Fundamental Trading FX

This topic will focus on fundamental analysis, sentiment analysis and technical analysis as an additional tool. From my experience I can say that my trading changed when I discovered fundamental analysis and sentiment analysis. Unfortunately technical analysis is absolutely subjective and is not able to give the desired results, all those who promote this approach are either beginners or want to sell you their stupid course. I don't blame them, they just want to make money by virtue of their intellectual abilities and only a few really know how to trade.

By the way, have you ever noticed that usually weak and stupid people cheat, steal and so on because they lack intelligence and abilities, so envious of those who can do something, they decide to cheat? Just an interesting observation.

In any case, for those who want to really make money on the market, you should pay attention to hedge funds and other professional participants and you will see that they mostly use fundamental analysis or quantitative analysis. Are they stupid? I don't think so. My approach is based on economic data, sentiment and technical analysis. I don't use quantitative analysis but it works fine too, to each his own.

Perhaps the first thing I would start with is to learn what type of market you are going to trade and what is the purpose of this market, who are the main participants of this market?

Considering that my specialization is the currency market, let's talk about it.

Key participants: funds / banks

The purpose of the market: each participant has his own purpose depending on his interests, but the main idea is to exchange at a more favorable rate than in a bank.

It's something to be aware of, but it doesn't give us as retail traders a huge advantage, it's more of an introduction to the topic. It is important for us to understand what the pros are thinking about, what they want and how they see the current context in the market. Retail traders should just admit that they are not trading well, their system does not give them any advantage over the market. I personally find it very funny to watch those who believe that their technical system makes any sense.... I often see them in casinos, spinning roulette.

I am not saying that fundamental analysis is the answer to all questions and the only correct approach, but with it you have a chance, unlike what 99% of retail traders do. It's time to rethink your approach. Even wonder if this topic will develop or not..... After all, it's not as interesting as drawing on a chart, so maybe only a few will catch the message.

A couple of last minute tips:1) Technical strategies don't work.2) Trading psychology is nonsense.3) Intraday trading without a good strategy does not work.

Good morning. Today I would like to touch upon such a problem as trading psychology. I have a completely different view of things than most people, I consider psychology to be a nonsense, because working on the table of ethereal problems within the framework of trading does not give us any advantage except for wasted time in the hope of changing ourselves, in the fight against ourselves.

Let's face it, you've probably heard that a trader must overcome his fear, greed, pity, FOMO and so on. You are also familiar with the excuse of “I have a good strategy but because of psychology I can not use it” or “I am in the process of learning and soon everything will work out”.... Most will agree with me after reading this post, or at least think about it, the main cause of “psychological problems” is neurophysiology and neurobiology that has developed during the process of human formation, we are living beings and we have our own feelings, emotions and we can not suppress or change it.

It is normal to experience such feelings in the market because this system is characterized by a high degree of uncertainty and the brain does not like uncertainty, just then there is a reaction “hit / run / freeze”, in response to the unknown. Many of you will say that you have a good working strategy and you understand the market.... But this is just a lie to yourself, you do not have a problem in psychology, there is no point in fighting yourself because you will definitely lose. Your main problem is that you don't know how the market works, you have no education and no strategy, just like all your gurus on youtube.

And as an afterthought... How did you learn about the problems in trading psychology? Most likely someone told you about it on the Internet, someone who is interested in selling you his stupid course or book. Only “psychologists” benefit from making you believe in psychology, if you want to do that, then do psychiatry, neurobiology and neurophysiology, not “psychology”. That's all for now.

In the course of my previous arguments you should have realized that trading on technical analysis, intraday trading and psychology is what 99% of people do and as a consequence they all lose.Now let's move on to something more interesting, market sentiment analysis. I realize that it's hard to change to a new way at once, so I start with something simpler, like sentiment analysis.

This type of analysis cannot be the main source of trading ideas and you will soon understand why. We will go over Retail Sentiment + COT report + Risk Sentiment.

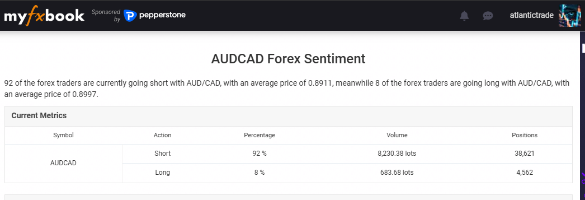

Retail sentiment - when amateur traders open their positions on the forex market with 70-80% probability they are wrong in the direction of instrument movement, which in turn gives a warning sign that opening positions together with amateurs is a way to lose your deposit. This indicator allows us to see what the crowd is set up for and what open positions it has. Unfortunately for many of you this indicator is only confirming and not leading, because we as professionals can not open trades based on what the crowd thinks, even against it, because the crowd can not think, they trade with the help of technical analysis and emotionally, hence the conclusion that any change of mood does not necessarily mean a change of fundamental trend.

I use the mood of retail traders as a very important confirmation of a less short-term trade, while medium-term trades do not necessarily need this confirmation as the focus shifts to macroeconomic factors.

In simple words, it is an indicator of the mood of the crowd, and it is absolutely real and objective, unlike "pseudo strategies". I still repeat that we as professionals should take it as a confirmation and not as a source of trading ideas, because the crowd is stupid and cannot give good ideas.

Just below you can see an example of AudCad we see that the crowd is shorting this currency pair and as we can see it is still growing, because the fundamental factors are in favor of strengthening the Australian dollar, but about this later. You get the point, we have to consider skews in the mood of the crowd from 70% and above. This is fashionably considered a good mood bias.

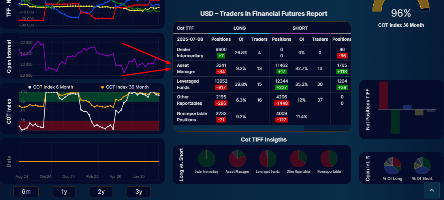

Now we'll touch on the COT report, these are futures market reports from hedge funds, banks and so on. For us traders, the benefit of this report is that we can see what positions the big players opened last week. This report is released every Friday for the past week, which means that this indicator is slightly delayed and can not be used for trading ideas, we as pros can not rely on delayed information, we must become the best out of best traders. This indicator is also a confirmation type for trading idea rather than the reason itself, it works very well in conjunction with the mood of retail traders.

There are only two types of COT reports that matter to us, large traders and asset managers, but I prefer to use the large traders report. I recommend you to familiarize yourself with this indicator. The idea is simple enough, who wouldn't want to know what the pros think being a trader with limited information?

The next topic, which is risk sentiment, is quite difficult in practical application because it requires real experience in trading fundamental analysis because the context is constantly changing. To put it simply, there are two risk on and risk off sentiments for big investors, when we say that we have risk on, it means that everything is stable in the world, there are no wars, crises and reasons to worry, which moves up risky assets such as AUD, GBP, NZD, CAD, Nasdaq, BTC.... Basically anything that is a risk asset. When we say risk off, it means that assets like USD, Gold, CHF, JPY, and sometimes EUR rise in value as a protective asset in times of wars and other crises.

Unfortunately for many of you the situation is not always clear-cut, so you need experience to be good at identifying risk sentiment, it is especially important to understand the current fundamental context, what the market is concerned about. For example, at the moment the war in the middle east has subsided, Trump again continues to pressure other countries with tariffs, but the conditions are quite mixed because despite the pressure of tariffs the US has again postponed their introduction until August and the market is not reacting so strongly to Trump's statements. That's why we're seeing growth in the stock market and risk assets. The situation is shaky but apparently the market doesn't care about Trump because he keeps rolling back real tariffs, but that doesn't mean it won't change and he'll wait until August. Considering what I told you, I think you should have realized that trading with the crowd is just stupid, you should be guided by what professional traders think about. Technical models without context are nonsense.

To summarize, this is important because most people don't think straight when it comes to learning something new because their brains have degenerated drawing lines and circles on a chart, just kidding.

You should have realized:1) Technical analysis alone doesn't work.2) Trading psychology is an excuse.3) Intraday trading is not desirable for most.4) 99.9% of social media trading gurus are frauds.5) Fundamental and quantitative analysis is the only answer.6) You need to separate yourself from the crowd to make money.7) By studying market sentiment and applying it to your trading you have taken the first significant step in the direction of learning fundamental analysis.

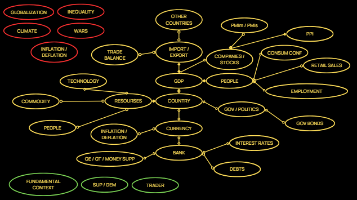

Now let's touch a little bit on economics and in general how everything works in reality, we will not go into details, we as traders need an advantage, concise and short but very useful.

We have a foreign exchange market, where people buy and sell currencies for their own interests to make money. Each country has its own currency that represents it, like a sports team on an economic battlefield. By the way, the American dollar is considered the strongest world currency, mostly all transactions are conducted in dollars, less often in euros and yen. Given that each currency represents a different country, we must also learn to evaluate the economy of that country, because traders make money on the distortions between the supply and demand of an asset. Fundamental analysis is clearly designed to find the objective value of an asset, as opposed to the subjective price of an asset. That is, understanding the real value of a currency gives us an advantage in understanding the prioritized direction. So by studying the fundamental context (what the market cares about, and the market is the big players) and macroeconomic indicators we get an objective picture and the position of forces. As you all know currencies are traded in pairs, for example Euro against American dollar, it means that we have to compare the value of this or that asset and understand whether there is a certain balance between supply and demand for a particular currency. In simple words demand grows when people want to possess something because they believe in the value of this asset and the less this asset is in circulation the higher the demand and lower the supply, the same is true only on the contrary for assets in which people believe much less because they believe that the value of this asset is falling and the supply is growing.

I am personally convinced that it is incredibly important for traders to understand how the law of supply and demand works.

In the currency market, the key indicator will be interest rates and decisions of the central bank, as it is the bank that controls the currency of the country. Next time we will touch in more detail on central bank actions and interest rates.

I forgot to talk about a couple of filters before we would move on to fundamental analysis.

First of all, the most important thing is the context, it is essentially formed by the market itself, i.e. the participants that matter. For example, the central bank, politicians, banks and so on. For example, at the moment the main context is focused on the US trade war with the rest of the world and the independence of the FED, which means that the PMI news or for example the expected decrease in the interest rate of any country is not important. Although in some other time frame it will matter. Simply put, it is what the market thinks that matters, not what you think.

Secondly, fundamental analysis is about the future, not about the past or present. It is about expectations about future prices, not about what is already known. You have no advantage in knowing what is already known, but in case of a surprise or the influence of certain data on the future prices, this will be the key to the correct use of fundamental analysis.

Fundamental analysis is about the present and the future at the same time, and it all depends on context.

I will try to explain as simply as possible how the Central Bank and interest rates work.

The central bank manages the country's money, it can make loans expensive or cheap by changing the interest rate. In fact, the central bank has two directions, either hawkish or dovish, tightening monetary policy or loosening monetary policy.

The central bank looks at economic data and based on the state of the domestic economy, the central bank will decide what to do with the interest rate. Let's say we have economic growth, i.e. the GDP of the country is growing, usually with economic growth, inflation is rising, which leads to higher prices, and if the economy overheats, the country can lose control over inflation, which will lead to hyper inflation and the collapse of the country. The central bank responds to rising inflation by raising interest rates so that credit becomes more expensive, thus cooling the economy and trying to control inflation. The same in reverse, if the economy is in decline and inflation is below 2% the central bank will lower interest rates to make credit cheaper and increase economic growth. In essence, the central bank is trying to balance the economic situation in the country so that the economy and the country are healthy. Therefore, for example, the forex market is not particularly volatile, as it is very liquid and no one needs a strong appreciation and depreciation of their domestic currency.

The interest rate is what the banks pay you if you deposit in a currency. For example, if the interest rate on the U.S. dollar is 4%, then if you invest in the dollar, you will get 4% per year. Interest rate differentials are important, but are not the key factor that will necessarily drive the price, there are a huge number of other factors that we cannot ignore.

For ease of understanding: If the central bank has raised interest rates or is about to do so, it is bullish for the currency. If the central bank has lowered or is about to lower the interest rate, it is bearish for the currency.It is beneficial for the exchange rate to have a good difference in interest rate differentials.

Unfortunately it can't be learned just by reading someone's book or article.....

When central banks make their statements, they always leave you with an idea of what they care about at the moment, which in turn forms the context in the market. If the central bank cares about inflation and the labor market, it will matter to all the other major participants, if it matters to the market, it should matter to you.

No one can cancel surprises about expectations. Let's say everyone was expecting the FED to cut the interest rate and they decided to leave it unchanged, that's a bullish scenario, a hawkish approach. Or for example at the meeting they made unexpected hawkish comments in favor of high rates, that's a bullish signal for the dollar.