Advertisement

Edit Your Comment

Technical & Fundamental Analysis by Sold ECN Securities

Jan 31, 2022 at 15:05

Dec 08, 2021 부터 멤버

게시물330

Apple Inc, stocks are in correction

Current trend

The price of the stocks of the global giant in the field of development and sale of personal and tablet computers Apple Inc. continues to trade in a corrective trend, being around 170.

Apple Inc. has very successfully started the new fiscal year 2022, demonstrating revenue of 123.9B dollars in Q1, which became an absolute record in the history of the company. This figure is 11% higher than the results of the same period a year earlier.

At the end of the quarter, the Board of Directors decided to send 0.22 dollars per share to the holders of its assets. The cut-off of the register of shareholders is scheduled for February 7, and the payment itself is scheduled for February 10, 2022. The estimated yield may be about 0.52% per annum, which is the average for the company.

Support and resistance

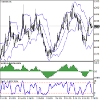

On the global chart of the asset, a global ascending channel continues to form, within which the price is located. Technical indicators are still in the state of a sell signal, which is beginning to weaken. The range of fluctuations of the EMA of the alligator indicator began to narrow, and the histogram of the AO oscillator, being below the zero line, formed the first ascending bar.

Resistance levels: 175, 182.

Support levels: 168, 158.

Solid ECN, a True ECN Broker

Feb 01, 2022 at 10:33

Dec 08, 2021 부터 멤버

게시물330

AUDUSD Market Forecast

RBA decision pushed quotes up

Current trend

The Australian currency shows stability against its main competitors, despite the decline against the US dollar last week. At the moment, AUDUSD is correcting upwards and is trading at around 0.7055 amid the decision of the Reserve Bank of Australia on a planned monetary policy adjustment.

The main interest rate was left at 0.10%, but the quantitative easing (QE) program will be completely terminated, and the last asset purchase under it is scheduled for February 10. Thus, the Australian regulator decided to follow the example of world financial regulators, despite the fact that the situation in the domestic economy is much better than in other countries. The updated forecast puts Australia's GDP growth at 4.25% over 2022 and inflation below 3.5%, even with high fuel prices and continued disruptions to supply chains.

The current trading week for the US currency began with a correction, which may intensify after the release of data on JOLTS Job Openings from the US Bureau of Labor Statistics. If the figures coincide with the analysts' forecast, which suggests a reduction to 10.300M from 10.552M a month earlier, this may have a negative impact on the dollar. In addition, traders should pay attention to Manufacturing PMI, which, according to forecasts, may decline from 58.7 to 57.5 points.

Support and resistance

On the global chart of the asset, the price is being traded within the downtrend. Technical indicators are in a sell signal state: fast EMAs on the Alligator indicator are below the signal line, and the AO oscillator histogram is trading in the sell zone.

Support levels: 0.6993, 0.6850.

Resistance levels: 0.7096, 0.7290.

Solid ECN, a True ECN Broker

Feb 01, 2022 at 10:49

Dec 08, 2021 부터 멤버

게시물330

Brent Crude Oil

Demand for oil exceeds supply

Current trend

Benchmark Brent Crude Oil prices continue their upward trend, having renewed the October 2014 high at $90 per barrel.

Tomorrow, a meeting of members of the Organization of Petroleum Exporting Countries will be held. Participants will hear a report with market development scenarios for the coming months, after which the Ministerial Monitoring Committee will make recommendations to OPEC+ countries. The parties are expected to consider the possibility of adjusting the production of "black gold" by 400K barrels and the impact of a new wave of the coronavirus epidemic on energy prices. Since October, the OPEC+ countries have been unable to reach the designated quota of 400K barrels, having increased production by only 260K barrels last December. Production in Saudi Arabia increased only to 9.93M barrels from 9.87M barrels, and in Iraq – to 4.27M barrels from 4.24M barrels. In Nigeria and Libya, the figure dropped to 1.34M against 1.42M barrels for Nigeria and 1.05M barrels against 1.14M barrels for Libya. According to preliminary data for January, Russia is also failing to meet its obligations to increase production, and in January, the country may fall behind the quota by 11%. Such a serious shortage of supply with ever-increasing demand has become the main reason for the sharp increase in asset quotes, and it is obvious that this trend will continue soon.

Support and resistance

The asset is growing within the framework of the global Expanding formation pattern. Technical indicators maintain a stable buy signal: indicator Alligator's EMA fluctuations range expands upwards, and the histogram of the AO oscillator forms bars with an upward trend in the buying zone.

Resistance levels: 90.08, 93.00.

Support levels: 87.88, 84.50.

Solid ECN, a True ECN Broker

Feb 01, 2022 at 12:02

Dec 08, 2021 부터 멤버

게시물330

Tesla Inc

Fourth-quarter results beat market expectations

The shares of Tesla Inc. are strengthening from the 3-month low of January 28, adding more than 18%. From a November 52-week high, the issuer fell by 24.5% but rose by 0.72% over the past week, while the S&P 500 index rose by 2.37%.

Last week, Q4 2021 earnings per share were released with earnings per share of $2.54, almost double last year's figure and well above the Wall Street experts' forecast of $2.34. Revenue rose by 65% YoY to $17.72B, also beating the market's forecast of $16.57B. In the current 2022, the corporation expects a 50% increase in revenue compared to 2021 to $75B, even if only the Freemont and Shanghai gigafactories work at full capacity (the planned production level is 3K electric vehicles per week).

Analysts at Swiss financial conglomerate Credit Suisse Group AG have upgraded Tesla Inc. from Neutral to Outperforming with an unchanged target price of $1,025. In a research note, the experts noted that the instrument has an attractive entry point after the recent sell-off.

Support and resistance

As part of the correction, the instrument renewed local lows and is consolidating. The key range is the area of 800.00–980.00. There is potential for further decline. Indicators reflect the strength of sellers: the price consolidated below MA (50) and MA (200); MACD histogram is in the negative zone. It is better to open the positions from the key levels.

Comparative analysis of the company's multipliers and companies-competitors in the industry indicates that the asset is overpriced.

Resistance levels: 980, 1050, 1115.

Support levels: 892, 800, 720.

Solid ECN, a True ECN Broker

Feb 01, 2022 at 14:27

Dec 08, 2021 부터 멤버

게시물330

NZDUSD

Fixing long positions is a catalyst for price correction

After reaching the main selling target in the area of 0.6540, NZDUSD is reversing into a correction with the target of 0.67 against the background of the weakening of the US dollar, which is falling from the high of 97.430 in the USD Index, reached last Friday, to the levels of 96.500-96.300 today. The negative trend is due to weak macroeconomic statistics published in the US on January 28.

Due to the difference in the monetary policy of the Reserve Bank of New Zealand and the US Federal Reserve, NZDUSD is likely to fall again with the target of 0.6400 after the correction.

Support and resistance

The long-term trend in NZD/USD is downward. Now a correction is being developed with the target of 0.6700, after reaching which it is worth considering new sales of the asset with the target at 0.6540, and in the case of breaking it down, the movement will continue to 0.6400. Traders should pay attention to the readings of the RSI indicator, which has generated a Divergence signal, which is a reversal pattern that suggests the development of a correction to a downtrend.

The mid-term trend is downward. Last week, traders broke through the target zone 3 (0.6648–0.6629). The next sell target is target zone 4 (0.6458–0.6439).

Resistance levels: 0.6700, 0.6864, 0.7055.

Support levels: 0.6540, 0.6400.

Solid ECN, a True ECN Broker

Feb 02, 2022 at 07:00

Dec 08, 2021 부터 멤버

게시물330

USDCAD, Elliot Wave Analysis

The pair may grow.

On the daily chart, a downward correction developed as the wave of the higher level 4, and the development of the fifth wave 5 started, within which the wave (1) of 5 forms. Now, the third wave of the lower level 3 of (1) is developing, within which the wave i of 3 has formed, a local correction has ended as the wave ii of 3, and the wave iii of 3 is developing. If the assumption is correct, the pair will grow to the levels of 1.3200–1.3410. In this scenario, critical stop loss level is 1.2446.

Solid ECN, a True ECN Broker

Feb 02, 2022 at 07:41

Dec 08, 2021 부터 멤버

게시물330

EURUSD

The euro develops a corrective impetus

Current trend

The instrument is moderately supported by the growing interest of investors in risky assets against the backdrop of discussions on the prospects for tightening monetary policy by the US Fed. At the moment, it is not clear whether the US regulator will decide on five or even more interest rate hikes this year, and whether the figure will be adjusted immediately by 50 basis points.

Bollinger Bands on the daily chart show a steady decline. The price range is narrowing, reflecting the emergence of multidirectional trading dynamics in the short term. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic shows an upward direction but is rapidly approaching its highs, which reflects the risks of overbought EUR in the ultra-short term.

Resistance levels: 1.1300, 1.1363, 1.1400, 1.1422.

Support levels: 1.1255, 1.1220, 1.1185, 1.1130.

Solid ECN, a True ECN Broker

Feb 02, 2022 at 07:57

Dec 08, 2021 부터 멤버

게시물330

EUR/USD

The European currency shows weak growth against the US dollar during the Asian session, developing the corrective momentum formed at the beginning of the week and updating the local highs from January 26. The instrument is moderately supported by the growing interest of investors in risky assets against the backdrop of discussions on the prospects for tightening monetary policy by the US Fed. At the moment, it is not clear whether the US regulator will decide on five or even more interest rate hikes this year, and whether the figure will be adjusted immediately by 50 basis points. The European Central Bank (ECB), in turn, relieved the markets of unnecessary expectations in advance, declaring its readiness to adjust existing parameters, focusing on the epidemiological situation caused by the spread of COVID-19, which is putting significant pressure on the region's economy. Macroeconomic statistics from Europe published on Tuesday turned out to be moderately optimistic. Investors reacted rather positively to the decline in the Unemployment Rate in Germany from 5.2% to 5.1%, while the Unemployment Change fell by 48K in January after a decrease of 29K a month earlier (expert forecasts assumed a change of only 6K).

GBP/USD

The British pound is trading with multidirectional dynamics against the US currency during the morning session, consolidating after a two-day rally, which brought the instrument to local highs on January 24. Significant support for the pound yesterday was provided by optimistic macroeconomic publications from the UK. Markit Manufacturing PMI in January rose from 56.9 to 57.3 points, while analysts did not expect any changes. Mortgage Approvals in December increased from 67.859K to 71.015K, which also turned out to be stronger than forecasts at the level of 66K. At the same time, Consumer Credit in December still slightly decreased from 0.999B to 0.831B pounds. Analysts had expected a decline to 0.80B pounds.

AUD/USD

The Australian dollar shows mixed trading dynamics against the US dollar during the Asian session. The instrument is consolidating near 0.7130 and is holding near the local highs of January 26. The development of "bullish" sentiment, in addition to the widespread weakening of the US currency across the spectrum of the market, was facilitated by the minutes of the meeting of the Reserve Bank of Australia (RBA) published yesterday. As expected, the Australian regulator left the interest rate unchanged at 0.10%, but at the same time announced the complete end of the quantitative easing (QE) program on February 10, which, however, does not mean the automatic launch of a rate increase cycle, since the regulator will continue to monitor the situation closely and respond accordingly. The overall positive picture was slightly spoiled only by the data on Retail Sales in Australia. In December, sales volumes fell by 4.4% after rising by 7.3% in November. Analysts expected a positive trend to remain at the level of 3.9%.

USD/JPY

The US dollar is showing a slight corrective growth against the Japanese yen in Asian trading, testing 114.80 for a breakout. The appearance of corrective dynamics is associated with the development of technical factors, while the fundamental background changes little. The macroeconomic statistics from the US published yesterday were ambiguous. ISM Manufacturing PMI in January fell from 58.8 to 57.6 points, which was better than market expectations by only 0.1 points. At the same time, ISM Manufacturing New Orders Index for the same period fell from 61 to 57.9 points with neutral investor forecasts. Markit Manufacturing PMI in January rose from 55 to 55.5 points, also ahead of analysts' neutral forecasts. Today, investors will be focused on the ADP Employment Change report, which precedes the publication of the final report on the labor market for January scheduled for Friday.

XAU/USD

Gold prices are falling during the Asian session, correcting after two days of growth and again trying to consolidate below the psychological level of 1800.00. The instrument, as before, is supported by geopolitical risks, as well as evidence of some slowdown in the global economic recovery. In turn, investors are counting on the beginning of a cycle of tightening monetary policy by the world's leading central banks. First of all, the US Federal Reserve is expected to raise the rate already during the March meeting, and now it is being actively discussed how large-scale the correction can be. However, the mood of investors was somewhat cooled by the Chairs of the Fed of San Francisco Mary Daly and the Fed of Philadelphia Patrick Harker, who said that there was no rush to raise the rate, and its sharp increase could be justified only in the event of a threatening rise in inflation.

The European currency shows weak growth against the US dollar during the Asian session, developing the corrective momentum formed at the beginning of the week and updating the local highs from January 26. The instrument is moderately supported by the growing interest of investors in risky assets against the backdrop of discussions on the prospects for tightening monetary policy by the US Fed. At the moment, it is not clear whether the US regulator will decide on five or even more interest rate hikes this year, and whether the figure will be adjusted immediately by 50 basis points. The European Central Bank (ECB), in turn, relieved the markets of unnecessary expectations in advance, declaring its readiness to adjust existing parameters, focusing on the epidemiological situation caused by the spread of COVID-19, which is putting significant pressure on the region's economy. Macroeconomic statistics from Europe published on Tuesday turned out to be moderately optimistic. Investors reacted rather positively to the decline in the Unemployment Rate in Germany from 5.2% to 5.1%, while the Unemployment Change fell by 48K in January after a decrease of 29K a month earlier (expert forecasts assumed a change of only 6K).

GBP/USD

The British pound is trading with multidirectional dynamics against the US currency during the morning session, consolidating after a two-day rally, which brought the instrument to local highs on January 24. Significant support for the pound yesterday was provided by optimistic macroeconomic publications from the UK. Markit Manufacturing PMI in January rose from 56.9 to 57.3 points, while analysts did not expect any changes. Mortgage Approvals in December increased from 67.859K to 71.015K, which also turned out to be stronger than forecasts at the level of 66K. At the same time, Consumer Credit in December still slightly decreased from 0.999B to 0.831B pounds. Analysts had expected a decline to 0.80B pounds.

AUD/USD

The Australian dollar shows mixed trading dynamics against the US dollar during the Asian session. The instrument is consolidating near 0.7130 and is holding near the local highs of January 26. The development of "bullish" sentiment, in addition to the widespread weakening of the US currency across the spectrum of the market, was facilitated by the minutes of the meeting of the Reserve Bank of Australia (RBA) published yesterday. As expected, the Australian regulator left the interest rate unchanged at 0.10%, but at the same time announced the complete end of the quantitative easing (QE) program on February 10, which, however, does not mean the automatic launch of a rate increase cycle, since the regulator will continue to monitor the situation closely and respond accordingly. The overall positive picture was slightly spoiled only by the data on Retail Sales in Australia. In December, sales volumes fell by 4.4% after rising by 7.3% in November. Analysts expected a positive trend to remain at the level of 3.9%.

USD/JPY

The US dollar is showing a slight corrective growth against the Japanese yen in Asian trading, testing 114.80 for a breakout. The appearance of corrective dynamics is associated with the development of technical factors, while the fundamental background changes little. The macroeconomic statistics from the US published yesterday were ambiguous. ISM Manufacturing PMI in January fell from 58.8 to 57.6 points, which was better than market expectations by only 0.1 points. At the same time, ISM Manufacturing New Orders Index for the same period fell from 61 to 57.9 points with neutral investor forecasts. Markit Manufacturing PMI in January rose from 55 to 55.5 points, also ahead of analysts' neutral forecasts. Today, investors will be focused on the ADP Employment Change report, which precedes the publication of the final report on the labor market for January scheduled for Friday.

XAU/USD

Gold prices are falling during the Asian session, correcting after two days of growth and again trying to consolidate below the psychological level of 1800.00. The instrument, as before, is supported by geopolitical risks, as well as evidence of some slowdown in the global economic recovery. In turn, investors are counting on the beginning of a cycle of tightening monetary policy by the world's leading central banks. First of all, the US Federal Reserve is expected to raise the rate already during the March meeting, and now it is being actively discussed how large-scale the correction can be. However, the mood of investors was somewhat cooled by the Chairs of the Fed of San Francisco Mary Daly and the Fed of Philadelphia Patrick Harker, who said that there was no rush to raise the rate, and its sharp increase could be justified only in the event of a threatening rise in inflation.

Solid ECN, a True ECN Broker

Feb 03, 2022 at 07:36

Dec 08, 2021 부터 멤버

게시물330

GBPUSD market update by Solid ECN

The market is waiting for the decision of the Bank of England

Current trend

The British pound is trading with a downtrend against the US currency during the morning session, retreating from the local highs of January 21, updated the day before.

Traders are in a hurry to fix their profits before today's publication of the decision of the Bank of England on the interest rate. Analysts' current forecasts suggest that the British regulator may raise the rate by 25 basis points to 0.5%, and the decision can be taken almost unanimously.

The UK economy is showing a fairly active recovery, and also did not undergo a noticeable weakening in Q4 2021 due to decisive actions by the government, which abandoned the practice of severe restrictions against the backdrop of the coronavirus pandemic. In addition, while the US Federal Reserve is only preparing for a possible rate hike in March, the Bank of England is already proactive. At the same time, further prospects for tightening monetary policy by the British regulator are not entirely clear.

Resistance levels: 1.36, 1.365, 1.37, 1.375.

Support levels: 1.3550, 1.35, 1.346, 1.3435.

Solid ECN, a True ECN Broker

Feb 03, 2022 at 08:15

Dec 08, 2021 부터 멤버

게시물330

Silver market update by Solid ECN

The metal prices are consolidating

Current trend

Silver prices show a mixed trend, hovering around 22.50. Market activity remains subdued as traders expect new price drivers to emerge. Today the European Central Bank (ECB) and the Bank of England will release their interest rate meeting minutes. At the moment, the ECB is not expected to make any changes in the vector of monetary policy, but the British regulator is likely to raise interest rates by 25 basis points.

Resistance levels: 22.7, 23, 23.37, 23.6.

Support levels: 22.4, 22, 21.39, 21.

Solid ECN, a True ECN Broker

Feb 03, 2022 at 11:14

Dec 08, 2021 부터 멤버

게시물330

EURUSD Technical and fundamentals by Solid ECN

The dynamics of the pair will be determined by the results of the ECB meeting

Current trend

This week, the European currency has been gaining in value and is currently trading around 1.13.

Earlier, positive dynamics was supported by data on inflation in the euro area and employment statistics in the USA, which, according to ADP, decreased by 301K in January instead of the expected growth of 207K (this reduction was the first in more than a year).

The pandemic caused by the COVID-19 Omicron strain has put serious pressure on all sectors of the economy, but, above all, on the hotel and tourism

Meanwhile, January inflation in the eurozone rose again. In addition, the Ukrainian crisis may affect the decision-making. In case of its negative development, there will be a threat of interruptions in energy supplies to the EU, and in these conditions it is impractical to reduce economic incentives. Thus, now the market is waiting for the outcome of the ECB meeting, not counting on serious actions by the regulator.

Resistance levels: 1.132, 1.141, 1.1475.

Support levels: 1.123, 1.1145, 1.099.

Solid ECN, a True ECN Broker

Feb 03, 2022 at 13:45

Dec 08, 2021 부터 멤버

게시물330

Meta Platforms Inc

Trading within the global sideways channel

The stocks of Meta Platforms Inc., which owns the largest social network in the world, move within a corrective trend, trading around $322 per share.

Yesterday, the company released its fourth-quarter and full-year 2021 financial results, which met ambiguous reactions from investors. Total revenue for the quarter was $33.671B, up 20% from $28.072B a year earlier.

Thus, despite the growth in income indicators, the most important parameters of revenue and EPS were worse than expected, which could lead to a significant drop in the company's shares today.

The price moves within a global sideways channel, falling within the local trend. Technical indicators keep a sell signal. Fast EMAs of the Alligator indicator are below the signal line, while the histogram of the AO oscillator remains in the sell zone.

Resistance levels: 337, 357.

Support levels: 310, 260.

Solid ECN, a True ECN Broker

Feb 04, 2022 at 07:20

Dec 08, 2021 부터 멤버

게시물330

EURUSD

The euro updates local highs

The day before, the single currency showed its most active growth over the past few months, reacting positively to the results of the meeting of the European Central Bank (ECB) on monetary policy. As expected, the regulator left the interest rate at 0% and the deposit rate was kept at -0.5%. Investors expect the program to end completely by the end of March. However, the ECB intends to reinvest proceeds from redeemable bonds under the PEPP until at least the end of 2024.

At the follow-up press conference, ECB President Christine Lagarde also focused on inflationary risks that are pushing officials towards a more "hawkish" stance. However, the regulator still expects that consumer price growth will slow down to the target level of 2% by the end of the year, and therefore the issue of raising the rate is not on the agenda.

Support and resistance

Resistance levels: 1.15, 1.1534, 1.1572, 1.16.

Support levels: 1.1433, 1.14, 1.1363, 1.13.

Solid ECN, a True ECN Broker

Feb 04, 2022 at 09:07

Dec 08, 2021 부터 멤버

게시물330

NZDUSD

Rising amid strong demand for risky assets

The macroeconomic statistics from the USA, published on Thursday, were ambiguous. Thus, Initial Jobless Claims for the week of January 28 decreased from 261K to 238K, better than market forecasts of a fall to 245K. Markit Service PMI was also positive, rising from 50.9 to 51.2 points for January, exceeding the neutral forecasts. In turn, ISM Service PMI for the same period fell from 62.3 to 59.9 points, which was slightly better than investors' expectations of 59.5 points. Traders were also disappointed by the volume of industrial orders, which fell by 0.4% for December after rising by 1.8% in the previous period. Analysts had expected a decline of 0.2%.

On the daily chart, Bollinger Bands are steadily declining. The price range is narrowing from below, reflecting the emergence of flat trading dynamics in the short term. The MACD indicator grows, keeping a strong buy signal (the histogram is above the signal line). Stochastic shows similar dynamics, approaching its highs, which indicates that NZD may become overbought in the ultra-short term.

Resistance levels: 0.67, 0.6732, 0.6761, 0.68.

Support levels: 0.665, 0.66, 0.6528, 0.60.

Solid ECN, a True ECN Broker

Feb 04, 2022 at 10:24

Dec 08, 2021 부터 멤버

게시물330

USDCAD

The pair is waiting for new drivers

The US dollar shows ambiguous dynamics of trading against the Canadian currency during today's Asian session, consolidating near 1.268. Market activity remains rather restrained, as investors are in no hurry to open new positions ahead of the publication of the labor market reports in the US and Canada.

Current forecasts for both countries are quite negative, but Canadian data stand out in this regard: among other things, investors expect the Unemployment Rate to rise from 5.9% to 6.2%. Net Change in Employment in Canada in January may decrease by 117.5K after rising by 54.7K in December.

In the US, investors are expecting modest growth in Nonfarm Payrolls of about 150K after rising 200K a month earlier. In addition, traders will focus on the statistics on the Average Hourly Earnings, which in January may reach 5.2% in annual terms after rising by 4.7% in December.

Resistance levels: 1.27, 1.2746, 1.2812, 1.29.

Support levels: 1.265, 1.26, 1.2558, 1.25.

Solid ECN, a True ECN Broker

Feb 04, 2022 at 11:21

Dec 08, 2021 부터 멤버

게시물330

USDCAD

The pair is waiting for new drivers

The US dollar shows ambiguous dynamics of trading against the Canadian currency during today's Asian session, consolidating near 1.268. Market activity remains rather restrained, as investors are in no hurry to open new positions ahead of the publication of the labor market reports in the US and Canada.

Current forecasts for both countries are quite negative, but Canadian data stand out in this regard: among other things, investors expect the Unemployment Rate to rise from 5.9% to 6.2%. Net Change in Employment in Canada in January may decrease by 117.5K after rising by 54.7K in December.

In the US, investors are expecting modest growth in Nonfarm Payrolls of about 150K after rising 200K a month earlier. In addition, traders will focus on the statistics on the Average Hourly Earnings, which in January may reach 5.2% in annual terms after rising by 4.7% in December.

Resistance levels: 1.27, 1.2746, 1.2812, 1.29.

Support levels: 1.265, 1.26, 1.2558, 1.25.

Solid ECN, a True ECN Broker

Feb 04, 2022 at 13:27

Dec 08, 2021 부터 멤버

게시물330

AUDUSD

Australian currency shows neutrality

The Australian currency is showing neutral trading dynamics due to ambiguous macroeconomic statistics, being currently around 0.715.

On the one hand, the position of the AUDUSD pair was strengthened by the report on building permits, the number of which increased by 8.2%.

On the global chart, the price moves within a long downtrend. Technical indicators are in the state of a weakening sell signal: indicator Alligator’s EMA fluctuations range narrows actively, and the AO histogram forms rising bars in the sell zone.

Resistance levels: 0.7182, 0.7315.

Support levels: 0.7100, 0.6991.

Solid ECN, a True ECN Broker

Jul 23, 2020 부터 멤버

게시물816

Feb 07, 2022 at 10:05

Dec 08, 2021 부터 멤버

게시물330

Gold market update by Solid ECN Securities

Trading participants reduce positions in gold

The development of the global sideways range of 1850–1730 in the gold continues, and the quotes are once again holding slightly above the key level of $1,800 per ounce.

There are no serious prerequisites for the growth of the asset yet, but there are not so many pressure factors either. The situation may change only in March during the meeting of the US Federal Reserve when the regulator's decision to raise the interest rate will be announced. To this point, traders should focus on the US dollar index and investment demand. Currently, the USD Index consolidates at the level of 95.5 after one of the most dynamic falls in recent years, which led to the current upward correction in gold. However, the observed dynamics have little prospects for further development in light of Friday's positive employment report in the US.

Support and resistance

On the daily chart, the price moves within the global sideways channel, correcting towards the resistance line. Technical indicators maintain a sell signal.

Fast EMAs on the Alligator indicator are below the signal line, and the AO oscillator histogram has moved into the sell zone and is forming local rising bars.

Resistance levels: 1830, 1870.

Support levels: 1790, 1720.

Trading participants reduce positions in gold

The development of the global sideways range of 1850–1730 in the gold continues, and the quotes are once again holding slightly above the key level of $1,800 per ounce.

There are no serious prerequisites for the growth of the asset yet, but there are not so many pressure factors either. The situation may change only in March during the meeting of the US Federal Reserve when the regulator's decision to raise the interest rate will be announced. To this point, traders should focus on the US dollar index and investment demand. Currently, the USD Index consolidates at the level of 95.5 after one of the most dynamic falls in recent years, which led to the current upward correction in gold. However, the observed dynamics have little prospects for further development in light of Friday's positive employment report in the US.

Support and resistance

On the daily chart, the price moves within the global sideways channel, correcting towards the resistance line. Technical indicators maintain a sell signal.

Fast EMAs on the Alligator indicator are below the signal line, and the AO oscillator histogram has moved into the sell zone and is forming local rising bars.

Resistance levels: 1830, 1870.

Support levels: 1790, 1720.

Solid ECN, a True ECN Broker

Feb 07, 2022 at 10:05

Dec 08, 2021 부터 멤버

게시물330

LyudmilLukanov posted:

These two are important for different reasons depending on the investor and trader.

Thank you for engaging in this topic @LyudmilLukanov

Solid ECN, a True ECN Broker

*상업적 사용 및 스팸은 허용되지 않으며 계정이 해지될 수 있습니다.

팁: 이미지/유튜브 URL을 게시하면 게시물에 자동으로 삽입됩니다!

팁: @기호를 입력하여 이 토론에 참여하는 사용자 이름을 자동으로 완성합니다.