Advertisement

Edit Your Comment

Query about "Gap of pips from market price for ny modification on open orders"

Apr 13, 2018 부터 멤버

게시물40

Jul 24, 2020 at 05:29

Apr 13, 2018 부터 멤버

게시물40

There is a minimum gap in pips that must be maintained from market price for setting SL or TP. The same gap is minimum difference from market price for setting trailing stops and pending orders.

Firstly what is that gap called ???

Secondly how is it calculated or set by brokers ? does it vary from broker to broker like spreads.?? Is it calculated with ATR or something ??? and does it change with changes in market volatility? and any more facts about this gap.?

I haven't been able to google anything related as i dont know what to call that gap.

Firstly what is that gap called ???

Secondly how is it calculated or set by brokers ? does it vary from broker to broker like spreads.?? Is it calculated with ATR or something ??? and does it change with changes in market volatility? and any more facts about this gap.?

I haven't been able to google anything related as i dont know what to call that gap.

Indicators are so deceiving, always lagging. Trend lines & Calendars are the best.

Aug 20, 2009 부터 멤버

게시물256

Jul 24, 2020 at 06:08

Aug 20, 2009 부터 멤버

게시물256

Hi,

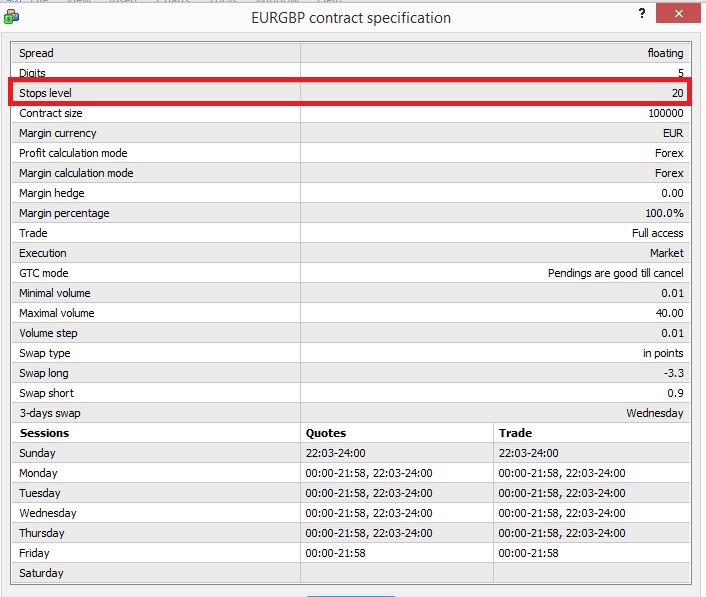

It's called stop level and it differs from broker to broker as well as from instrument to instrument.

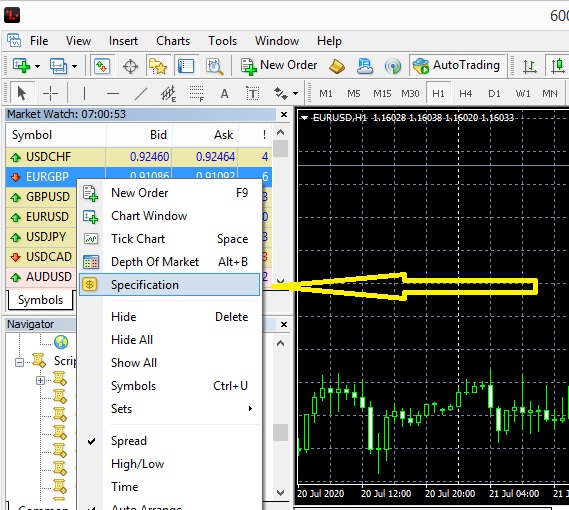

You can find the exact specification in MT4 by right-clicking on the instrument in the market watch window. See attached screenshot.

Select "Specification" from the context menu that appears and a box will appear showing all the contract specifications, including the stop level. See second screenshot.

It's called stop level and it differs from broker to broker as well as from instrument to instrument.

You can find the exact specification in MT4 by right-clicking on the instrument in the market watch window. See attached screenshot.

Select "Specification" from the context menu that appears and a box will appear showing all the contract specifications, including the stop level. See second screenshot.

Wealth Creation Through Technology

Aug 20, 2009 부터 멤버

게시물256

Jul 24, 2020 at 06:14

Aug 20, 2009 부터 멤버

게시물256

I don't know where brokers get it from, but I am not aware that it changes but I suppose it is possible. It is presumably a function of the volatility of the instrument involved. I'm sure if you just browse your brokers, you will find any TRY pair would have a relatively large stop level.

I generally avoid brokers that have stop levels greater than zero on something like EURUSD because to my mind it says that they have issues executing you trades. But I would be more understanding if they have a stop level on the EURTRY, for example. This is anecdotal evidence however.....I can't point you in the direction of anything useful in this regard.....just experience.

I generally avoid brokers that have stop levels greater than zero on something like EURUSD because to my mind it says that they have issues executing you trades. But I would be more understanding if they have a stop level on the EURTRY, for example. This is anecdotal evidence however.....I can't point you in the direction of anything useful in this regard.....just experience.

Wealth Creation Through Technology

Apr 13, 2018 부터 멤버

게시물40

Jul 24, 2020 at 16:58

Apr 13, 2018 부터 멤버

게시물40

@compuforexpamm Wow...that was so informative. TYSM.

Indicators are so deceiving, always lagging. Trend lines & Calendars are the best.

Apr 13, 2018 부터 멤버

게시물40

Jul 24, 2020 at 17:00

Apr 13, 2018 부터 멤버

게시물40

@compuforexpamm btw, which broker do u prefer...?? since u said u'll avoid those having "stops level" more than "0" on high volatility pairs. Just asking.

Indicators are so deceiving, always lagging. Trend lines & Calendars are the best.

Aug 20, 2009 부터 멤버

게시물256

Jul 24, 2020 at 17:19

Aug 20, 2009 부터 멤버

게시물256

@saurabh_suman, just to be clear, I said that I will be more understanding if the is a stop level on a high volatility pair, but I don't like to see it on majors like EURUSD.

I have several brokers that I use that I am happy with. Here is the list in no particular order :-

Tickmill UK, Think Markets, IC Markets, Pepperstone, Activtrades, Exness, FP Markets, FBS, Orbex, FXPrimus, FxPro, Axitrader, FXTM, Alpari and Hotforex, Roboforex. FXTM & Alpari appear to be the same company.

IC Markets in conjunction with FXPayback is great because it brings the commission down. Alternatively the VIP account at Tickmill only charges $2 commission which is awesome. These are brokers that I have experience with and happily use on an ongoing basis.

I have several brokers that I use that I am happy with. Here is the list in no particular order :-

Tickmill UK, Think Markets, IC Markets, Pepperstone, Activtrades, Exness, FP Markets, FBS, Orbex, FXPrimus, FxPro, Axitrader, FXTM, Alpari and Hotforex, Roboforex. FXTM & Alpari appear to be the same company.

IC Markets in conjunction with FXPayback is great because it brings the commission down. Alternatively the VIP account at Tickmill only charges $2 commission which is awesome. These are brokers that I have experience with and happily use on an ongoing basis.

Wealth Creation Through Technology

Aug 20, 2009 부터 멤버

게시물256

*상업적 사용 및 스팸은 허용되지 않으며 계정이 해지될 수 있습니다.

팁: 이미지/유튜브 URL을 게시하면 게시물에 자동으로 삽입됩니다!

팁: @기호를 입력하여 이 토론에 참여하는 사용자 이름을 자동으로 완성합니다.