- घर

- कम्युनिटी

- नए ट्रेडरों

- ☕️ Cup and Handle Pattern: Quick Breakdown

☕️ Cup and Handle Pattern: Quick Breakdown

📈 Cup and Handle Pattern Explained

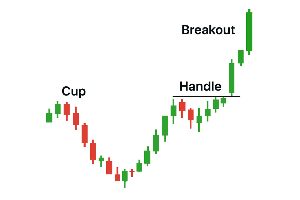

The Cup and Handle is a bullish continuation pattern that suggests a potential breakout after a period of consolidation and minor pullback.

🔹 Cup: A rounded bottom formation resembling a “U” shape. It reflects a gradual shift from selling pressure to buying interest, often following a prior uptrend.

🔹 Handle: A short-term pullback or sideways movement after the cup, forming a small downward-sloping channel or flag. This represents a final shakeout before the breakout.

🔹 Breakout: Price breaks above the handle’s resistance level, signaling renewed bullish momentum and continuation of the prior uptrend.

📊 Volume Behavior:

Volume typically decreases during the cup formationSlight increase during the handleStrong volume surge during breakout confirms the pattern🕒 Timeframe: Cup and Handle patterns can span from several weeks to months on higher timeframes (daily, weekly), but also appear on intraday charts for active traders.

🧠 Trader Psychology: The cup reflects a recovery phase where sentiment shifts from bearish to bullish. The handle shows hesitation or profit-taking. Once resistance is cleared, confidence returns and buyers drive the price higher.

Use this pattern to spot high-probability breakout setups in trending markets!