Oil in a bear hug, despite the rebound

Oil in a bear hug, despite the rebound

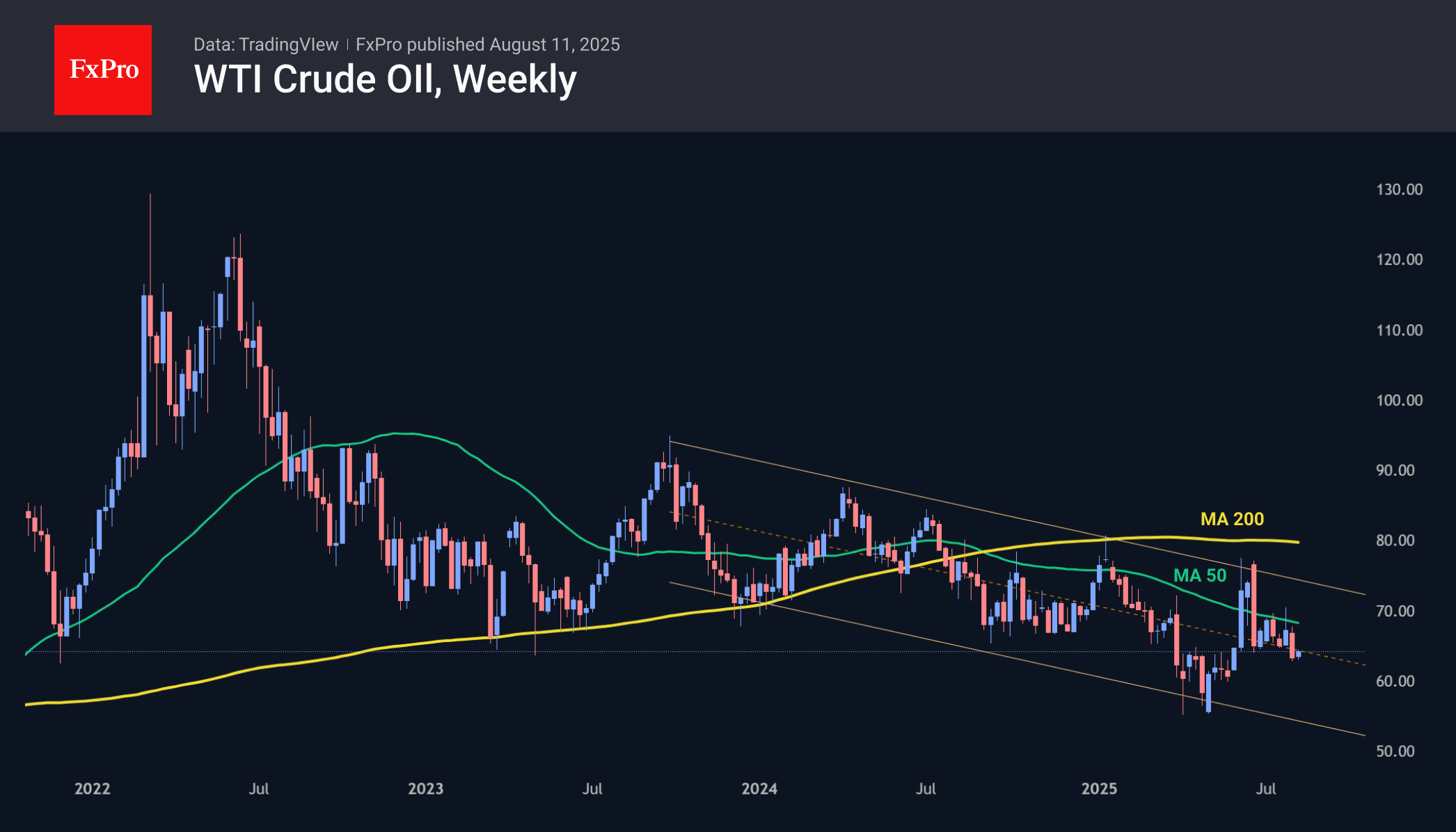

Oil rose about 1.3% on Monday to $63.5 per barrel of WTI after falling 11% over the previous seven trading days. The decline was the market's reaction to weak US labour market data, which forced a downward revision of demand forecasts, and the almost simultaneous increase in OPEC+ quotas, with demand revised upward.

It is easy to see that the oil market is focused on the negative side of the news, preferring to see an increase in the oil surplus rather than hoping for an early rate cut, as the stock market does.

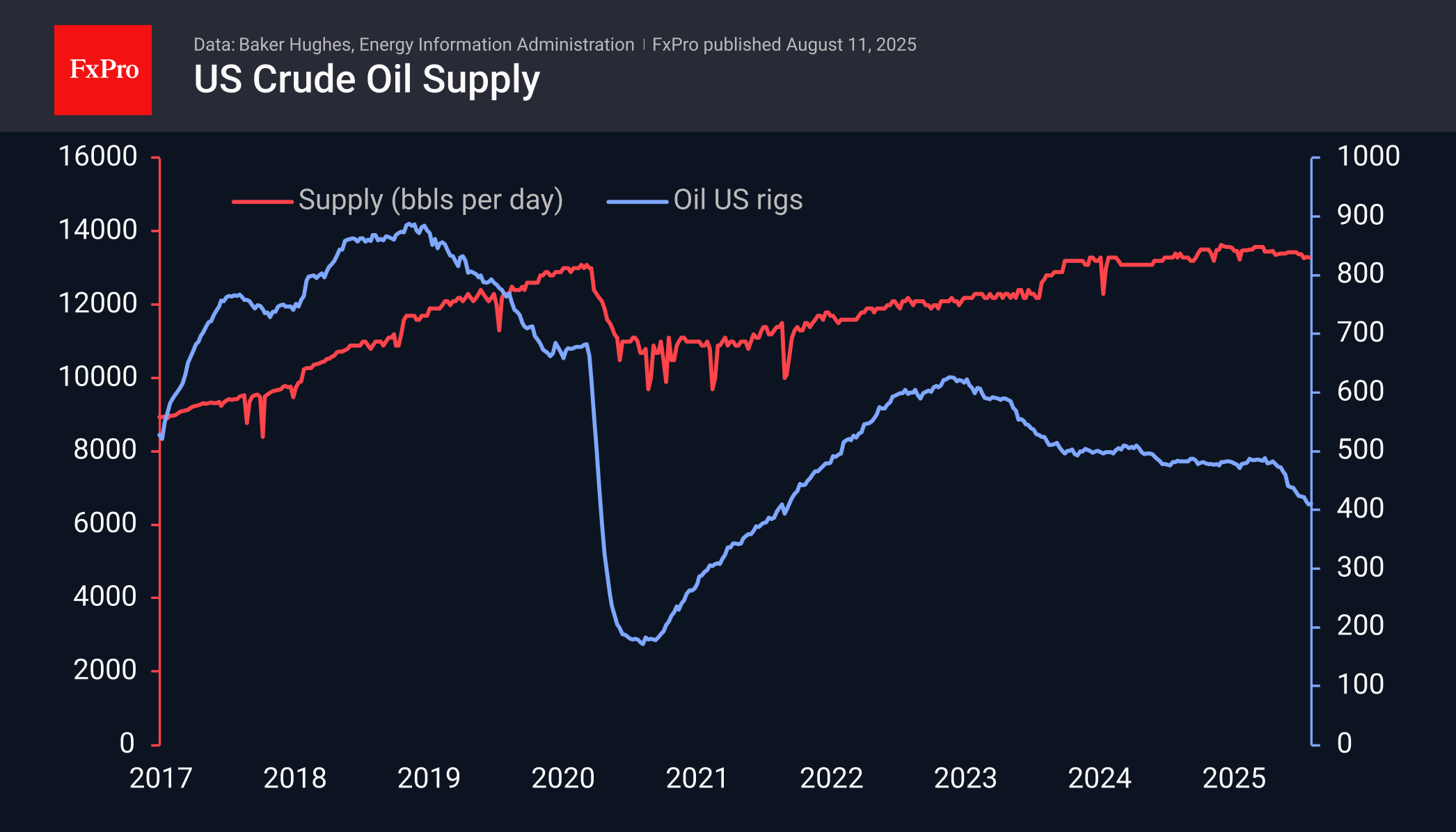

The latest oil statistics were on the side of the bulls, showing an increase in the number of oil rigs from 410 to 411 last week — the first increase since early April. At the same time, the EIA previously reported a decline in production to 13.28 million barrels per day, compared to 13.31 million a week earlier and a peak of 13.58 million at the end of March. Apparently, the reduction in investment in US production has begun to show up in the current data.

In this regard, it is not surprising that representatives of the US Republican Party, which has a strong oil industry lobby, have stepped up pressure on competitors, starting with Russia, and consumers, starting with India. As before with Europe, we see behind these steps a desire to further increase its power as a global energy exporter against the background of stagnant domestic demand.

Monday's oil growth looks like a technical rebound after a significant decline that sent the price to the middle of the range since September 2023. A couple of weeks ago, the 50-week moving average once again confirmed its strength as resistance, setting the stage for a decline to the lower end of the corridor and a potential renewal of June lows at $55 per barrel of WTI by the end of the year.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)