Risk sentiment weakens as US government shutdown commences

US federal government shutdown begins

Following a fruitless meeting between US President Trump and the four Congressional leaders, the US federal government is now officially shut. Notably, there have been 15 shutdowns since 1981, and only three lasted more than five days. Crucially though, the longest closure occurred in 2018 when Trump was in the White House.

While critical agencies will remain in operation, the Bureau of Labour Statistics and the US Census Bureau are expected to suspend their data releases until further notice. This means that, barring a quick agreement between Democrats and Trump, Thursday’s and Friday’s jobs data will not be published. Coupled with the light Fedspeak calendar, markets will be forced to make do with private data releases.

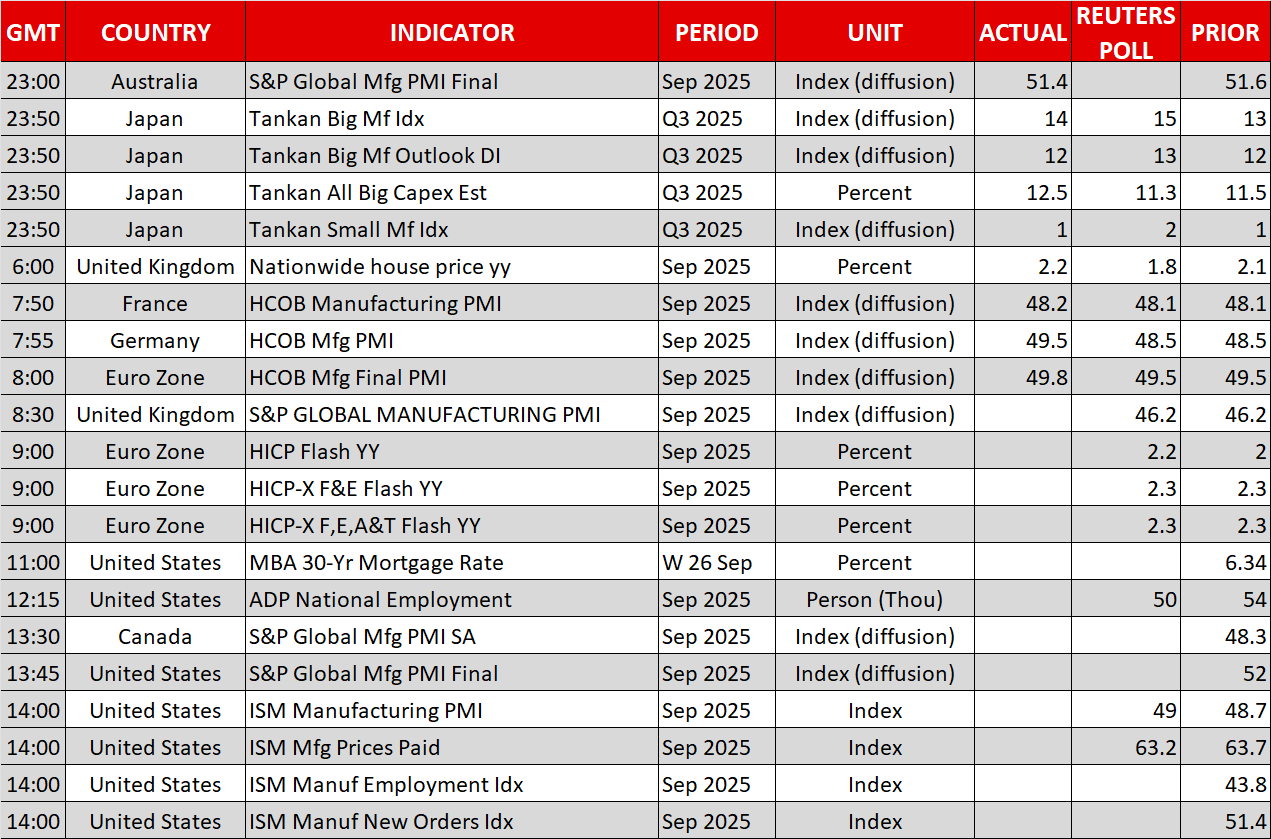

Today, the ADP employment report and the ISM manufacturing PMI survey will be published, helping shape market expectations for the late-October Fed rate meeting. The ADP report is forecast to show a 50k increase, following a 54k gain in August. The six-month rolling average has dropped to 62.2k, the lowest pace since early 2022, excluding the COVID impact. Despite the low ADP-NFP correlation, a solid print today could go a long way towards making investors more optimistic about the current strength of the labour market.

Later today, the ISM manufacturing PMI survey is expected to show a marginal improvement to 49, with the headline index staying below 50 for the seventh consecutive month. Given the market’s sensitivity to labour market indicators, it would be interesting to see whether the employment subindex remains stuck at its lowest levels since mid-2020.

Dollar weakness lingers, mixed movements in September

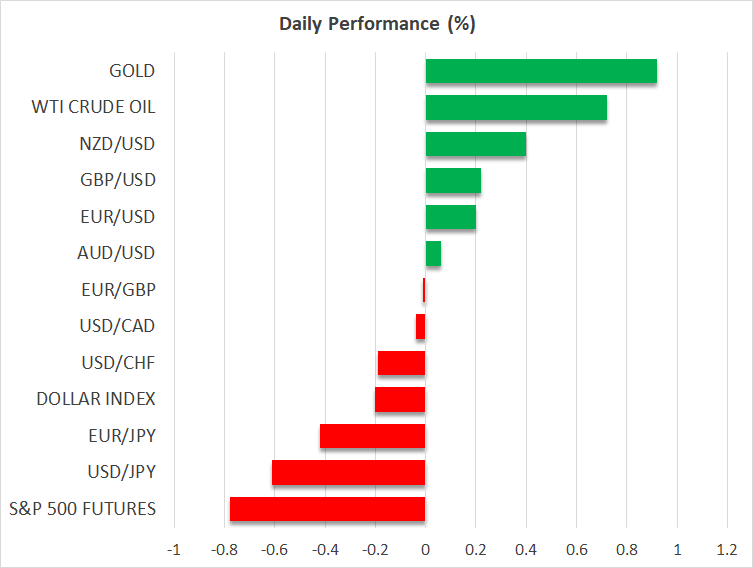

The US shutdown comes at the start of the final quarter of 2025, which is expected to be equally volatile as the rest of the year. Amidst these market conditions, the dollar remains under pressure, with euro/dollar trading at 1.1760 at the time of writing. This latest upward move could also be attributed to yesterday’s strong German CPI report, raising the possibility of a sizeable upside surprise at today’s eurozone preliminary CPI report.

More noticeably, dollar/yen continues to decline, quickly returning to the midpoint of its recent range trading, and testing the support set by the busy 146.46-147.78 zone. The newsflow from the Japanese side has not been sufficiently positive to justify this move, particularly as the country is gearing for Saturday’s LDP leadership contest, and today’s soft quarterly Tankan survey.

Notably, despite some recovery against specific peers in September, the dollar remains strongly on the back foot in 2025. It is currently down 14% against the euro, with dollar/Swiss franc in the second spot with a 12% decline. Dollar/yen is just 6% lower this year.

Equities digest US shutdown news

While major investment houses speculate on the duration of the shutdown, equities are still digesting the current newsflow. That mood could quickly turn sour if the shutdown continues into next week, especially if US President Trump does not appear ready to compromise.

September was a positive month, mostly for US and Asian equities. That said, the German DAX 40 continues to outperform its US counterparts, including the mighty Nasdaq 100 index. But their returns are dwarfed by the 47% increase recorded by gold, which is outperforming even stablecoins.

Gold reaches new all-time high, oil pressured by OPEC+ speculation

After posting a new all-time high, gold is hovering north of $3,860, ready to take advantage of any weakness in the dollar and/or a deterioration in risk appetite. Meanwhile, the newsflow from both the Ukraine-Russia and Israel-Hamas conflicts remains negative, which, despite the week-long absence of China due to its Golden Week, might be sufficient to keep gold bid.

Finally, speculation regarding the October 5 OPEC+ online meeting is rife, with oil prices stabilizing above $62.50 after reports of a 500k bpd increase were dismissed by the OPEC Secretariat. That said, a production increase is expected on Sunday, but it is unlikely to diverge much from the September decision of a 137k bpd rise.