Edit Your Comment

How accurate is the sentiment indicator?

Oct 02, 2019 부터 멤버

게시물2

Mar 27, 2024 at 17:46

Oct 02, 2019 부터 멤버

게시물2

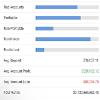

This is supposedly based on “verified, real accounts only” but these stats just don’t seem plausible at all. No way there are twice as many winning traders as losing traders and the average account size is 6 figures.

How are these stats actually being generated? Can someone explain?

How are these stats actually being generated? Can someone explain?

Those who can't do...teach

Jul 19, 2024 부터 멤버

게시물2

Jul 19, 2024 at 19:37

Jul 19, 2024 부터 멤버

게시물2

Factors such as sample size, diversity of participants, and transparency in data collection can influence the accuracy of sentiment indicators. Additionally, sentiment indicators should be interpreted alongside other technical and fundamental analyses for a comprehensive understanding of market sentiment.

Jul 24, 2024 at 18:13

Feb 12, 2016 부터 멤버

게시물133

Sentiment indicators provide insights into the overall mood or positioning of market participants, which can be useful for gauging potential market direction. However, their accuracy is limited as they reflect collective sentiment rather than predict precise price movements. While sentiment indicators can highlight extreme bullish or bearish positions, they should be used in conjunction with other forms of analysis to make well-rounded trading decisions.

Sep 21, 2019 부터 멤버

게시물8

Aug 01, 2024 at 13:03

Sep 21, 2019 부터 멤버

게시물8

hi there

these stats are often based on selective data from a subset of traders or accounts, which can skew the results. they might not reflect the broader trading community and can be influenced by promotional or biased reporting methods.

these stats are often based on selective data from a subset of traders or accounts, which can skew the results. they might not reflect the broader trading community and can be influenced by promotional or biased reporting methods.

Wallstreet Money

Dec 05, 2024 at 11:32

Dec 02, 2024 부터 멤버

게시물75

Nutty32 posted:

Sentiment tools can help to being on the correct side of the market. They can't be used for timing. Use stop entry orders and wait for market to start moving in the direction of the sentiment reading.

You’re right. Sentiment tools are great for analyzing the general mood of the market but here, timing is everything. Waiting for confirmation using stop-entry orders is a good tactic.

Dec 06, 2024 at 05:15

Oct 16, 2024 부터 멤버

게시물26

JPInvestments posted:

This is supposedly based on “verified, real accounts only” but these stats just don’t seem plausible at all. No way there are twice as many winning traders as losing traders and the average account size is 6 figures.

How are these stats actually being generated? Can someone explain?

You’ve got a valid point! It does sound a bit too good to be true. Sometimes brokers highlight a specific subset of accounts (like pros or high-net-worth clients) to skew stats. Also, “winning traders” could just mean those with a slight profit, not necessarily consistent big gains.

Dec 07, 2024 at 14:20

Feb 12, 2016 부터 멤버

게시물133

JPInvestments posted:

This is supposedly based on “verified, real accounts only” but these stats just don’t seem plausible at all. No way there are twice as many winning traders as losing traders and the average account size is 6 figures.

How are these stats actually being generated? Can someone explain?

Just imagine how small is this fraction of the market and how changes in sentiment of this fraction can affect market prices.. maybe during some highly illiquid price but still hardly feasible to make profit using this data somehow. Useless for me, some fancy stuff tbh

May 08, 2023 부터 멤버

게시물97

Oct 02, 2019 부터 멤버

게시물2

Dec 18, 2024 at 19:09

Oct 02, 2019 부터 멤버

게시물2

Ethanishere posted:

No way those statistics are correct, the average deposit of $70k? Whose average is that, George Soros?

One of the only non bot replies in here. That's exactly what I'm saying. According to the sentiment indicator there are nearly 3x more winners than losers and the average winner is up 300k while the average loser is down 50k? Come on these stats are so outrageously fabricated its not plausible whatsoever. Obviously 99% of accounts are losers and the average deposit prob isn't even $100. To make matter worse, myfxbook is charging for a subscription for a supposedly better version of this tool. This is such a scam and needs to be exposed.

Those who can't do...teach

Dec 19, 2024 at 06:32

Dec 09, 2024 부터 멤버

게시물136

Brick_56 posted:

Not always accurate since it depends on market's mood and nature. the chance of switch can cause the change in sentiment which will affect badly in your trading performance.

So true! Market sentiment can change fast, and it can really impact trades. How do you manage sudden shifts in mood?

Dec 20, 2024 at 06:28

Oct 16, 2024 부터 멤버

게시물23

Daniel424 posted:

What I know is, sentiment indicators can give you some good insight, but they’re not always spot on, especially when markets are moving fast.

Honestly, I have found sentiment indicators to be pretty useful. Even in fast markets. If paired with other tools, they can still give solid insights—just gotta know how to interpret them quickly

Jul 25, 2024 부터 멤버

게시물18

*상업적 사용 및 스팸은 허용되지 않으며 계정이 해지될 수 있습니다.

팁: 이미지/유튜브 URL을 게시하면 게시물에 자동으로 삽입됩니다!

팁: @기호를 입력하여 이 토론에 참여하는 사용자 이름을 자동으로 완성합니다.