1.4800.

In the event of a backward flip, the 20-day exponential moving average (EMA) at 1.4360 could provide a cushion ahead of the 1.4255-1.4290 area, which includes the 50-day EMA and the 23.6% Fibonacci retracement of the September-January uptrend. A step lower could signal a potential negative trend reversal, prompting a swift decline towards 1.4100.

For now, USDCAD is holding a neutral bias, with traders waiting for either a decisive move above 1.4430-1.4465 or below 1.4255-1.4290 to drive the pair accordingly.