EBC Markets Briefing | South African rand muted amid trade uncertainty

The South African rand edged down on Tuesday, as investors watched out for any progress on trade talks for countries to strike trade deals.

Trump's tariffs on South Africa could cause around 100,000 job losses, with the agriculture and automotive sectors hardest-hit, central bank governor Lesetja Kganyago said earlier this month.

Washington will not immediately impose a new 10% tariff against members of the BRICS bloc, but will proceed if countries take so-called "anti-American" policy actions, according to a source familiar with the matter.

He said statistics showing South African car exports to the US slumped more than 80% in the wake of import tariffs imposed on cars by the Trump administration in April were very concerning.

The African country already has one of the highest unemployment rates in the world, with the official rate sitting at 32.9% in Q1. it saw a marginal GDP growth of 0.1% in the quarter.

The weakness has begun to show since the 2008-2009 financial crisis, with annual growth averaging less than 1% over the past decade. Citi said it was lowering its forecast for the economic growth this year to 1.0%.

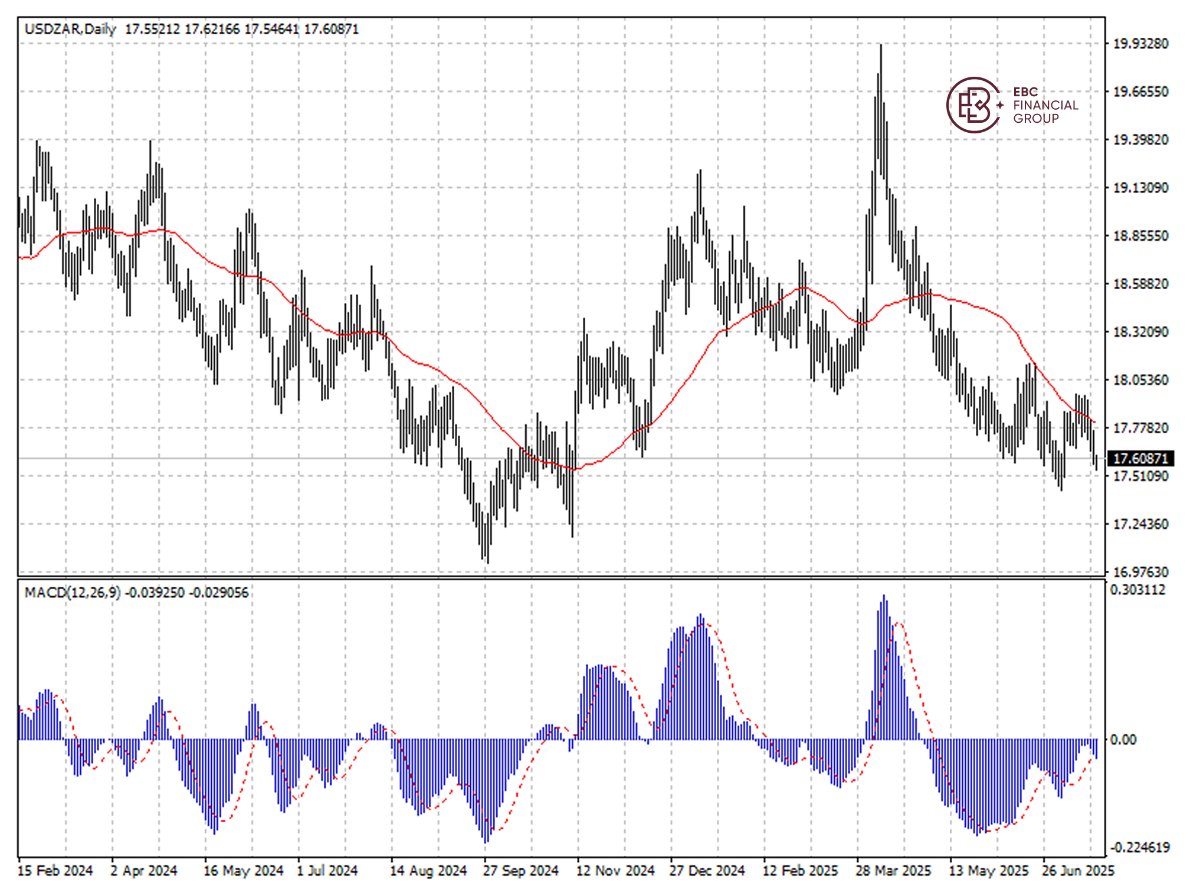

The rand's rally may stall for a while given MACD divergence, but we still see support at 50 SMA around 17.8 per dollar.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.