Forex Envy Power Edition (에 의해 forex_trader_47717)

사용자가 이 시스템을 삭제했습니다.

Edit Your Comment

Forex Envy Power Edition 토론

Aug 21, 2011 부터 멤버

게시물6

Sep 13, 2012 at 17:12

Aug 21, 2011 부터 멤버

게시물6

The risk of a «blow out» is imminent... Another 100 pips against the USD from a couple of majors and that's it. Risk increase exponentially with grid/martingale systems... It's a shame!

Q: Is the best way to do money with those system is to «crank it up hard» several times with a lot of small deposits time to time, averaging the SL with past history DDs? ...Because one day or another, you'll be out. So better to be fast! No?

I will be very surprised to calculate an «average» DD and apply it time to time, rugularly. Yes! Sometimes you'll be able to cash out 1000% in 1 month!... Or lose it all in 4-5 days, due to «we don't know why»... Is the (huge) sometime profits can surpass the (multiples) regular losses?

Any suggestions/commentary?

Jeff

Q: Is the best way to do money with those system is to «crank it up hard» several times with a lot of small deposits time to time, averaging the SL with past history DDs? ...Because one day or another, you'll be out. So better to be fast! No?

I will be very surprised to calculate an «average» DD and apply it time to time, rugularly. Yes! Sometimes you'll be able to cash out 1000% in 1 month!... Or lose it all in 4-5 days, due to «we don't know why»... Is the (huge) sometime profits can surpass the (multiples) regular losses?

Any suggestions/commentary?

Jeff

Sep 13, 2012 at 17:18

Aug 20, 2011 부터 멤버

게시물587

1 solution is to have 2 accounts:

1 big with the risk factor lower than 1 (so a target of 5 / 6% per month)

and a second one, small one, with higher risk (target 50% per month) and withdraw the profits into the big account as quickly as possible.

when the small one is killed, restart it by moving money from the big one into the small one...

I try this and the account was killed in 2 days ;-)

1 big with the risk factor lower than 1 (so a target of 5 / 6% per month)

and a second one, small one, with higher risk (target 50% per month) and withdraw the profits into the big account as quickly as possible.

when the small one is killed, restart it by moving money from the big one into the small one...

I try this and the account was killed in 2 days ;-)

Sep 14, 2012 at 02:11

Apr 18, 2012 부터 멤버

게시물43

I was using recommended settings and all my accounts and my nephews accounts blew up today. Something definaatly not right.

And it's been 17 hours since the stats have been updated.. I'd like to know what they look like now..

And it's been 17 hours since the stats have been updated.. I'd like to know what they look like now..

If you are makeing less than 100% a month you aren't doing it right!

Sep 14, 2012 at 03:06

(편집됨 Sep 14, 2012 at 03:13)

Jun 24, 2012 부터 멤버

게시물69

Tneedham:

My accounts blew up today using FE power edit with basic set up both power long and short.

One account with 5 times more fund than required blew up because I am pretty sure 50% broker/50% FE coding bug

Reason1 : broker didn't sold my EURUSD in 1 min retracement for whatever reason

Reason2 : Broker quoting system is able to effect FE code bugs, It double order both EURUSD and NZDUSD resulting overtrade at big lots.

Results : All money Plus bonus money gone

One small account blew up due 30% lost from "Chicken out" 2 days ago from strange USDCAD level 15 and it was in "freeze to TP modes" but still blew up.

Reason 1: - 10% slightly underfund

Reason 2: - EurUSD didn't sold for whatever reason in 1 min retracement

Results : MC call and only 20% money remain

Another small account blew up due to slightly underfund.

Reason 1: - 20% Underfund

Reason 2: - EurUSD didn't sold in for whatever reason 1 min retracement

Results : MC call and only 20% money remain.

I had total 4 live accounts blew up on me by Power long pair ( everyone said that it is safe), and 2 demo accounts blew up on me. Am I really bad luck or There are problem with FE 3?

My accounts blew up today using FE power edit with basic set up both power long and short.

One account with 5 times more fund than required blew up because I am pretty sure 50% broker/50% FE coding bug

Reason1 : broker didn't sold my EURUSD in 1 min retracement for whatever reason

Reason2 : Broker quoting system is able to effect FE code bugs, It double order both EURUSD and NZDUSD resulting overtrade at big lots.

Results : All money Plus bonus money gone

One small account blew up due 30% lost from "Chicken out" 2 days ago from strange USDCAD level 15 and it was in "freeze to TP modes" but still blew up.

Reason 1: - 10% slightly underfund

Reason 2: - EurUSD didn't sold for whatever reason in 1 min retracement

Results : MC call and only 20% money remain

Another small account blew up due to slightly underfund.

Reason 1: - 20% Underfund

Reason 2: - EurUSD didn't sold in for whatever reason 1 min retracement

Results : MC call and only 20% money remain.

I had total 4 live accounts blew up on me by Power long pair ( everyone said that it is safe), and 2 demo accounts blew up on me. Am I really bad luck or There are problem with FE 3?

Sep 14, 2012 at 03:12

Aug 20, 2011 부터 멤버

게시물587

unfortunatly we cant associate the big moves on the market to a FE bug...

there is no pullback on a lot of pairs for many days. with or without bugs in FE, all the accounts are stressed a lot.

its like the sell / buy strength has completly changed on the market, and nobody is here to try to counter the trend.

we have to except a flat market tomorrow and some actions or news to raise the pull backs...

there is no pullback on a lot of pairs for many days. with or without bugs in FE, all the accounts are stressed a lot.

its like the sell / buy strength has completly changed on the market, and nobody is here to try to counter the trend.

we have to except a flat market tomorrow and some actions or news to raise the pull backs...

Sep 14, 2012 at 03:23

Jun 24, 2012 부터 멤버

게시물69

Willgart:

I agree with you, I find that retracement is so weak and very short now.

I still have one big account floating stressing by NZDUSD, I hope that it will recoved.

Basicly, ALL FE accounts are under stress badkt right now.

Are all Grid Martingale EA the same? not really sure.

Sometime, I am wondering why Other EA with same style "Grid martingale", Totalgrid, I am running it both live and Demo, it is at about 5% DD while FE DD is 50%

I agree with you, I find that retracement is so weak and very short now.

I still have one big account floating stressing by NZDUSD, I hope that it will recoved.

Basicly, ALL FE accounts are under stress badkt right now.

Are all Grid Martingale EA the same? not really sure.

Sometime, I am wondering why Other EA with same style "Grid martingale", Totalgrid, I am running it both live and Demo, it is at about 5% DD while FE DD is 50%

Sep 14, 2012 at 03:28

Aug 20, 2011 부터 멤버

게시물587

I'm using totalgrid too, and I already got a margin call, quicker than FE.

I found FE better balanced for the lot size and TP points.

but the overall management of totalgrid is superior and should protect the account more than FE does.

but both are martingale and can suffer MC quickly...

I think the market will come back to good movement next week. the strenght cant continue like this.

I found FE better balanced for the lot size and TP points.

but the overall management of totalgrid is superior and should protect the account more than FE does.

but both are martingale and can suffer MC quickly...

I think the market will come back to good movement next week. the strenght cant continue like this.

Sep 14, 2012 at 04:00

Jun 24, 2012 부터 멤버

게시물69

Willgart:

I use latest Totalgrid with low risk setting, but it still produce same profits as FE Power, It improves quite fast, It fixes that negative basket problem, It doesn't have news server, it seems that it has some fuzz logic, and it will automatic " Freeze to TP" randomly to reset all level to o, it will keep level low, also it uses much lower profit taking point than FE long so it can esape with smaller price rebouce.

Anyway, Those Grid Martinegrale EA are danger, I am looking for other safer EA.

I hope that market can come back to good movement ASAP so my other FE account will be safe.

I use latest Totalgrid with low risk setting, but it still produce same profits as FE Power, It improves quite fast, It fixes that negative basket problem, It doesn't have news server, it seems that it has some fuzz logic, and it will automatic " Freeze to TP" randomly to reset all level to o, it will keep level low, also it uses much lower profit taking point than FE long so it can esape with smaller price rebouce.

Anyway, Those Grid Martinegrale EA are danger, I am looking for other safer EA.

I hope that market can come back to good movement ASAP so my other FE account will be safe.

forex_trader_32776

Mar 28, 2011 부터 멤버

게시물942

Sep 14, 2012 at 09:12

Mar 28, 2011 부터 멤버

게시물942

the performance / survival rate of any Grid Martingale relies on ONE Factor - Its the Grid Step vs Takeprofit. Some get lucky and get the retracement which will close the basket and others can miss the retracement by One pip. A smaller gridstep can get more profits and close the baskets easier but the Risk is far greater since the lot size can multiply very quickly.

Will Envy accounts Blow? It wouldn't be their First nor their last.

It only takes ONE currency pair to Trend to kill your account and Forex Envy runs on many pairs == More chances of margincall

Will Envy accounts Blow? It wouldn't be their First nor their last.

It only takes ONE currency pair to Trend to kill your account and Forex Envy runs on many pairs == More chances of margincall

Sep 14, 2012 at 10:26

May 24, 2010 부터 멤버

게시물354

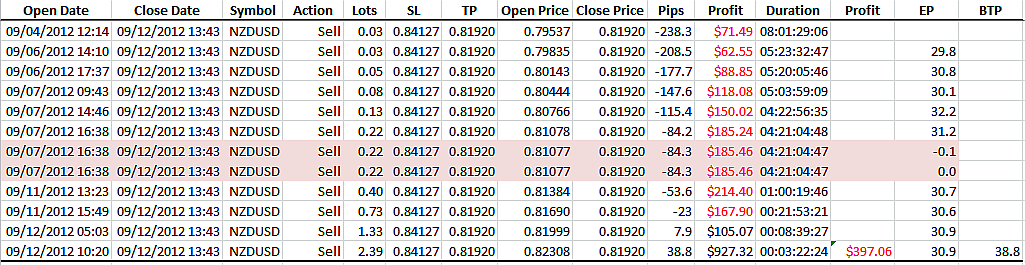

This is real statements Forex Envy Power Edition

http://statements.forexpeacearmy.com/6dc7b30c4fd11fa56d49ffaef8d0c4081040f0dd.htm

Floating P/L: -53 221.41

Equity: 31 731.63

Neither does not surprised, that they banned monitoring of account.

http://statements.forexpeacearmy.com/6dc7b30c4fd11fa56d49ffaef8d0c4081040f0dd.htm

Floating P/L: -53 221.41

Equity: 31 731.63

Neither does not surprised, that they banned monitoring of account.

forex_trader_32776

Mar 28, 2011 부터 멤버

게시물942

Sep 14, 2012 at 10:50

Aug 20, 2011 부터 멤버

게시물587

we really are under a unique market scenario.

the totalgrid guy publish some stats,

98.5% of the trades are closed before the level 11 (which could be like a level14 or 15 in FE)

currently the TG account is at the level 13. (or a missing level 17 in FE)

the max hitted during back tests was 14, so we are near the record...

the market is in a very rare case, the probability of having this market is less than 0.5%!!! (or 1 time a year)

here we have the problem of having more than 1 pair in the sky.

martingale systems are not designed to survive this point.

conclusion, for FE, get the current market and identify the settings to survive it and you'll have a new set of settings safer which can survive incredible market.

Because the profit will certainly be reduced. I think the strategy will be more an emergency action plan to put in place if the user want to survive, like:

set the freeze to all pair to on

add X% of capital to the account

activate the setting mode 7 for the pairs in trouble (a level which raise the number of trades, without raising the lot size)

and wait

if the account is saved, withdraw the added capital. else... well...

I'll refund my accounts next week, because the probability of profit will be high after a so big move.

when I got my first margin call, I got 100% the following month!

the totalgrid guy publish some stats,

98.5% of the trades are closed before the level 11 (which could be like a level14 or 15 in FE)

currently the TG account is at the level 13. (or a missing level 17 in FE)

the max hitted during back tests was 14, so we are near the record...

the market is in a very rare case, the probability of having this market is less than 0.5%!!! (or 1 time a year)

here we have the problem of having more than 1 pair in the sky.

martingale systems are not designed to survive this point.

conclusion, for FE, get the current market and identify the settings to survive it and you'll have a new set of settings safer which can survive incredible market.

Because the profit will certainly be reduced. I think the strategy will be more an emergency action plan to put in place if the user want to survive, like:

set the freeze to all pair to on

add X% of capital to the account

activate the setting mode 7 for the pairs in trouble (a level which raise the number of trades, without raising the lot size)

and wait

if the account is saved, withdraw the added capital. else... well...

I'll refund my accounts next week, because the probability of profit will be high after a so big move.

when I got my first margin call, I got 100% the following month!

Sep 14, 2012 at 11:53

May 24, 2010 부터 멤버

게시물354

Sep 14, 2012 at 12:55

Apr 18, 2012 부터 멤버

게시물102

*상업적 사용 및 스팸은 허용되지 않으며 계정이 해지될 수 있습니다.

팁: 이미지/유튜브 URL을 게시하면 게시물에 자동으로 삽입됩니다!

팁: @기호를 입력하여 이 토론에 참여하는 사용자 이름을 자동으로 완성합니다.