Advertisement

Edit Your Comment

What's the best way to trade Martingale Forex Trading

Nov 21, 2011 부터 멤버

게시물1601

Mar 29, 2015 at 14:50

(편집됨 Mar 29, 2015 at 14:51)

Nov 21, 2011 부터 멤버

게시물1601

Scalping101 posted:

Trader A has a 1:1 ratio risk 100 to get 100

Trader B has a 1:1 ratio risk 10 to get 10

Also, in your exemple with see that you ignore what I tried to describe.

Why do you limit Risk/Reward to 1/1 ???

what about a smart trader C (CrazyTrader : ) ) that has a 1:10 ratio risk 10 to get 100

why when we talk about martingale, views are locked into "casino" reward? this is stereotype. Look outside the box.

forex_trader_202879

Aug 07, 2014 부터 멤버

게시물378

Mar 29, 2015 at 15:01

Aug 07, 2014 부터 멤버

게시물378

CrazyTrader posted:Scalping101 posted:

Trader A has a 1:1 ratio risk 100 to get 100

Trader B has a 1:1 ratio risk 10 to get 10

Also, in your exemple with see that you ignore what I tried to describe.

Why do you limit Risk/Reward to 1/1 ???

what about a smart trader C (CrazyTrader : ) ) that has a 1:10 ratio risk 10 to get 100

why when we talk about martingale, views are locked into "casino" reward? this is stereotype. Look outside the box.

He is ignoring what you are trying to say, because that isn't what martingale is.... Martingale is only a "recovery system". Meaning you only place increasing lots to cover the lost you just experienced. Martingale is locked into casino reward because that is where it is derived from. You live in a bubble world which of course made of fairytales, and when you had a chance to trade with us in the live world YOU BLEW IT!

Nov 21, 2011 부터 멤버

게시물1601

Mar 29, 2015 at 15:42

(편집됨 Mar 29, 2015 at 15:43)

Nov 21, 2011 부터 멤버

게시물1601

Cholipop posted:

He is ignoring what you are trying to say, because that isn't what martingale is.... Martingale is only a "recovery system". Meaning you only place increasing lots to cover the lost you just experienced. Martingale is locked into casino reward because that is where it is derived from. You live in a bubble world which of course made of fairytales, and when you had a chance to trade with us in the live world YOU BLEW IT!

OMG the noob is back.

You are so useless man... you just said a martingale is a recovering system. Once more you are blind, and you can't understand my point... but lol, I'm not surprised at all... we are used to it.

No one says that martingale must be used like in casion like risk/reward 1:1... but you all do this way... haha.

Jun 28, 2011 부터 멤버

게시물444

Mar 30, 2015 at 00:11

Jun 28, 2011 부터 멤버

게시물444

Another way to do a martingale would be to double the range size instead of the lot size. You would decide whether to buy or sell by finding the center price and buying below it and selling above. Just increase the lot size by 1. In other words we start with .01 lots then .02, .03, .04, ... until we win and then start over. While our range size (range = open - stop-loss) starts at 10 pips then doubles to 20 pips, 40, 80 ... pips. This will slow down the trades when the price is going against us but give a better return shorting the range size when the price is going in our favor.

Doing it this way does involve the martingale as part of the system, to some extent.

Bob

Doing it this way does involve the martingale as part of the system, to some extent.

Bob

where research touches lives.

Nov 21, 2011 부터 멤버

게시물1601

Mar 30, 2015 at 07:23

Nov 21, 2011 부터 멤버

게시물1601

ForexAssistant posted:

Another way to do a martingale would be to double the range size instead of the lot size. You would decide whether to buy or sell by finding the center price and buying below it and selling above. Just increase the lot size by 1. In other words we start with .01 lots then .02, .03, .04, ... until we win and then start over. While our range size (range = open - stop-loss) starts at 10 pips then doubles to 20 pips, 40, 80 ... pips. This will slow down the trades when the price is going against us but give a better return shorting the range size when the price is going in our favor.

Doing it this way does involve the martingale as part of the system, to some extent.

Bob

Glad to see that someone is able to get my whole idea. Except that my stop Loss won't change, otherwise this will have a bad effect on cumulative loss.

If you have a very good strategy to allow accurate Pip-Drawdown (Entry accurancy), then you don't need to take futher risk by increasing StopLoss...as the strategy will work sooner than later.

I see you have added the account to your watchlist and I will post back here in few time, and we will see how the account goes wild. : )

Nov 21, 2011 부터 멤버

게시물1601

Mar 30, 2015 at 08:08

(편집됨 Mar 30, 2015 at 08:09)

Nov 21, 2011 부터 멤버

게시물1601

Cholipop posted:

Sounds great in theory

Lol, the scammer had no choice to admit the power of my martingale view

Cholipop posted:

until you actually use it in real life

Seems that you are the only who still doesn't know how to use FX Blue

Cholipop posted:

and end up burning the account.

Don't wish too much... you have some serious ill/mathematics problem, explain to the world how you blow an account with 10 pips SL?

Anyway you have been suspended for a couple of weeks... if this wasn't enough for you I will make sure next you get banned for ever.

Oct 11, 2013 부터 멤버

게시물769

Mar 30, 2015 at 10:27

Oct 11, 2013 부터 멤버

게시물769

Martingale can be used as a recovery system or a just a managing system if you know how to use it. I know traders that use martingale succesfully, but they are aware that the capital in their account is not infinte and they use capital % based stop losses to close all their trades. For example, you decide to use martingale, but you also decide not to lose more than 40% or 50% of your account. The distribution of your entries is a different story, and that's where the thinking begins.But dont get me wrong, martingale does require a relatively large account and you must be willing to lose big.

Nov 21, 2011 부터 멤버

게시물1601

Mar 30, 2015 at 11:12

Dec 12, 2014 부터 멤버

게시물109

CrazyTrader posted:Cholipop posted:

Sounds great in theory

Lol, the scammer had no choice to admit the power of my martingale viewCholipop posted:

until you actually use it in real life

Seems that you are the only who still doesn't know how to use FX BlueCholipop posted:

and end up burning the account.

Don't wish too much... you have some serious ill/mathematics problem, explain to the world how you blow an account with 10 pips SL?

Anyway you have been suspended for a couple of weeks... if this wasn't enough for you I will make sure next you get banned for ever.

Considering your trading results that are worst than random.

Losing 10 pips would be about 10X more likely than getting 100. Thats if you improve youre trading to random - you are not there yet.

and series of about 13 losing trades will wipe your account (size of chance of your life )dummy.

You think you discovered again something new and smart.

but again, its just a gambler fallacy, next to your chartists illusion.

Get investors and get paid 15 percent of theyr profits. More on my website.

forex_trader_202879

Aug 07, 2014 부터 멤버

게시물378

Mar 30, 2015 at 11:17

Aug 07, 2014 부터 멤버

게시물378

CrazyTrader posted:

No, this is what I try to demonstrate, martingale is a very powerfull tool for exponential profit combined with extremely low risk.

Give me 2 months time... so I have something to show.

Please demonstrate it in a LIVE account. I wonder why you didn't use martingale with that account called "chance of my life". lmao All in all in theory it "works", but once you go live it seems to never work out as planned. Please crazytrader, upload a real account, even if it is for 100 usd and show us how it is done.

forex_trader_202879

Aug 07, 2014 부터 멤버

게시물378

Mar 30, 2015 at 11:17

Aug 07, 2014 부터 멤버

게시물378

alexforex007 posted:

Martingale can be used as a recovery system or a just a managing system if you know how to use it. I know traders that use martingale succesfully, but they are aware that the capital in their account is not infinte and they use capital % based stop losses to close all their trades. For example, you decide to use martingale, but you also decide not to lose more than 40% or 50% of your account. The distribution of your entries is a different story, and that's where the thinking begins.But dont get me wrong, martingale does require a relatively large account and you must be willing to lose big.

Excellent point... The distribution of the % of your lots using martingale is another key factor. It all goes back to the system you are actually using.

Nov 21, 2011 부터 멤버

게시물1601

Mar 30, 2015 at 12:08

Nov 21, 2011 부터 멤버

게시물1601

togr posted:

Martingale is not trading system. It does not tell you when to enter the trade.

It is just money management system telling you to increase trade size when equity decreases. That's risky though.

No one is saying that Martingale is a trading system.

As for a money management, I don't like martingale as it is very risky... therefore not appropriate for money management.

The way I define martingale isn't risky, because I use very tight SL and that lotsize is increased when capital decreases, not equity, which is SO DIFFERENT.

I really wonder why I give this tricks to you guys.... and it's not my fault if you can't see how to use it. I have taken the time to explained it enough.

Nov 21, 2011 부터 멤버

게시물1601

Nov 21, 2011 부터 멤버

게시물1601

Jun 28, 2011 부터 멤버

게시물444

Mar 30, 2015 at 12:57

Jun 28, 2011 부터 멤버

게시물444

I don't need to comment on a martingale anything, as the martingale will stand or fall on its own but I will have to side with CrazyTrader on showing live accounts on an open web, you are just begging for problems. In the States there is a company that helps protect against identity theft. To sell his service the own put his social security number on the side of a truck with his advertisement for lifelock.

Not only did his bank accounts get hacked but so did his business. He didn't have so much money that it got hackers interested in him, it was just his brazen claims of being safe. Needless to say, he doesn't do that anymore. Traders manage risk, you can't avoid it and even the best traders have bad days but you are not managing risk by putting information from your live account out there where you can get someone interested in what you have.

As a trader you have to control your emotions, so if I say to you that since you are using a demo account your information or opinions don't count. Does that put more money in your bank account? Does it take money away? No, then what doesn't count is my opinion. Don't let your emotions get in the way of your logic. I don't show live accounts and never will. If someone doesn't want to try out a no loss trading system because it isn't shown on a live account, that person is stupid and should not be trading in the first place.

By the way, this too is my opinion and you don't have to listen to any of this either if it doesn't make rational sense to you.

Bob

Not only did his bank accounts get hacked but so did his business. He didn't have so much money that it got hackers interested in him, it was just his brazen claims of being safe. Needless to say, he doesn't do that anymore. Traders manage risk, you can't avoid it and even the best traders have bad days but you are not managing risk by putting information from your live account out there where you can get someone interested in what you have.

As a trader you have to control your emotions, so if I say to you that since you are using a demo account your information or opinions don't count. Does that put more money in your bank account? Does it take money away? No, then what doesn't count is my opinion. Don't let your emotions get in the way of your logic. I don't show live accounts and never will. If someone doesn't want to try out a no loss trading system because it isn't shown on a live account, that person is stupid and should not be trading in the first place.

By the way, this too is my opinion and you don't have to listen to any of this either if it doesn't make rational sense to you.

Bob

where research touches lives.

Nov 21, 2011 부터 멤버

게시물1601

Mar 30, 2015 at 13:02

Nov 21, 2011 부터 멤버

게시물1601

mavericks posted:

Thats if you improve youre trading to random - you are not there yet.

yeah my performance are visible and still update every 5 minutes.

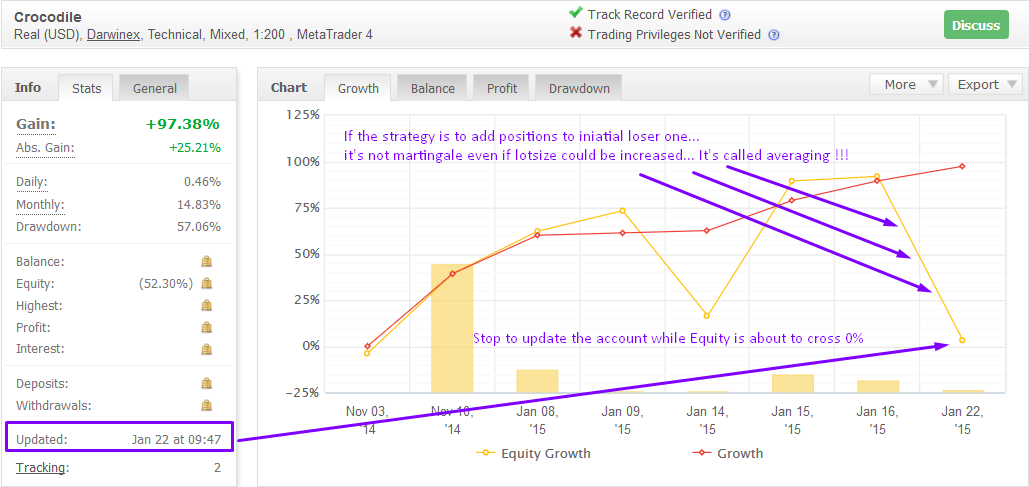

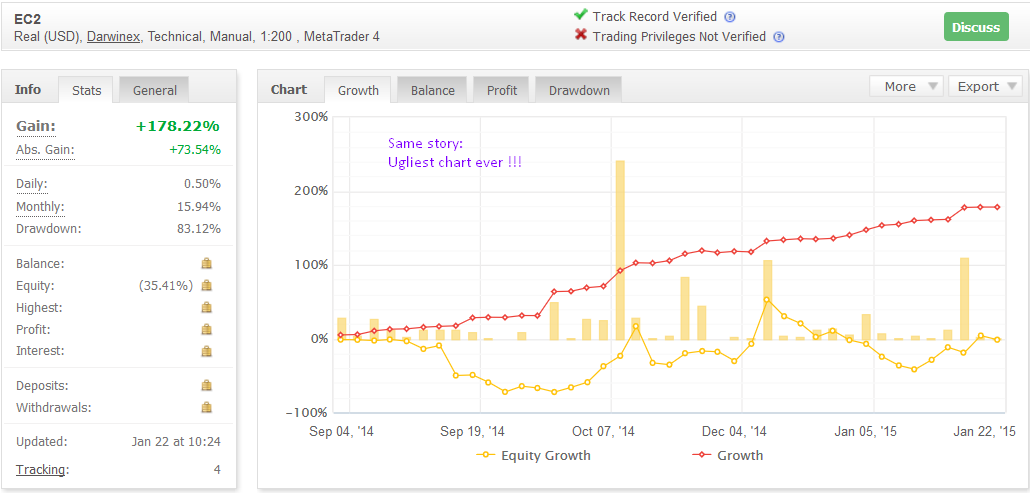

Let's talk about yours, it will be very good example for you guys to understand the difference between martingale vs Averaging:

Ps: Who needs to learn to trade???

Nov 21, 2011 부터 멤버

게시물1601

Mar 30, 2015 at 13:10

Nov 21, 2011 부터 멤버

게시물1601

ForexAssistant posted:

I don't need to comment on a martingale anything, as the martingale will stand or fall on its own but I will have to side with CrazyTrader on showing live accounts on an open web, you are just begging for problems. In the States there is a company that helps protect against identity theft. To sell his service the own put his social security number on the side of a truck with his advertisement for lifelock.

Not only did his bank accounts get hacked but so did his business. He didn't have so much money that it got hackers interested in him, it was just his brazen claims of being safe. Needless to say, he doesn't do that anymore. Traders manage risk, you can't avoid it and even the best traders have bad days but you are not managing risk by putting information from your live account out there where you can get someone interested in what you have.

As a trader you have to control your emotions, so if I say to you that since you are using a demo account your information or opinions don't count. Does that put more money in your bank account? Does it take money away? No, then what doesn't count is my opinion. Don't let your emotions get in the way of your logic. I don't show live accounts and never will. If someone doesn't want to try out a no loss trading system because it isn't shown on a live account, that person is stupid and should not be trading in the first place.

By the way, this too is my opinion and you don't have to listen to any of this either if it doesn't make rational sense to you.

Bob

In 2 words.... "wise man"

Nov 21, 2011 부터 멤버

게시물1601

Mar 30, 2015 at 13:34

(편집됨 Mar 30, 2015 at 13:35)

Nov 21, 2011 부터 멤버

게시물1601

mavericks posted:

Losing 10 pips would be about 10X more likely than getting 100

You are really so dumb that you can't get smart enough to get the whole logic.

Deposit: $1000

Attempt 1 => Losing $10

Attempt 2 => Losing $20

Attempt 3 => Losing $30

Attempt 4 => Losing $40

Attempt 5 => Losing $50

Attempt 6 => Losing $60

Attempt 7 => Losing $70

Attempt 8 => Losing $80

Attempt 9 => Losing $90

Attempt 10 => Winning $1000

Total gain: 1000 - (10 + 20 + 30 + 40 + 50 + 60 + 70 + 80 + 90) = $ 550

So fucking noob... does it matter to get 10 times more chance to hit SL rather TP as you make 55% in 1 trade???

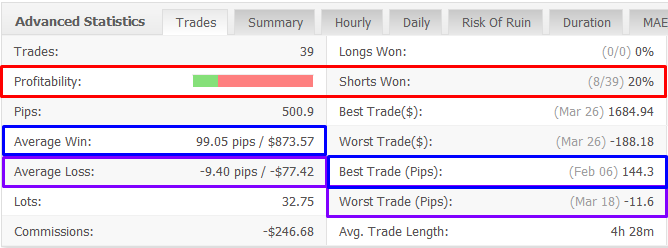

All you need for this is a strategy like this one:

*상업적 사용 및 스팸은 허용되지 않으며 계정이 해지될 수 있습니다.

팁: 이미지/유튜브 URL을 게시하면 게시물에 자동으로 삽입됩니다!

팁: @기호를 입력하여 이 토론에 참여하는 사용자 이름을 자동으로 완성합니다.