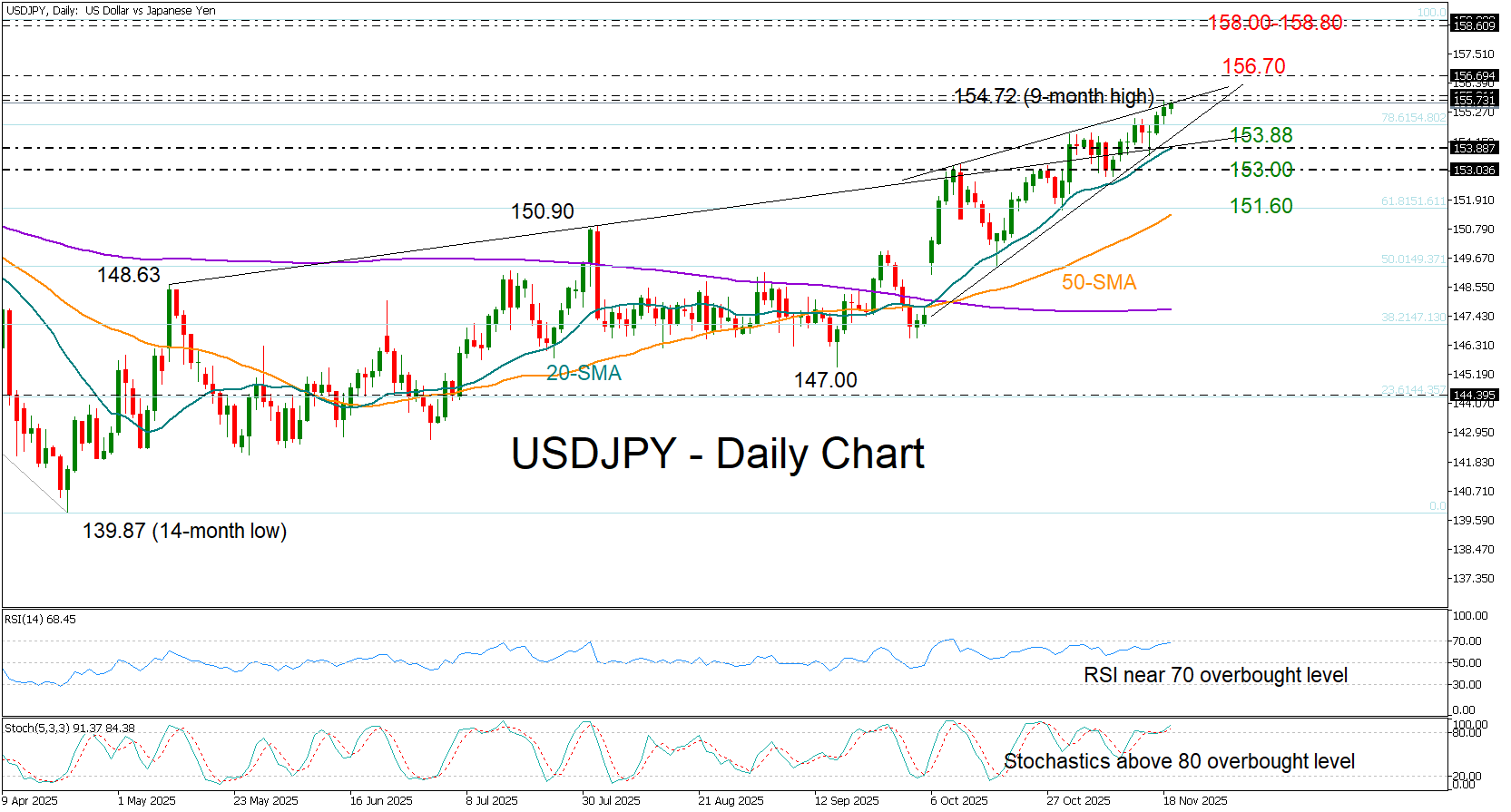

USD/JPY holds near 9-month high, but pullback lingers

USD/JPY remains constrained around its January-February’s barrier despite edging up to a new nine-month high of 155.72 on Tuesday. The BoJ governor endorsed a gradual rate-hike approach during his meeting with Prime Minister Sanae Takaichi, as inflation continues to hover above the central bank’s 2.0% target. A senior adviser to the Prime Minister also indicated that rate hikes are unlikely before March and only once there is evidence that the proposed larger fiscal budget is boosting demand.

The BoJ chief is next scheduled to meet with the finance minister, and the pair remains deep in overbought territory, making downside moves possible. Still, any pullback may not derail the positive trajectory unless the price dips below the 20-day simple moving average at 153.88 and, more importantly, records a new lower low below the 153.00 level. In that case, bears could drag the price down to 151.60.

On the upside, resistance could next emerge around 156.70, and a further step higher could re-test January’s top at 158.00–158.86.

In short, USD/JPY cannot rule out a pullback as it hovers in a caution zone. A clear move above 156.70 may be a prerequisite for fully erasing the 2025 downtrend.